First Ever Global Housing Led Recession: One out of Eight American Mortgage Holders either Late or in Foreclosure on their Mortgage: 66 Percent of Mortgages Prime but what does that mean if Prime is now Defaulting at High Rates?

One of the many things I have realized during this crisis is people will flat out make things up when it comes to housing. Im not talking about little white lies like sure buddy, your golf swing isnt so bad but Watergate style lies like we dont have any Alt-A or Pay Option ARMs anymore. Im not sure where people are pulling their data but from the multiple sources Im looking at, we have roughly $450 to $500 billion in Alt-A mortgages floating in our market. And let us for argument sake, set aside those toxic mortgages. We have a new problem hitting the market. Prime mortgages are now imploding on a massive scale. After all, with no job and no income it is hard to make the house payment no matter how conventional and Leave It to Beaver your mortgage looks like.

The Mortgage Bankers Association came out today stating that 12.07 percent of all mortgages were delinquent or in foreclosure. This is the highest on record going back to 1972. What is even more troubling is prime fixed-rate mortgages to the most creditworthy borrowers made up a substantial jump of the new foreclosures coming in at 29 percent. One out of every eight Americans is now either late on a mortgage payment or in the foreclosure process. That statistic is nuts. Here is an observation from previous economic downturns. This economic recession was largely driven by a global housing bubble fueled by easy access to the Wall Street casino. Toxic mortgages which became a larger part of the overall market have pummeled housing prices into the ground. This is where we are at (you are here in your mall map). Yet in this stage of the recession, we are now seeing the double whammy of housing prices falling for more historical reasons like job losses and this is spilling over into the prime mortgage market. That is not a good sign because the prime market is gigantic:

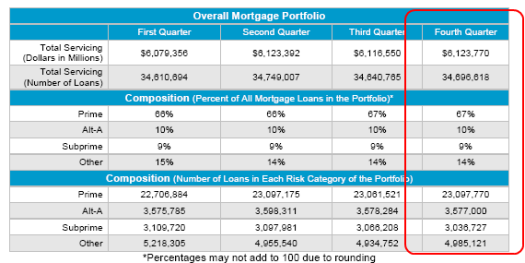

The above data is from the OCC and OTS Mortgage Metrics Report. As you can see for yourself, 6.6 million in Alt-A and subprime mortgages is clearly a sign that there is still many toxic mortgages in the market. This above data is for the combined national bank and thrift servicing portfolio and holds nearly $6.1 trillion in mortgages. The largest part of this portfolio of course is the prime segment making up 66% of all loans. So the rapid rise in prime defaults is extremely concerning. Look at it this way. Let us assume the remaining Alt-A and subprime loans implode at 25%. That gives us 1.65 million more defaults and of course this is absurdly conservative on these toxic banana republic loans. But what if we reach a 10 percent default rate with prime mortgages? That will give us 2.2 million more defaults. That is why the cracks in the prime market are going to cause deeper pain:

http://www.doctorhousingbubble.com/first-ever-global-housing-led-recession-one-out-of-eight-american-mortgage-holders-either-late-or-in-foreclosure-on-their-mortgage-66-percent-of-mortgages-prime-but-what-does-that-mean-if-prime-is/