The Last Bubble: The Problem of Unresolved Debt in the US Financial System

http://jessescrossroadscafe.blogspot.com/2010/07/speaking-of-unresolved-bad-debt-in.htmlFourteen percent of mortgages are behind on payments � about 7.7 million borrowers or, more starkly, one in seven.

A record 4.63 percent of borrowers are in foreclosure.

Approximately 13 million homeowners have no equity or negative equity. They would make nothing from the sale of their house if they could sell it. Or they would lose a little or a lot. Thus do we have the phenomena of strategic default � now as common as no-money-down mortgages during the boom.

Pending Homes Sales Crash in a Record Fall to a Record Low as Tax Break Expires. Data Following Expiration of Subsidies for Downpayments Suggests Hard Second Dip. Demand is Severely Weakened. Not A Single Major News Outlet Recognizes the News.

The Index of pending home sales fell a record 30% in May to a record-low reading of 77.6 - two huge pessimistic indicators of future prices nationwide. Yet the combination of two record negatives went barely reported when the stats were announced last week.

http://housingstory.net/2010/07/08/pending-homes-sales-crash-in-a-record-fall-to-a-record-low-as-tax-break-expires/Michael David White has painted some dire pictures of the US housing market, but this one is shocking in its implications:

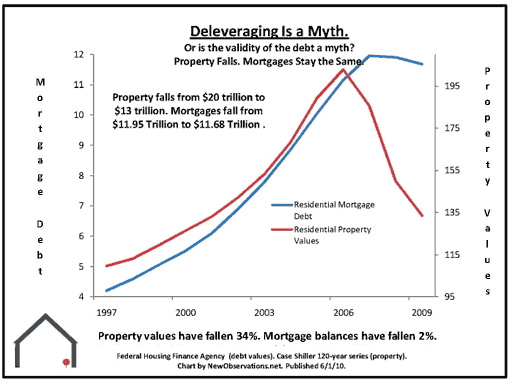

Mortgage Bubble: Property falls. Mortgages stay the same.

Property falls from $20 trillion to $13 trillion. Mortgages fall from $11.95 trillion to $11.68 trillion.

Property values have fallen 34%. Mortgage balances have fallen 2%.

For the first time in U.S. history, banks own a greater share of residential housing net worth in the United States than all individual Americans put together.

That is, what Americans' homes are worth, their equity, decreased by $7 trillion - from $20 trillion to $13 trillion, from spring 2006 to spring 2010. In the same period, mortgage debt, what Americans owe on their homes, went down by only $270 billion. Yes, that's right: US homeowners lost more, by a factor of 26, than they "gained" through clearing mortgage debt. Thus, if we estimate that there are 75 million homeowners in America, they all, each and every one of them, lost $93,333.

Good morning America!! And your own government is still trying to encourage homeownership? Now why would they want to do that in the face of numbers such as these? How much thought have you given that question? Over the past 4 years, the "right to own a home" has become synonymous with the "right" to lose some $25,000 a year. Why does Washington, through Fannie and Freddie, Ginnie Mae and the FHLB, continue to guarantee guaranteed losses for American citizens?

Every single US banking company but the 6 Too Big To Fail ones lost money in 2009, all 980 of them:

Of the 986 bank holding companies in the US last year, a total of 980 of them LOST MONEY.

(LINK: Six Giant Banks Made $51 Billion Last Year; The Other 980 Lost Money:

http://www.forbes.com/2010/06/03/goldman-sachs-citigroup-markets-lenzner-morgan-stanley_print.html )

And that�s even after all the government bailouts the sector received. Hmmmm. Robust banking recovery? Not a chance. However, the remaining six banks, all of which are "too big to fail", did manage to earn a combined $51 billion in 2009, sending their stocks soaring as a result. So despite 980 out of 986 bank holding companies returning nothing but red, the sector actually fared pretty well from a market perspective.

Does this make any sense to you? Here we have an entire sector that is essentially broken; where a mere handful have maintained profitability not from their own strength but thanks to the taxpayers� bailouts. ... And banking is not the only sector Sprott and Franklin say is completely out of whack. It all leads back, how could it not, to housing, Fannie and Freddie, and more losses for homeowners going forward, to add on to the $7 trillion already incurred.

The banking sector isn�t the only equity space that confounds us � the housing stocks are as equally absurd. Despite what you may have heard from your local real estate agent, the fundamentals for US housing are looking dismal. ... The housing �green shoots� were the product of government initiative, rather than true fundamental improvement, and were thus short term in nature. Now that the government program has ended, the whole sector looks poised to fall apart.

To summarize, all US banks would have lost money last year if it hadn't been for your taxpayer dollars, and, indeed, all but the 6 biggest did. They received many trillions in public funds, all of which are a loss to you, who have also lost those $7 trillion on your home values. The overall picture is one of a ridiculous patchwork of lies and tricks and fraud and ultimately for you, losses bigger than you can bear.

http://theautomaticearth.blogspot.com/2010/07/july-14-2010-is-it-time-to-storm.html Nine out of ten Americans will notice that there is a significant gap that must be closed here. What makes it even more chilling is that the gap is continuing to widen as home prices continue to correct to the mean.

This debt must be resolved. There are two major ways to do it: repayment and default.

Repayment is probably a fantasy, if not beating a dead horse. The homeowners do not have the money with which to pay the loans given the current state of employment and wage stagnation, and the mortgages are for the most part on houses whose value is significantly under water compared to the debt, as in ' just mail in the keys.'

Straight up default, writing off the debt even through foreclosure, is also probably out of the question, because it would essentially vaporize the balance sheet of the US banking system which is also insolvent, to a greater degree than most understand, and if they understand it, would admit.

...

Someone has to end up 'holding the bag.' And the consumer cannot rise to the occasion, the banks are all insolvent and a sinkhole until they change their business models. So what will be 'the last bubble?' Bernanke has managed to monetize about 1.5 trillion dollars so far. Only 5.5 trillion more to go, if housing prices can stabilize at current levels, and employment return to pre-crash levels quickly.

A few European readers have expressed their relief, and some noticeable pride, that their banking and political system resolved its own debt crisis so quickly and easily. To the extent that their banks are holding dollar denominated financial assets, they have merely stopped the table from shaking for the moment, as their sand castles await the next mega tsunami to come rolling across the Atlantic.

Consider this well, and you will understand what is happening in the economy, and why certain things occur over the next 24 months, despite the fog of wars, currency and otherwise. And it was all unnecessary, attributable to the dishonesty and greed of a remarkably small number of men in New York and Washington who managed to rig the markets and the political process, with the acquiescence and support of a public grown complacent and in far too many cases, soft headed and corrupt.

These are the same people, along with their enablers, who are now preaching the virtues of austerity for the many, and free and easy markets for themselves. All gain, no pain. While the game is going it must still be played.

http://jessescrossroadscafe.blogspot.com/2010/07/speaking-of-unresolved-bad-debt-in.html