Sometimes you have to wonder if banks arent desperately waiting for the moment in which the government simply nationalizes the whole shebang. The mother of all bailouts. Call it the uber bailout in which we inject so much capital into the system that we actually become the system. After you see todays Real Home of Genius, you will understand why I am arriving at this somewhat obvious conclusion.

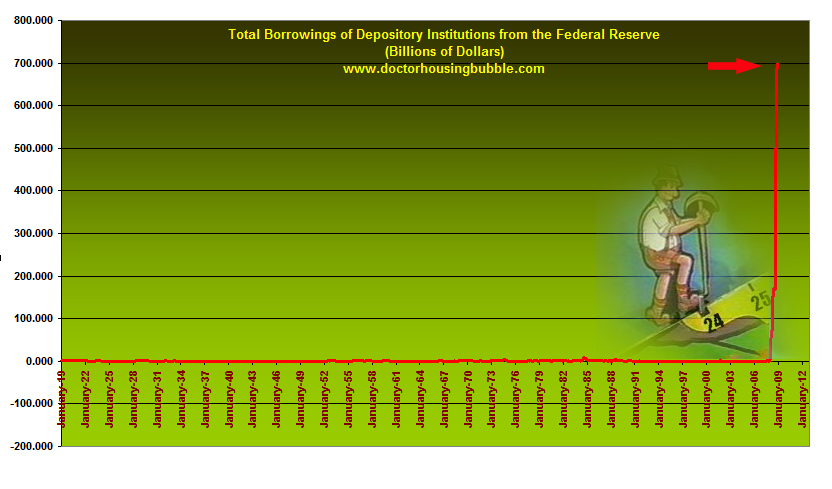

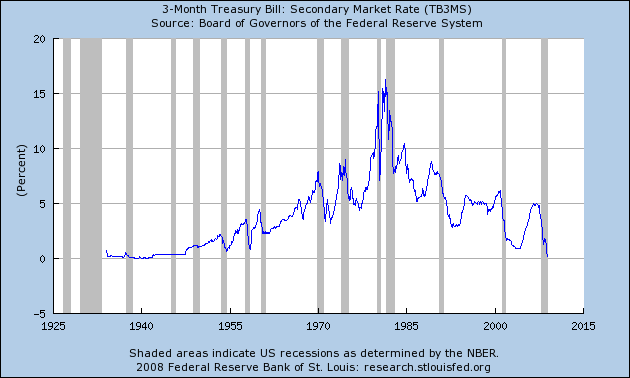

One of the main reasons central banks came about was the idea of the lender of last resort. That is, when banks stop lending who would be there to step in to fill the void? Ben Bernanke has pretty much put to rest any notion that the Fed is not only the lender of last resort but of first, second, and third resort. How much action is Bernanke taking with the markets? Let us take a look at a couple of charts:

These two charts do a good job summing up the current situation. The Federal Reserve is running out of arrows in its quiver. We have already reached 0 percent with the lowest term treasuries. In addition, banks are borrowing like mad already matching the $700 billion TARP amount through other mechanisms. The Federal Reserve has over $2 trillion on its balance sheets yet they continually deny the American public the ability to look inside its books. As the revered Madoff once said this is, basically, a giant Ponzi scheme.

I have to find some humor in that depository institutions are exchanging questionable assets for treasuries while at the same time we are injecting capital into them via the $700 billion TARP plan. Isnt this like a double bailout? First, we already know that the assets they are exchanging are questionable. Why? If they werent questionable they would be trading them on the open market. The reason banks are still not lending to one another is because they know how corrupt their balance sheet is and what would make them suspect their neighboring bank would be any different? Early in the week, I heard Steve Forbes on the KNX Business Hour saying the government should suspend mark-to-market. I bet he would like that. How about we suspend any stock tickers from showing low bids?

More at:

http://www.doctorhousingbubble.com/real-homes-of-genius-today-we-salute-you-riverside-with-our-real-home-of-genius-award-taking-porcelain-to-another-level/