http://www.mongabay.com/brazil.htmlToday deforestation in the Amazon is the result of several activities, the foremost of which include:

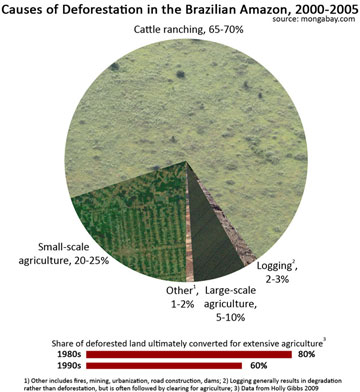

Clearing for cattle pasture - 65%-70%

Colonization and subsequent

subsistence agriculture 20%-25% (subsistence agriculture refers to small farmers raising food for their own needs - i.e. food or for feed for their animals - usu. chickens and maybe a pig or in some parts of the world, goats.)

Infrastructure improvements 1%-2%

Commercial agriculture 5%-10%

Logging 2%-3%

regarding commercial agriculture:

Recently, soybeans have become one of the most important contributors to deforestation in the Brazilian Amazon. Thanks to a new variety of soybean developed by Brazilian scientists to flourish in rainforest climate, Brazil is on the verge of supplanting the United States as the world's leading exporter of soybeans.

NOte that soybeans are cultivated and sold for feed for cattle. So then in total, cattle account for about 70%-80% of deforestation in Brazil. regarding sugar cane, I have read that actually the area of former rainforest is not fertile enough to sugar-cane production.

All I can do is quote you the facts on the

current conditions on the ground in Brazil.

Most sugar-cane is grown in Southern Brazil (90%).

http://www.brazil.org.uk/publications/index_files/mythsvsfacts.pdf Most sugarcane for ethanol production (90%) is harvested in South-Central Brazil, over

2,500 km (1,550 miles) from the Amazon. The remainder (10%) is grown in Northeastern

Brazil, about the same distance from the Amazon�s easternmost fringe. That is roughly

the distance between New York City and Dallas, or between Paris and Moscow. There

is a very tiny production of sugarcane in the Amazon (less than 0.2% of Brazilian total

production) that is processed at four mills that were built more than 20 years ago at a

time when the government provided fiscal incentives to set up industrial facilities in this

region to supply the local market. Without subsidies these mills would not have been

economically viable since the Amazon region does not offer favorable conditions for

commercial sugarcane production. For this reason, future expansion is anticipated to

continue in South-Central Brazil, primarily in degraded pastures.

...now it is certainly possible that some idiots might plant sugar cane in

already deforested regions, either not knowing or not caring that they might only get two seasons of decent yield. After that the yield would decline rapidly. But as the above source said, the rainforest area is not fertile enough for "

commercial production of sugarcane".

Thus it is very unlikely that a

commercial operation would bother planting in an area

1) that is not suitable yield-wise for profitable sugar cane farming, and

2)

that is thousands of miles away from anyplace they could sell it. Sugar cane has to be made into ethanol very soon after harvesting it(the sugar begins to rot, and you lose the sugar content). The ethanol plant would have to be within several miles of where the sugar cane was harvested. It's not likely anybody is going to build a multi-million dollar ethanol plant (on land where it's illegal to build) thousands of miles from their prospective market. NOte it costs big bucks to transport your product

where there is NO INFRASTRUCTURE (i.e. highways, bridges able to handle multi-ton trucks)

...so if you're concerned about deforestation, cut back on eating red meat! (just try cutting back 10%). Not only are cattle the major cause of deforestation..they also produce world-wide MORE GreenHouse Gases than the entire transportation sector (which includes trains, planes and ships at sea!). It's the methane you see.