Not sure what you are measuring with that term as the "duration" is actually going to depend on several other variables triggered by marginal price increases in petroleum more than the pace of geologic constraints (especially true because of oil sands).

IMO what is important is whether there are ready and available alternatives to petroleum.

There are available: renewables, nuclear and energy efficiency with battery storage or H2; plus natural gas and or biofuels and of course, coal.

What matters next would be

a) the price/unit of delivered power compared to petroleum

b) the capital cost to implement the technologies and how the capital cost is spread across society

c) The net energy yield of the various options.

There is no way the world disintegrates into the MAdMax scenario or anything like it. Counter-intuitive as it may seem, it is also more probable IMO that a hard and fast need to transition (the signal would be rising prices) would actually spur the global economy rather than result in prolonged depressed economies. The problems the we will see are going to be a result of artificially supporting the present petroleum based economy long past the time when more efficient systems should take over; resulting in a sort of monopolistic inefficiency that societies get to pay for.

Those are *possible* choices, but we also need to evaluate those choices against a set of criteria in order to extract the "should" from the "could".

As originally published:

Abstract

This paper reviews and ranks major proposed energy-related solutions to global warming, air pollution mortality, and energy security while considering other impacts of the proposed solutions, such as on water supply, land use, wildlife, resource availability, thermal pollution, water chemical pollution, nuclear proliferation, and undernutrition. Nine electric power sources and two liquid fuel options are considered. The electricity sources include solar-photovoltaics (PV), concentrated solar power (CSP), wind, geothermal, hydroelectric, wave, tidal, nuclear, and coal with carbon capture and storage (CCS) technology. The liquid fuel options include corn-ethanol (E85) and cellulosic-E85. To place the electric and liquid fuel sources on an equal footing, we examine their comparative abilities to address the problems mentioned by powering new-technology vehicles, including battery-electric vehicles (BEVs), hydrogen fuel cell vehicles (HFCVs), and flex-fuel vehicles run on E85. Twelve combinations of energy source-vehicle type are considered. Upon ranking and weighting each combination with respect to each of 11 impact categories, four clear divisions of ranking, or tiers, emerge. Tier 1 (highest-ranked) includes wind-BEVs and wind-HFCVs. Tier 2 includes CSP-BEVs, geothermal-BEVs, PV-BEVs, tidal-BEVs, and wave-BEVs. Tier 3 includes hydro-BEVs, nuclear-BEVs, and CCS-BEVs. Tier 4 includes corn- and cellulosic-E85. Wind-BEVs ranked first in seven out of 11 categories, including the two most important, mortality and climate damage reduction. Although HFCVs are much less efficient than BEVs, wind-HFCVs are still very clean and were ranked second among all combinations. Tier 2 options provide significant benefits and are recommended. Tier 3 options are less desirable. However, hydroelectricity, which was ranked ahead of coal-CCS and nuclear with respect to climate and health, is an excellent load balancer, thus recommended. The Tier 4 combinations (cellulosic- and corn-E85) were ranked lowest overall and with respect to climate, air pollution, land use, wildlife damage, and chemical waste. Cellulosic-E85 ranked lower than corn-E85 overall, primarily due to its potentially larger land footprint based on new data and its higher upstream air pollution emissions than corn-E85. Whereas cellulosic-E85 may cause the greatest average human mortality, nuclear-BEVs cause the greatest upper-limit mortality risk due to the expansion of plutonium separation and uranium enrichment in nuclear energy facilities worldwide. Wind-BEVs and CSP-BEVs cause the least mortality. The footprint area of wind-BEVs is 2�6 orders of magnitude less than that of any other option. Because of their low footprint and pollution, wind-BEVs cause the least wildlife loss. The largest consumer of water is corn-E85. The smallest are wind-, tidal-, and wave-BEVs. The US could theoretically replace all 2007 onroad vehicles with BEVs powered by 73 000�144 000 5 MW wind turbines, less than the 300 000 airplanes the US produced during World War II, reducing US CO2 by 32.5�32.7% and nearly eliminating 15 000/yr vehicle-related air pollution deaths in 2020. In sum, use of wind, CSP, geothermal, tidal, PV, wave, and hydro to provide electricity for BEVs and HFCVs and, by extension, electricity for the residential, industrial, and commercial sectors, will result in the most benefit among the options considered. The combination of these technologies should be advanced as a solution to global warming, air pollution, and energy security. Coal-CCS and nuclear offer less benefit thus represent an opportunity cost loss, and the biofuel options provide no certain benefit and the greatest negative impacts. Same single paragraph broken apart for ease of reading:

Same single paragraph broken apart for ease of reading:Energy Environ. Sci., 2009, 2, 148 - 173, DOI: 10.1039/b809990c

Review of solutions to global warming, air pollution, and energy security

Mark Z. Jacobson

Abstract

This paper reviews and ranks major proposed energy-related solutions to global warming, air pollution mortality, and energy security while considering other impacts of the proposed solutions, such as on water supply, land use, wildlife, resource availability, thermal pollution, water chemical pollution, nuclear proliferation, and undernutrition.

Nine electric power sources and two liquid fuel options are considered. The electricity sources include solar-photovoltaics (PV), concentrated solar power (CSP), wind, geothermal, hydroelectric, wave, tidal, nuclear, and coal with carbon capture and storage (CCS) technology. The liquid fuel options include corn-ethanol (E85) and cellulosic-E85. To place the electric and liquid fuel sources on an equal footing, we examine their comparative abilities to address the problems mentioned by powering new-technology vehicles, including battery-electric vehicles (BEVs), hydrogen fuel cell vehicles (HFCVs), and flex-fuel vehicles run on E85.

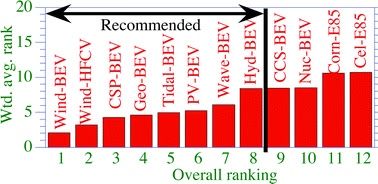

Twelve combinations of energy source-vehicle type are considered. Upon ranking and weighting each combination with respect to each of 11 impact categories, four clear divisions of ranking, or tiers, emerge.

Tier 1 (highest-ranked) includes wind-BEVs and wind-HFCVs.

Tier 2 includes CSP-BEVs, geothermal-BEVs, PV-BEVs, tidal-BEVs, and wave-BEVs.

Tier 3 includes hydro-BEVs, nuclear-BEVs, and CCS-BEVs.

Tier 4 includes corn- and cellulosic-E85.

Wind-BEVs ranked first in seven out of 11 categories, including the two most important, mortality and climate damage reduction. Although HFCVs are much less efficient than BEVs, wind-HFCVs are still very clean and were ranked second among all combinations.

Tier 2 options provide significant benefits and are recommended.

Tier 3 options are less desirable. However, hydroelectricity, which was ranked ahead of coal-CCS and nuclear with respect to climate and health, is an excellent load balancer, thus recommended.

The Tier 4 combinations (cellulosic- and corn-E85) were ranked lowest overall and with respect to climate, air pollution, land use, wildlife damage, and chemical waste. Cellulosic-E85 ranked lower than corn-E85 overall, primarily due to its potentially larger land footprint based on new data and its higher upstream air pollution emissions than corn-E85.

Whereas cellulosic-E85 may cause the greatest average human mortality, nuclear-BEVs cause the greatest upper-limit mortality risk due to the expansion of plutonium separation and uranium enrichment in nuclear energy facilities worldwide. Wind-BEVs and CSP-BEVs cause the least mortality.

The footprint area of wind-BEVs is 2�6 orders of magnitude less than that of any other option. Because of their low footprint and pollution, wind-BEVs cause the least wildlife loss.

The largest consumer of water is corn-E85. The smallest are wind-, tidal-, and wave-BEVs.

The US could theoretically replace all 2007 onroad vehicles with BEVs powered by 73000�144000 5 MW wind turbines, less than the 300000 airplanes the US produced during World War II, reducing US CO2 by 32.5�32.7% and nearly eliminating 15000/yr vehicle-related air pollution deaths in 2020.

In sum, use of wind, CSP, geothermal, tidal, PV, wave, and hydro to provide electricity for BEVs and HFCVs and, by extension, electricity for the residential, industrial, and commercial sectors, will result in the most benefit among the options considered. The combination of these technologies should be advanced as a solution to global warming, air pollution, and energy security. Coal-CCS and nuclear offer less benefit thus represent an opportunity cost loss, and the biofuel options provide no certain benefit and the greatest negative impacts.

You can download the full article at his webpage here:

http://www.stanford.edu/group/efmh/jacobson/Articles/I/revsolglobwarmairpol.htmOr use this direct download link:

http://www.stanford.edu/group/efmh/jacobson/Articles/I/ReviewSolGW09.pdfYou can view the html abstract here:

http://www.rsc.org/publishing/journals/EE/article.asp?doi=b809990cDownload slide presentation here:

http://www.stanford.edu/group/efmh/jacobson/Articles/I/0902UIllinois.pdfResults graphed here:

http://pubs.rsc.org/services/images/RSCpubs.ePlatform.Service.FreeContent.ImageService.svc/ImageService/image/GA?id=B809990C