Paul Krugman November 20, 2009, 11:44 am

Interest rates: the phantom menaceFrom various bat squeaks I�ve put together a view of what I think lies behind the surprising � and damaging � deficit squeamishness of the Obama administration. So here�s what I think they�re thinking � and why it�s wrong-headed. (Fairly wonkish stuff after the jump).

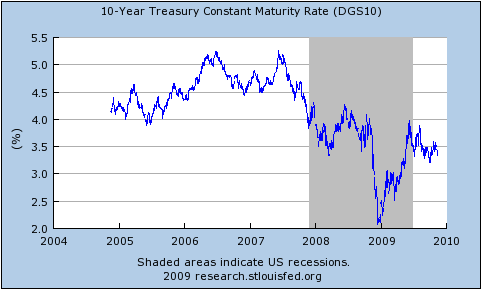

On the face of it, there�s no reason to be worried about interest rates on US debt. Despite large deficits, the Federal government is able to borrow cheaply, at rates that are up from the early post-Lehman period, when market were pricing in a substantial probability of a second Great Depression, but well below the pre-crisis levels:

Underlying these low rates is, in turn, the fact that overall borrowing by the nonfinancial sector hasn�t risen:

the surge in government borrowing has in fact, less than offset a plunge in private borrowing.

So what�s the problem?

Well, what I hear is that officials don�t trust the demand for long-term government debt, because they see it as driven by a �carry trade�: financial players borrowing cheap money short-term, and using it to buy long-term bonds. They fear that the whole thing could evaporate if long-term rates start to rise, imposing capital losses on the people doing the carry trade; this could, they believe, drive rates way up, even though this possibility doesn�t seem to be priced in by the market.

What�s wrong with this picture?

First of all, what would things look like if the debt situation were perfectly OK? The answer, it seems to me, is that it would look just like what we�re seeing.

--- snip --- please read the whole thing at link ---And one last point: I just don�t think the inner circle gets how much danger we�re in from another vicious circle, one that�s real, not hypothetical. The longer high unemployment drags on, the greater the odds that crazy people will win big in the midterm elections � dooming us to economic policy failure on a truly grand scale.

http://krugman.blogs.nytimes.com/2009/11/20/interest-rates-the-phantom-menace/#more-5561