The biggest threat to America and President Obama and the Democratic Party is the economic conventional wisdom.

I don't know what the second biggest threat is, but it's a distant second.

In short form, the dominant ideas in political economics are variants of home-spun yankee virtue: Don't borrow money. Don't create new money. The national debt is a huge problem. Printing new money will lead to hyper-inflation. The FED must raise interest rates to reign in the inflation that inevitably follows loose money policies.

This is largely a political/economic thing.. Actual bond traders spending real money are keen for US Treasuries today (PIMCO just increased their treasury holdings from 48% to 60%), even as republican political/economy types in Congress and op-ed pagesinsist our bonds are on the verge of collapse.

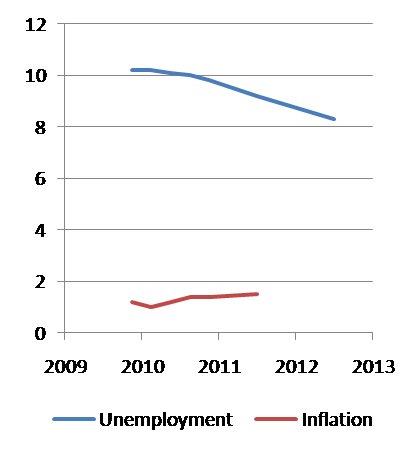

And inflation? Here's what the fed is projecting, and most economic actors are confirming:

The Fed inflation target is 2% as a healthy base-line level to keep the economy from stalling and evan after printing all this money we are unlikely to hit the mark.

Everyone knows that the more money there is the more inflation there is. Everyone knows that the more available bond investment money the US Government gobbles up the higher interest rates have to go. And those things are true... but not necessarily useful. For instance, the federal government is borrowing money with both hands but the amount of total debt in America is

down. Private parties are not borrowing! And Banks are not lending, at least not to those of us less credit worthy than the federal government of the USA. Does printing money cause inflation? Yes... if you consider even avoiding a fatal deflationary spiral to be causing inflation, which it is. (If prices were dropping 5%/year and you printed so much money prices stabilized at 0% change would that be 5% of inflation created? And if so, why is that supposed to be a bad thing? Inflation is only bad when it has bad effects. It is not like a religious dietary law.)

This conventional wisdom is the only true bi-partisanship we have... it is promoted from the lowest tea-bag rally to the words of the President himself.

It is a national religion, and an old one. It is the religion that put us into the great depression and then put us BACK into the depression a few years later because even though everyone had just seen the Great Depression with their own eyes and seen it ameliorated through bold application of Keynesian economics they were STILL convinced that spending and debt are always bigger problems than unemployment and stagnation.

That really is a religion!

Paul Krugman is out there blogging every day about how what an economy needs

depends on the environment. What might be good advice for a child being given her first piggy-bank is not universal macro-economic wisdom.

We are in a liquidity trap where central bank influence on interest rates has been largely exhausted without creating much growth, investment, or even inflation.

That is an unusual situation. It is like a trauma doctor transfusing a patient with severe internal bleeding... to maintain vital blood pressure sometimes requires pumping in a counter-intuitively large amount of plasma. And rather than speculating about what the patients blood pressure

should be you actually measure it.

In this environment damaging inflation does not automatically arise when we print more money. In the last two years we have probably printed more new money than we normally would in a decade, yet there is no inflation! Why? Well, for one thing in the housing and stock market collapse American households lost 8-10 TRILLION dollars.... dollars that went to money heaven. The FED has been trying to stave off big net declines in the money supply.

But it is a religion, so even though the dogma of the religion are being refuted every day that just proves that when the "inevitable" dogmatic truths kick in it will be even worse. If the rapture didn't happen today then that makes it even likelier it will happen tomorrow! We're due.

Why must the health care bill be under $1 trillion? Why was it obvious that the stimulus package had to be under $1 trillion? Why should the FED stop printing all this money? Why is it "obvious" that the FED will have to raise rates soon?

There is, and was, no compelling real-world economic argument for those ideas at this moment in time. Merely a sonambulistic invocation of "common sense."

And why is it "obvious" that the federal deficit is a pressing problem? The federal deficit is not the cause of unemployment. It is not why your home price collapsed.

But what everybody knows that just ain't so threatens to keep our economy weaker than a kitten, keep unemployment high and put Republicans in the WH and Congress.

Paul Krugman (and many others... it's a school of economic thought, not just one guy's ideas) keeps blogging away trying to tell me, you, us, President Obama and anyone who will listen... a literal Casandra. (remember, Casandra's prediction all came true. It's just that they were never believed.)

If you are not familiar with the deficit/bond/inflation hawk menace then read back through the last week or two of Krugman's blog for a general introduction.

http://krugman.blogs.nytimes.com/The poor man is running around with his hair on fire when it would be ever so much more respectable to harrumph about the dangers of deficit spending and loose money policies.