These guys were perfectly happy to get you into that New Home, "No Matter what it takes," during the hay-days of the Ownership Society.

Federal Reserve Bank of New York Staff Reports, no. 318

Federal Reserve Bank of New York Staff Reports, no. 318 (pdf)

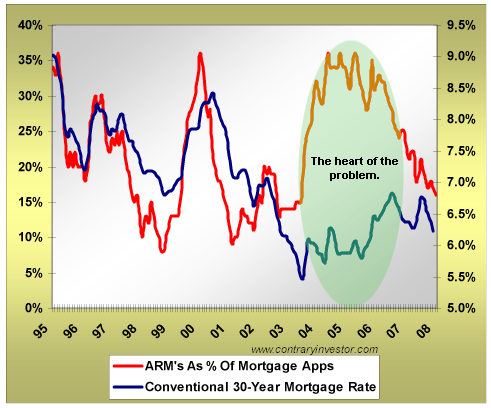

These Banks were happy to write you an "Easy" ARM Mortgage (Adjustable Rate Mortgage) as long as the Housing Market continued to soar, or as long as they could "unload" those Subprime Mortgages on some other Underwriter of last resort (like Freddie or Fannie).

But when the main underwriter, back in

Feb 2007, stood up and said

"No More", well that Party of "Easy Profits for Bankers" came to a screeching halt ... and Economic chaos has ensued ...

------

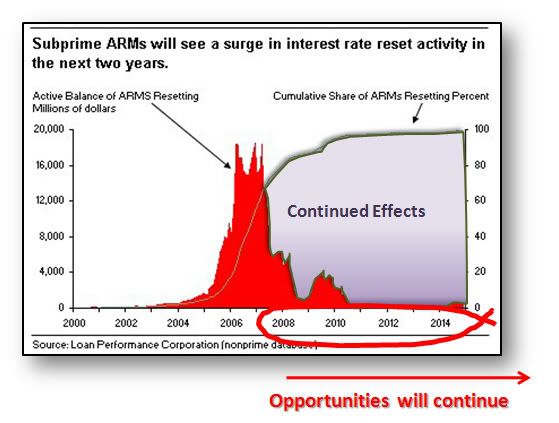

Too bad that pounding hangover from that Credit Party is due to continue, for years to come, as all those ARMs continue to reset (ratchet up the interest rates) for the immediate future.

Notice the caption on that Mortgage Corporation Powerpoint Graphic: "Opportunities will continue" starting around 2008 and beyond.

What were they banking on?All those Easy ARM Mortgages

automatically resetting upward by as much as 2% percentage points

annually, starting at the 2, 3, 5, 7, or 10 year mark in the Loan --

Easy Money for the Banks!That or those Subprime ARM-holders would re-finance to a "30-year fixed" Mortgage, using the Equity they acquired in their Homes, through monthly payments, and from

Home Price Appreciation More Easy Money for the Banks!Deregulation let these new-fangled

Balloon-type Loans flourished over the last decade. The Balloons here however, were spread out to

each year, once the reset period starts, instead of at the end of the Loan in the original Balloon Loans scams, (preceding the 30's Depression).

The business plan behind those ARMs, depended on the Price of the Home going up ... forever.

(Economics 001 apparently!) What they failed to take into account was all those Rising Home Prices, were being fueled by all the "average people" flocking to the snap up those "Easy Mortgages" -- including mobs of get-rich Real Estate Speculators too (ie. the flippers)

CNNMoney.com

When bad loans get worseA whole class of adjustable rate mortgage borrowers could take a bath when rates reset this year.By Les Christie, June 21 2007

More than $1 trillion worth of adjustable rate mortgages (ARMs) will be hit with higher reset rates this year, and that could add up to big trouble for many homeowners.

...

The end of the housing boom changed the math when it comes to ARMs. Not only are mortgage rates higher, but lower home prices in many markets means borrowers have fewer options than they had before home prices dropped.

...

Credit-damaged home buyers could obtain a 2/28 hybrid ARM with affordable fixed-rate (teaser-rate) payments for two years before they reset at higher, floating rates.

At the end of two years, borrowers would ideally have made regular payments, demonstrated their credit-worthiness and raised their credit scores. They could then easily then refinance into an affordable fixed-rate loan.

Another kind of ARM borrower is the prosperous, low credit risk and financial savvy customer who chose the low initial interest rates on hybrid ARMs to free up cash for other purposes. When rates reset, they have the financial wherewithal to pay off loans or refinance into a fixed rate or another bargain-rate ARM.

But there is a third class of ARM users whose numbers grew during the most recent boom. They're the ones who chose ARMs because they couldn't finance their purchases any other way, and they gambled that soaring prices would make the deals work.

(Emphasis Added)http://money.cnn.com/2007/06/20/real_estate/when_ARMs_reset/Well, Physics tells us, all Bubbles will eventually Burst -- No matter

what, the underlying "force of expansion".

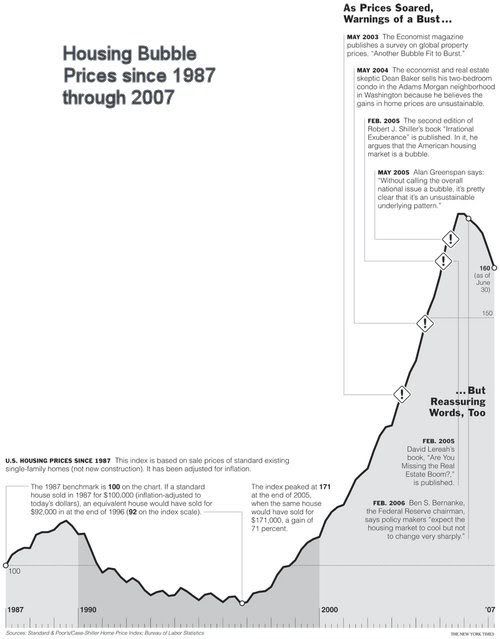

The Housing Bubble was NO exception.

All that "Assumed Equity" underpinning all those Subprime Investments began rapidly evaporating, in 2006. Soon many Home Owners were finding themselves "upside down" on their Mortgages -- owing more than the Home is now worth.

The Banks wanted out of these suddenly risky investments,

but Freddie Mac had closed the door --

No More Underwriter of Last Resort -- for you!(Ironically, Henry Paulson, and GWB, saw another "Last Resort" they could tap, to pick up that Subprime tab. Afterall all those Banks are TOO Important to fail ... the hard-working American People --

apparently NOT so Much!)

ConsumerAffairs.com

Subprime Lending Out Of Favor At Freddie MacFebruary 27, 2007

Freddie Mac, one of the nation's largest buyers of home mortgages, has taken the first step to distance itself from subprime lending, as are other lenders large and small. Shutting off the mortgage spigot is likely to further cool the already chilly housing market.

The company has announced a series of tough new standards for the loans it purchases, and makes it clear it plans to pass on a number of riskier types of loans that have been linked to increased default rates.

...

Freddie Mac said it will also limit the use of low-documentation underwriting for these types of mortgages to help ensure that future borrowers have the income necessary to afford their homes.

Consumer advocates reacted positively. Martin Eakes, CEO of the Center for Responsible Lending, said Freddie Mac was "leading the way toward better underwriting practices in the subprime market."

(Emphasis Added)http://www.consumeraffairs.com/news04/2007/02/freddie_mac_subprime.htmlFreddie Mac could see the "writing on the wall". They told Banks they would have to start meeting "Freddie's New Regulations" (Someone

had to set some rules!)

Well you can imagine the Reaction of those high-stake Bankers -- in a word:

PANIC!and ultimately Bank Failures, left and right.

Mortgage Lenders had believed the GWB hype back in 2002, about the Ownership Society, and the growth opportunities possible because of SubPrime Loans:

Bush Speech 2002 (youtube link)Mortgage Lenders had believed The Federal Reserve Board, Governor Edward M. Gramlich in 2004, when he challenged the key Mortgage Market Players:

should lenders seek new possibilities for extending prime and subprime mortgage credit? If lenders do make new loans, can conditions be designed to prevent new delinquencies and foreclosures?

...

Fannie Mae and Freddie Mac should be continually testing their restrictions to find a set of rules that adequately protect borrowers without unduly constricting lenders.

...

Federal regulators face challenges as well. The Federal Reserve Board has already revised HMDA to ask for rate information on subprime mortgage loans so that subprime mortgage markets can be better analyzed and understood. Using its authority to regulate high-cost loans under the Home Ownership and Equity Protection Act, the Fed has also made several changes to protect consumers with high-cost mortgages.

...

There are challenges for everybody. Rising to these challenges will ensure that continued subprime mortgage lending growth will generate even more social benefits than it seems to have already generated.

(Emphasis Added)http://www.federalreserve.gov/boarddocs/speeches/2004/20040521/default.htmSO the Banking Lenders obliged ...They set up a System of Credit Scores to "nationalize" the no-fault Creditworthiness of everyone:

VantageScore, by Gary Kearns, President, Experian-Scorex

VantageScore, by Gary Kearns, President, Experian-Scorex (pdf)

You only got FICO Score of 660 or lower?

You only got FICO Score of 660 or lower? --

"No Problem, Have we got a Deal for you! We can put you in a No-Nonsense ARM -- No Problem. What's your Time Horizon, by the way? ... How long will you be in the Home, 2, 3, 5 years or more? ..." Too bad for those Banking Opportunists, "Freddie Mac's New Regulations" in early 2007, put a screeching halt all those "get rich" schemes ...

That and the inevitable puncturing of the Market Bubble, that the "forces of the Free Market" worked feverishly to over-inflate.

Looks like that Hangover may last a while.

(That return trip, looks kind of a scary.)Who's steering this Economic Ship anyways? Who's responsible for promoting, and then chasing all those "Ownership Society dreams"?

And what's the Ship's ultimate destination, now?

A thriving and growing middle class --Or a limitless fund for that Members-only Party, that only the Top 1% is invited to -- as always?

Any guesses anyone, which direction our Economic Ship has been on?

Any guesses anyone, which direction our Economic Ship has been on?

and is now headed to?Looks like uncharted waters to me!

NEW WORLD ORDER? (as George

H. Bush promised?)

Hardly! More like the Old World Chaos

of peasants and kings ...

It's time to put some Grown-ups back at the Economic Helm.

It's time for Common Sense and Accountability, back in Government!

Enough!Enough of the Party of Free-loaders and Greed!

--------------------------

PS.

Media Matters exposes the Right Wing Playbook to blame it on Freddie and Fannie

MYTH: Fannie Mae and Freddie Mac caused the "current financial mess"

In a September 19 Huffington Post blog post, Center for American Progress senior fellow David Abramowitz wrote:

"There must be a Republican playbook circulating widely with a chapter entitled, 'What to say if asked who's to blame for the foreclosure mess.' Because an awful lot of Republican candidates are all suddenly yelling 'Fannie Mae, Fannie Mae, Fannie Mae' whenever plunging home prices and the housing crisis comes up. <...> So their plan seems to be to chant Fannie Mae often and loudly enough, and hope the public will get confused about who really caused this huge national calamity. It is always a good political story to just blame a bad guy who has something to do with the same topic.

Indeed, during the September 24 edition of Fox News' Special Report, host Brit Hume said, "Many financial analysts are saying that if mortgage giants Fannie Mae and Freddie Mac had been effectively regulated years ago, the supercharged subprime mortgage meltdown that led to the current financial mess would either never have happened or would have been nowhere near as severe." But rebutting the suggestion that the subprime mortgage purchasing activities of Fannie Mae and Freddie Mac caused the "current financial mess," economist Dean Baker recently stated:

Fannie and Freddie got into subprime junk and helped fuel the housing bubble, but they were trailing the irrational exuberance of the private sector. They lost market share in the years 2002-2007, as the volume of private issue mortgage backed securities exploded. In short, while Fannie and Freddie were completely irresponsible in their lending practices, the claim that they were responsible for the financial disaster is absurd on its face -- kind of like the claim that the earth is flat.

(Emphasis Added)for more Fannie and Freddie facts check:

http://mediamatters.org/items/200810100022