Alt-A, Option ARM, and Subprime Loans will Turn California into a Zombie Mortgage State. 28 Percent of Alt-A loans in California 60 Days Late. Alt-A Mortgages by California Region. 1.1 Million Alt-A and Subprime Mortgages Still Active.

The green shoots are now officially guiding the Southern California housing market. The sentiment has shifted in the region. Even though some 40,000 foreclosed homes are sitting off in some fantasy banker balance sheet, many people are jumping back into the housing game. For those purchasing at rock bottom prices in distressed areas like the Inland Empire, this may not be so bad. After all, if you are able to purchase a home for $100,000 that once sold for $300,000 that in fact may be a good deal. But if you are jumping into those mid-tier markets like Pasadena, Culver City, or Palms for example you will need to gear up for the next few years.

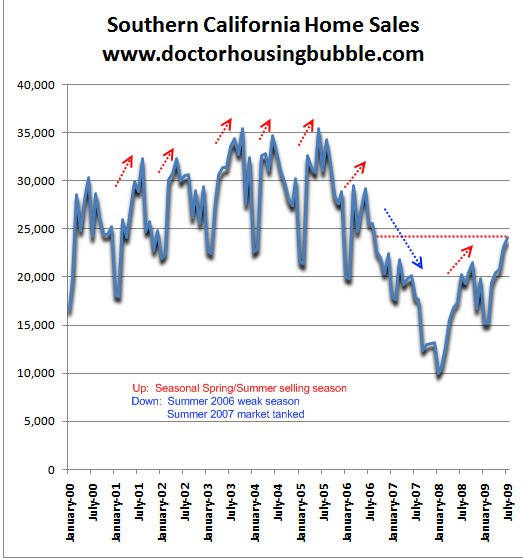

Earlier this week the Southern California home sale numbers showed another pop in sales and stabilization in price. We have discussed how this can be a deceiving indicator especially for those mid-tier markets. But let us look at the sales trend:

This data reflects the entire Southern California housing bubble for the decade. What youll clearly see is the spring and summer seasonal jump in sales. Like clockwork, this happened every single year until 2006 when the pop was weak. In 2007, the market imploded and sales simply cratered. Since that time, over 50 percent of home sales have been foreclosure resales. Even last month, some 43 percent of homes that sold in the region were foreclosure resales. Some would like to think that all the Alt-A and option ARM problems are long gone from the system. Thanks to data from Loan Performance, I am now able to look at specific regions of the state and see how deep the Alt-A problems go.

http://www.doctorhousingbubble.com/alt-a-option-arm-and-subprime-loans-will-turn-california-into-a-zombie-mortgage-state-28-percent-of-alt-a-loans-in-california-60-days-late-alt-a-mortgages-by-california-region-11-million-alt/