The United States has enjoyed approximately four decades of

relative economic equality in its history. Its no coincidence that this period coincided with the

greatest sustained economic boom in U.S. history. Nor is it a coincidence that it began during the presidency of Franklin Delano Roosevelt and ended with the presidency of a man who was intent on dismantling FDRs

New Deal, which had been largely responsible for the unprecedented economic boom and economic equality in our country.

FDRs New Deal consisted of numerous statutes that served to

greatly reduce income inequality AND improve the economic prosperity of the vast majority of Americans.

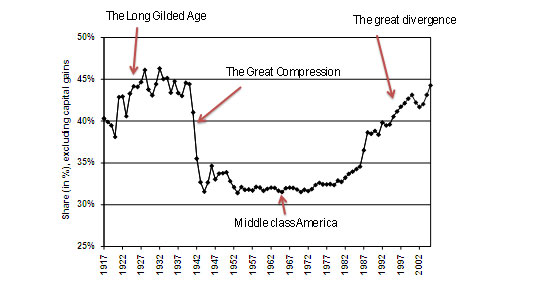

This chart graphically shows the period of relative economic equality, which is denoted as the percent of income made by the richest 10% of Americans:

That period began in the late 1930s, as FDRs New Deal policies began to take effect, with the percent of annual wealth made by the top 10% of Americans plunging from about 45% to about 32% (while median income greatly increased). There it remained until the

Reagan Revolution of the early 1980s, which was characterized by a concerted and largely successful effort to dismantle FDRs New Deal. Under George Bush II, income inequality in the United States attained unprecedented levels, which have thus far been sustained during the Obama administration.

There is a very important take-home lesson from all this: General prosperity goes together with income

equality, whereas income

inequality goes with economic downturns. Indeed, the two periods of greatest income inequality in U.S. history (the late 1920s and the early years of the 21st Century) immediately preceded what are probably the worst economic slumps in U.S. history (the

Great Depression of 1929 and the

financial meltdown of 2008). Note that these

facts of U.S. economic history stand in great contradiction to the self-serving

theory of trickle down economics the theory that predicts that the infusion massive amounts of wealth to the wealthy will trickle down to the rest of society.

The corporationCorporations are neither inherently destructive nor inherently useful to society. Rather, they are artificial creations of government whose rationale for existence is to serve the interests of the society (through its government) that creates them. Consider a

standard definition of a corporation:

A corporation is an institution that is granted a charter recognizing it as a separate legal entity having its own privileges, and liabilities distinct from those of its members

Corporations exist as a product of corporate law

An important feature of corporation is limited liability. If a corporation fails, shareholders normally only stand to lose their investment, and employees will lose their jobs, but neither will be further liable for debts

I highlighted in red the parts of the definition that emphasize the

dependency of all corporations on the government that creates them. Clearly, a corporation can only exist with the assistance of the government that creates it. I emphasize that point because those who own and profit from corporations tend to whine and complain incessantly about government regulations whose purpose is to ensure that the corporation

serves the public interest rather than

opposes it, in an effort to profit those who control it. By whining and complaining about government regulation, these corporate elites attempt to convey the impression that government regulation impinges upon their freedom or inalienable rights. They either forget, choose to ignore, or simply attempt to bamboozle their fellow citizens into forgetting that corporations have no inalienable rights. They are simply an artificial creation of society, meant to serve societys interests. How could it be otherwise? Why should a society create and favor an entity that will

oppose or

destroy its interests? Barry Lynn discusses the

intended purpose of corporations in his book,

Cornered The New Monopoly Capitalism and the Economics of Destruction:

In previous chapters we have seen how, in the half century after the Civil War, men used the institution of the corporation to enclose in their fences the people who actually make and invent the products and services on which we depend. We also saw how politicians outside the corporation and engineers inside it learned to use law and management systems to neutralize the power of the individual capitalist and slowly transform the giant industrial corporation into a semi-socialized institution of immense economic value that did not threaten any political balances in our republic

In the early years of our nation there was much (justified) suspicion that the corporation could turn into a sort of Frankensteins monster if we let it.

Thomas Jefferson said in 1816, I hope we shall

crush in its birth the aristocracy of our moneyed corporations. An article titled,

Our Hidden History of Corporations in the United States notes:

For 100 years after the American Revolution, legislators maintained tight control of the corporate chartering process. Because of widespread public opposition, early legislators granted very few corporate charters, and only after debate. Citizens governed corporations by detailing operating conditions not just in charters but also in state constitutions and state laws. Incorporated businesses were prohibited from taking any action that legislators did not specifically allow.

Capitalism vs. SocialismThe

difference between capitalism and socialism is that with capitalism the means of production and distribution are owned by individuals, whereas with socialism the means of production and distribution are

collectively owned by society/government. I put owned in quotes because ownership can be an ambivalent word. For example, an industrial plant may be owned by individuals, but that doesnt necessarily mean that they can do anything they want with it. Their government may have myriad regulations pertaining to their industrial plant, for the purpose of preventing the plant from polluting the surrounding air, water, and soil, for example. Government also taxes properties for the purpose of providing goods or services to its citizens. To the extent that government regulates or collects taxes on private property it may be considered that government in a sense owns that property. Thus it is that many kinds of private property or services are in part owned by government. So perhaps control would be a better word to describe the situation than own.

With this understanding in mind, it can be accurately said that the vast majority of societies/nations in the world today utilize various mixes of capitalism and socialism. I believe that this is as it should be, since there are certain types of economic activity that are best handled primarily individually and others that are best handled collectively.

Neither capitalism nor socialism is a specific economic system, but rather each represents a broad range of types of economic activity. It is not the purpose of this post to discuss under what conditions is capitalism the better system vs. under what conditions is socialism the better system (Ive discussed this in some depth

here and

here).

Ideally, the purpose of

both types of systems is to benefit humankind. And yet, both can be and often have been grossly corrupted or perverted, such that only a small few benefit at the expense of everyone else. So the more important question is not which system is better, but rather what kind of controls and safeguards need to accompany these economic systems in order that they best benefit society. Barry Lynn explains capitalism like this:

Capitalisms is, then, at the most basic level, the set of legal arrangements that govern how individual private citizens can combine the vast

power that is contained in a pool of capital with the political power that is inherent in the institutions of the corporation, the bank and the market

A people can devise and enforce their laws in ways that enable them to harness the power in concentrated capital to the task of enabling free citizens to build great things. Or a people can allow some group in their midst to devise and enforce laws that enable that group to use the power in concentrated capital to harness free citizens

The perversion of capitalismIn the United States today, capitalism has been grossly perverted. That fact can be seen graphically in the graph presented in the first part of this post, which shows income inequality climbing to the obscene levels that havent been seen in this country since the period that directly preceded the Great Depression. Now once again we see income inequality rearing its ugly head, with the predictable result of the greatest economic downturn since the Great Depression, accompanied by massive human suffering.

FDR knew how to describe the perversion of our economic system, as he did in his classic

1936 Democratic Convention speech to the American people, in which he explained the rationale behind his New Deal, which lifted tens of millions of Americans out of their poverty following the Great Depression:

Out of this modern civilization economic royalists carved new dynasties. New kingdoms were built upon concentration of control over material things. Through new uses of corporations, banks and securities, new machinery of industry and agriculture, of labor and capital

the whole structure of modern life was impressed into this royal service.

There was no place among this royalty for our many thousands of small business men and merchants who sought to make a worthy use of the American system of initiative and profit. They were no more free than the worker or the farmer

The privileged princes of these new economic dynasties, thirsting for power, reached out for control over Government itself. They created a new despotism and wrapped it in the robes of legal sanction. In its service new mercenaries sought to regiment the people, their labor, and their property. And as a result the average man once more confronts the problem that faced the Minute Man.

The hours men and women worked, the wages they received, the conditions of their labor these had passed beyond the control of the people, and were imposed by this new industrial dictatorship. The savings of the average family, the capital of the small business man, the investments set aside for old age other people's money these were tools which the new economic royalty used to dig itself in.

Presumably the purpose of any economic system is to help a society to function better or more specifically to facilitate its economic transactions in a way that benefits society. Otherwise why should a society or government use its laws and enforcement mechanisms to support an economic system?

But with a

perverted economic system, instead of benefiting the bulk of society, the system is purposely turned by the financiers who control it to benefit themselves at the expense of the many. Thus we see severe disparities in income and wealth. There are a number of mechanisms that can be used to pervert economic systems in this way:

MonopolyWhen individuals or corporations have a monopoly on a particular product or service there is no room for market forces to operate. The owner of the monopoly has the opportunity to maximize its profits at the expense of everyone else. Our society has long recognized this problem. That is why, beginning with the

Sherman Anti-trust law of 1890, and continuing with President Theodore Roosevelts

trust busting efforts, the U.S. government has had a long and justified history of intervening to prevent unfair monopolistic practices, especially with regard to services that are essential to us, such as gas and electric utilities.

But during the Reagan Presidency our government began to cease enforcing our anti-monopoly laws. Barry Lynn discusses the effects of this in his book:

The structural monopolization of so many systems has resulted in a set of political arrangements similar to what we used to call corporatism. This means that our political economy is run by a compact elite that is able to fuse the power of our public government with the power of private corporate governments in ways that enable members of the elite not merely to offload their risk onto us but also to determine with almost complete freedom who wins, who loses, and who pays. Then suddenly there was Secretary of the Treasury Henry Paulson

using our tax money to fix his bank and the banks of all his friends

The Bush and Obama administrations and

Congress all responded to the collapse of our financial system in most instances by accelerating consolidation

The effects are clear

the derangement not merely of our financial systems but also of our industrial systems and political systems. Most terrifying of all is that this consolidation of power and the political actions taken to achieve it appears to have impaired our ability to comprehend the dangers we face and to react in an organized and coherent manner.

Socializing risks while privatizing benefitsIf an individual or corporation can undertake big time gambling operations with a guarantee that it will be reimbursed by others for its losses, while being allowed to keep its gains for itself, it will find itself in a win-win situation. It then has the potential for enormous profits with little or no risk.

Banks and other lending institutions are supposed to provide a social service to society. It is for this reason alone that governments are justified in supporting them with an enforceable legal framework, and financial assistance when needed to maintain the fiscal solvency of these institutions. In recent years weve heard a lot about too big to fail, which is our governments rationale for bailing them out with taxpayer money when they get into severe financial difficulty. The rationalization for this is the idea that the service these institutions render to society is so great that we cannot allow them to fail. But if we the taxpayers are going to bail them out, then shouldnt we demand that their services actually are of great benefit to us and that their power be limited in the future to the extent that we are no longer dependent upon them? Apparently not. Both the Bush administrations and the Obama administrations Wall Street bailouts in 2008 and 2009

poured trillions of dollars into these institutions in return for almost nothing in the way of demanding fiscal reforms to prevent future similar occurrences.

James Galbraith explained how Treasury Secretary Geithners plan for bailing out Wall Street was nothing but a plan to get financial institutions to transfer their losses to the American taxpayers:

The plan is yet another massive, ineffective gift to banks and Wall Street. Taxpayers, of course, will take the hit

The banks don't want to take their share of those losses because doing so will wipe them out. So they, and Geithner, are doing everything they can to pawn the losses off on the taxpayer

. In Geithner's plan, this debt won't disappear. It will just be passed from banks to taxpayers, where it will sit until the government finally admits that a major portion of it will never be paid back.

The

Glass-Steagall Act, enacted during the 1930s in response to the Great Depression and the banking crisis that exacerbated it, was supposed to act as a safeguard against banks that engaged in reckless speculation which society often ended up paying for. It worked quite well until it ceased to be enforced during the Reagan administration and was finally

repealed during the Clinton administration, with the active backing of Treasury Secretary Robert Rubin.

Robert Reich commented on how the recently enacted

Wall Street reform legislation utterly failed to address the basic perversions of our financial system, especially with regard to the issue of pawning off the losses of big banks onto the American people:

The American people will continue to have to foot the bill for the mistakes of Wall Streets biggest banks because the legislation does nothing to diminish the economic and political power of these giants. It does not cap their size. It does not resurrect the Glass-Steagall Act that once separated commercial (normal) banking from investment (casino) banking. It does not even link the pay of their traders and top executives to long-term performance. In other words, it does nothing to change their basic structure. And for this reason, it gives them an implicit federal insurance policy against failure unavailable to smaller banks thereby adding to their economic and political power in the future.

Purposefully creating confusingAnother ploy that the financiers use to rig the system to funnel money into their own pockets is the creation of financial instruments that have radically different purposes than what they claim. For example, thousands of Americans have been tricked into taking out loans at exorbitantly high interest rates or with exorbitantly high penalties that are very difficult to avoid.

Robert Kuttner discusses the use of credit default swaps, which are mainly financial instruments for funneling money into the financiers pockets:

In some cases, investment banks created swaps purely for the purpose of gambling that the underlying security would go bust, often betting against their own customers

This is like selling a car with faulty brakes and then buying an insurance policy on the buyer of those cars

The whole affair was a house of cards

The worth of homes and mortgage securities led each other downward

Housing prices collapsed

Millions of homeowners could no longer afford their monthly payments

Tens of millions found that their homes were suddenly worth less than the mortgages.

Some descriptions of our perverted economic systemThe end result of all these perversions of our economic system has been that it has in many respects acted as a parasite on society rather than a tool to help it function smoothly. Here is what some highly respected authors have had to say about this:

James PetrasPetras describes the current position of the financial elites in our society in his book,

Rulers and Ruled in the US Empire:

Within the ruling class, the financial elite is the most parasitical component and exceeds the corporate bosses (CEOs) and most entrepreneurs in wealth. Today, the richest two percent of adults own more than

half of the worlds wealth

Income ratios ranging between 400 to one and 1,000 to one between the ruling class and median wage and salary workers is the norm. Living standards for the working and middle classes and the urban poor have declined substantially over the past 30 years

Even the financial press is writing articles such as that entitled:

Why Ordinary Americans have Missed Out on the Benefits of Growth

Here is one of many of Petrass explanations on how the system works:

A vast army of workers, peasants and salary employees produce value which becomes the basis for

speculative financial instruments. The transfer of value from the productive activities of labor up through the trunk and branches of financial instruments is carried out through various vehicles

credit, debt leveraging, buyouts and mergers

The financial sector acts as combined intermediary, manager, proxy-purchaser and consultant, capturing substantial fees, expanding their economic empires. Finance capital is the midwife of the concentration and centralization of wealth and capital as well as the direct owner of the means of production and distribution. Finance capital has moved from exacting a larger and larger tribute (commission or fee) on each large-scale financial transaction, toward penetrating and controlling an enormous array of economic activities

James GalbraithJames K. Galbraith, in his book

The Predator State, notes that the concept of a predator class is not new, and he introduces the concept by first discussing Thorstein Veblens

Theory of the Leisure Class, published in 1899:

The leisure classes do not work. Rather, they hold offices. They perform rituals. They enact deeds of honor

The leisure class is predatory as a matter of course

The relation of overlords to underlings is that of predator to prey. Vested interests

live off the work of others by right and tradition, and not by their functional contribution to the productivity of the system

Predators rely on prey for their sustenance, but they also require and must motivate their assistance

Galbraith goes on to describe the purpose of what he calls The Predator State:

The predator state is an economic system wherein entire sectors have been built up to feast on public systems built originally for public purposes

The corporate republic simply administers the spoils system

The business of its leadership is to deliver favors to their clients. These range from coal companies to sweatshop operators to military contractors. They include the misanthropes who led the campaign to destroy the estate tax

the Benedict Arnold companies that move their taxable income to Bermuda

They include the privatizers of Social Security

Everywhere you look, regulatory functions have been turned over to lobbyists. Everywhere you look, public decisions yield gains to specific private persons

. This is not an accident: it is a system. In the corporate republic that presides over the predator state, nothing is done for the common good

The concept of competence has no relevance: to be incompetent, you must at least be trying. But the men in charge are not trying

We are their prey. Hurricane Katrina illustrated this perfectly, as Bush gave contracts to Halliburton and at the same time tied up efforts to restore the city

Robert KuttnerRobert Kuttner discusses in the introduction to his book,

A Presidency in Peril The Inside Story of Obamas Promise, Wall Streets Power, and the Struggle to Control our Economic Future, the status of our perverted economic system:

The failure of the old order was pervasive. The public officials of both parties who had assured us that financial deregulation would deliver broad prosperity were shown to be catastrophically wrong. The Wall Street moguls who insisted that their own grotesque enrichment was merely a by-product of their vital service to capital markets were revealed as frauds. The free market economists who had given intellectual cover to the deregulators in government and the scoundrels in the banks were now intellectually bankrupt.

Barry LynnFrom Barry Lynns book:

The pressure from financiers to increase profits has resulted in an ever swifter monopolization of the industrial systems on which we depend

This pressure derives

from the legal structure of American capitalism itself. The American model of capitalism of corporate monopolies supposedly owned by financiers who direct all their power to maximizing the production only of cash builds vandalism right into the system

The economics of destruction Barry Lynn explains that our economic system has become so perverted that in the process of creating great wealth for the few, the interests of our financial elite are served more by

destroying real property rather than by

creating it:

I want to complete our look at how capital interlinks, through the institution of the corporation, to the real world in which we live, in order to understand why nowadays we smash so many of the machines and technologies and systems we need to live. To do this I will focus on two main issues: how the rich re-appropriated the institution of the corporation after we took it away from them in the early twentieth century, and how regarding the rich as the owners of these institutions lies at the heart of our present crisis

We will see that the single biggest problem with the physical stability of our industrial and financial systems is that we have seated almost complete control over these institutions, and hence the real properties held within them, in a class of people whose interests are served not by building things but by breaking things

.

As a society we understood and addressed this during the Great Depression of the 1930s:

Americans proved that for long periods, we were able to effectively use our laws to prevent a few among us from concentrating capital and control over our corporations

And we proved that we can use our laws to redistribute such powers even once they have been concentrated, as we did during the New Deal era, when we democratized access to, and control over, the power in capital

But beginning with the presidency of Ronald Reagan, all the safeguards we had built up to ensure that our economic system served the interests of all of society rather than only the interests of the financiers, began to come apart:

The real power shifted away from us to the fund managers and the financiers, who supposedly did our bidding but who instead used our gold to forge the fetters with which to bind us. So the entire system of distributed and oppositional ownership over the American industrial corporation developed over the course of a century was undone in less than a generation. Power was concentrated once more in the capitalist alone, who is the one actor whose interests once he or she has used a corporation to consolidate control over some market or other is served not by protecting and improving the properties thereby captured but rather by reducing the number of workers in the system

by cutting the number of machines in the system

and by stripping out the various forms of wealth built into the system

The fruits of economic perversionLynn sums up the economic system in the United States today as:

Control without ownership; power without responsibility; appetite without mind. Our industrial treasures smashed. Our ability to create destroyed.

It should be evident from the graph depicted at the beginning of this post that shortly after the election of Ronald Reagan to the U.S. presidency, income inequality in our country began a steep rise, reaching pre-Great Depression levels within a single generation.

The economic effects of severe income inequality were demonstrated by the Great Depression of the early 1930s and the more recent worst economic downturn since that time. But the effects of severe income inequality are not limited to economic consequences. Epidemiologists Richard Wilkinson and Kate Pickett demonstrate in their book,

The Spirit Level Why Greater Equality Makes Societies Stronger, numerous non-economic consequences of obscene income inequality that are independent of absolute income or wealth. These consequences include more mental illness, greater use of illegal drugs, higher imprisonment rate, higher infant mortality rate, more homicides, higher imprisonment rate, lower educational performance of our children, lower index of child well-being, lower trust in our fellow citizens, and lower status of women, among other adverse societal effects. Wilkinson and Pickett attribute much of this to the effects of the humiliation that many people feel when they see others around them who have much more status, wealth, and power than they do. This is especially applicable in a society in which wealth and status is considered by many to be a mark of ones character.