Foreclosure Nation: Highest Foreclosure Quarter in History. On Pace for 3.5 to 4 million Foreclosure Filings for 2009. California Housing Market Bubble Update. More Speculation and more bubble economics. California true Unemployment Rate over 21 Percent.

In the first half of 2009, nationwide foreclosure filings topped the 1.9 million mark for the first time ever surpassing the 1.5 million for the first half of 2008. Also, Q2 of 2009 was the worst quarter in terms of foreclosure filings ever. Whatever the case may be with a handful of good earnings reports including some Wall Street firms that are making billions on a disaster they helped to orchestrate, the overall housing market is still deteriorating. The Alt-A and option ARM problems still loom in the near future with really no strategic way to address them. Many of these loans will be recasting in large numbers in states like California and Florida where housing is still in tatters. The U.S. Treasury and Federal Reserve seem intent on prolonging the slump as long as possible to give them time to craft another bubble. Weve seen this with the loan modifications which amount to additional government sponsored option ARMs which virtually convert homeowners into long-term renters.

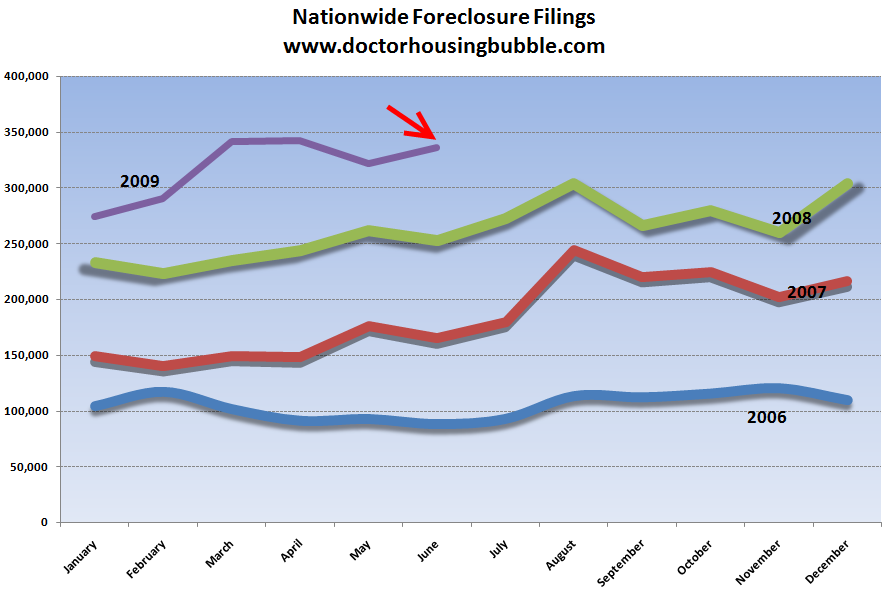

Before we drill down into California, let us first take stock of the nationwide foreclosure situation:

We are on pace for approximately 3.5 to 4 million foreclosure filings in 2009. This is unheard of in modern history. What makes this number even more startling is that the government has handed over trillions of dollars to Wall Street and the banking system yet the problems still persist for most average Americans. Many Americans are wondering if the money they handed over (unwillingly most of the time) is even doing any good. The outrage from last Septembers Paulson 3 page $700 billion memo seems to have subsided. From that time however, the bailouts have gotten bigger and are following the unfortunate same trend. That is why foreclosures are still rocketing up. Weve committed some $13 trillion in bailouts, enough to pay off every single mortgage in the United States, yet here we are still with massive foreclosures slamming the housing market lower while more and more Americans lose their jobs.

http://www.doctorhousingbubble.com/foreclosure-nation-highest-foreclosure-quarter-in-history-on-pace-for-35-to-4-million-foreclosure-filings-for-2009-california-housing-market-bubble-update-more-speculation-and-more-bubble-ec/