For the decade 1995-2005 inflation in Japan was negative.

Neg-a-tive. Deflation. Prices declining.

2005 -0.2742%

2004 -0.0080%

2003 -0.2486%

2002 -0.8950%

2001 -0.7581%

2000 -0.7128%

1999 -0.3301%

1998 0.6655%

1997 1.7681%

1996 0.1331%

1995 -0.1240%

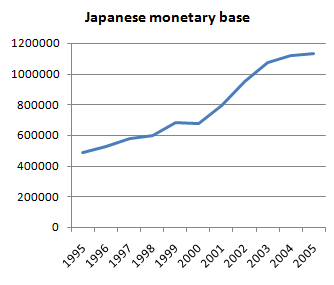

http://www.rateinflation.com/inflation-rate/japan-historical-inflation-rate.phpDuring that period the Japanese monetary base more than doubled.

http://krugman.blogs.nytimes.com/2010/07/29/deflation-risks/

http://krugman.blogs.nytimes.com/2010/07/29/deflation-risks/The reason Japan was able to more than double its monetary base in a decade while prices continued to decline is that they were in an economic crisis caused by the collapse of a housing bubble with a consequent crisis in banking and central bank interest rates were stuck at 0%.

Just like us.It is

assumed in America that a bigger deficit will cause higher interest rates.

It is

assumed in America that printing money will cause inflation.

Neither of those things is true TODAY, in the context of existing real-world circumstances.

These things are assumed because they would be true in typical circumstances.

FIRST RULE OF CRISIS MANAGEMENT: If you need a first rule of crisis management you probably are not in typical circumstances.

We have seen this story before. Quite recently. In the only world economy remotely our size. And yet we are incapable of learning from it because it conflicts with things "everybody knows."

People who should know better--economists, bankers, political leaders--talk about how comparisons to Japan are over-done as if that's supposed to sound wise. "We are not Japan." Yeah, no shit. We read our comic books front to back instead of back to front and tend to cook our fish. But in terms of pertinent questions like deficit, stimulus, inflation and monetary base we are more like 1990s Japan than anybody has been since the 1930s. Nt identical, but more like.

So the readily available fact that Japan more than doubled her monetary base in seven years in very recent memory

trying desperately to create inflation and failing should be of interest to the people who run this country. (For the record, the US Federal Reserve has a minimum inflation target of 2% and has been creating a lot of money trying to create even that pitiful level of inflation and has failed.)

This is a comment by the President of the Philadelphia Federal Reserve... not Glen Beck or a psychotic street preacher or a fourth grader. THE PRESIDENT OF THE PHILADELPHIA FEDERAL RESERVE:

�I think the fear of deflation in and of itself is probably overblown, from my perspective,� Charles I. Plosser, president of the Philadelphia Fed, said last week in an interview. He said that inflation expectations were �well anchored� and noted that $1 trillion in bank reserves was sitting at the Fed. �It�s hard to imagine with that much money sitting around, you would have a prolonged period of deflation,� he said.

http://www.nytimes.com/2010/07/30/business/economy/30fed.html?_r=3&hp

We are fucking doomed.