freshwest

freshwest's JournalDefinitely! Was hoping he'd run for POTUS one day after watching him at the DNC:

Gov. Deval Patrick's Rousing DNC Speech

Published on Sep 4, 2012

Massachusetts Gov. Deval Patrick's full speech at the 2012 Democratic National Convention.

More on Governor Patrick:

http://en.wikipedia.org/wiki/Deval_Patrick

Thanks for the picture of him with Obama. So many patriots out of the great state of Massachusetts. 2014 and 2016, here we come!

Know your enemy. Major barf bag warning:

Dick Gregory is true to his class. The worthless, sell out, pundit class. While people were shredded to pieces in the war daily, it's time to part-tay! Eff 'em.

Aren't they just precious?

Obama is honest and his opposition isn't. That's why he keeps winning. Of course, too many in media

talk about Obama and his agenda, without ever having read it first. Or listening to the man speak.If they had, they would realize he never leaves anything out, is speaks in terms of complex truths.

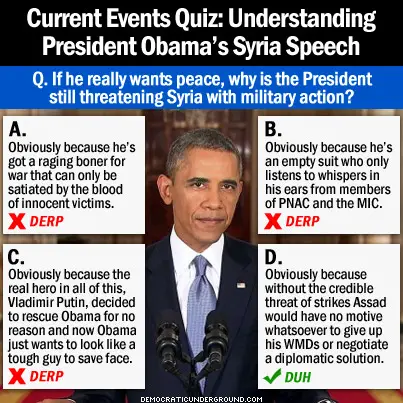

When I argue with baggers, they call him 'arrogant' or 'ignorant' or 'a liar' when they have never listened to even one speech, news conference or read what he literally says, because they are doing this:

They cannot have any debate based on anything but regurgitated bias and repeating what their media told them. They believe they have all the answers, when all they have are voices in their head, like Beck or Rush.

It's frightening, the power of repetition, using the way people learn and for the advancement of the Koch Reichwing. Very, very hard to fight it.

Patriot News, Free Republic and Before It's News already have the anwers!

BOMBSHELL: Clinton Directed False Flag in Benghazi to Instigate WW III in Middle EastThat's from BIN and a quick google showing a few results. I won't link, but you know that is where this is going... Wait for it...

K & R... Althouggh the cap will be lifted in the ACA

I've posted this over and over and it's in my Journal. AFAIK, there is no serious objection to this anymore. There was when the ACA was first being discussed, by those with high income. It was going to be lift the cap or apply means testing, that was the threat.

YOHABLO had numbers for me when I remembered this discussion:

76. If you are referring to the FICA tax .. $113,700: and yes this cap should be eliminated.

We really could solve a lot of problems by eliminating or either jacking it up to say $500,000. You see these are very wealthy folks we're talking about. They won't be relying on Social Security or Medicare to see them through to ultimate end. They've got money stashed away... dividends, investments. You get the picture. So they could care less. You almost never, never hear about this on MSM ..do you? Hmmm wonder why?

http://www.democraticunderground.com/1014619542#post76

And it's never in MSM, which is why this keeps on coming up.

Changes in taxes on higher income due to the ACA:

Below is a summary of several of the tax law changes that are effective beginning in 2013 and 2014.

Increased Medicare Hospital Insurance Tax

For tax years beginning in 2013, the ACA provides for an increase in the Medicare hospital insurance (HI) tax rate. The HI tax is one of two taxes that comprise the Federal Insurance Contribution Act (FICA) taxes imposed on employers. The other FICA tax is the Old Age, Survivors and Disability Insurance tax. FICA taxes are imposed separately on employers and employees. Self-employed individuals pay an alternative tax, which is essentially equal to both the employer and employee portion of the FICA taxes. Employers pay FICA taxes on wages paid in connection with employment, while employees pay FICA taxes on wages received. The HI tax rate is presently equal to 1.45 percent on wages paid and is not subject to a wage cap.

Beginning in 2013, the ACA increases the HI tax rate for certain “high-income” individuals. An additional HI tax is imposed at a rate of 0.9 percent on taxpayers with wages above: (1) $250,000 and filing a joint return; (2) $125,000 if married filing separately; and (3) $200,000 for all others. For employers, the increased HI taxes will require greater compliance monitoring because of the introduction of graduated rates. In other words, employers will need to be prepared to closely monitor wages.

Surtax on Non-Wage Income for High-Income Individuals

For tax years commencing in 2013, the ACA introduces a surtax on certain high-income individuals, which is imposed at 3.8 percent. The base of the surtax is the lesser of either “net investment income” or the portion of a taxpayer’s modified adjusted gross receipts that exceeds the threshold amounts. The threshold amounts are $250,000 for joint returns, $125,000 for married filing separately and $200,000 for all other taxpayers.

http://www.casinoenterprisemanagement.com/articles/september-2012/fees-and-taxes-learning-aca

There is more there; the search results I am getting are aggravating. Most of them are commerical, so I apologize. The official sources are being pushed so far down in the results that sometimes they do not show up at all.

But these are things that progressives have wanted for a long time. And they were all tucked into the ACA, which is one of the many reasons that the GOP hates it so much. JMHO.

http://www.democraticunderground.com/10023931805#post26

More from ProSense:

...The ACA changes that and makes the wealthy pay more via additional taxes on ordinary and investment income.

Employers already take out 7.65 percent of workers’ wages to support the elderly and disabled. Of that, 1.45 percent goes toward paying Medicare’s hospital bills. Obamacare increases the Medicare hospital tax by 0.9 percent, beginning in 2013, for anyone who earns more than $200,000 ($250,000 for joint filers). It also creates a new, 3.8 percent tax on investment income, setting income thresholds at the same $200,000 and $250,000 levels mentioned above. Taken together, those two provisions are expected to generate $210.2 billion over the next decade.

http://www.democraticunderground.com/10022078875

http://www.democraticunderground.com/10022903550#post87

Anyway, enough for now.

OMG!! From the link, Francis said:

Indeed, Pope Francis has impressed communities worldwide with his modest and thrifty attitude and more liberal teachings on women, abortion and homosexuality.In July he suggested a more permissive attitude towards gay couples, remarking that it was not up to him to make judgements on the sexual orientation of clergy as long as they were searching for God and had goodwill....

Pope Francis has also eschewed the traditional Popemobile for a Ford Fiesta and more recently cast out the 'Bishop of Bling' from his German palace with its £20,000 bathtub and walk in wardrobe. There are now plans for it to be turned into a soup kitchen for poor people.

His war on corruption continued on Monday when Pope Francis delivered an impassioned sermon, during which he quoted a passage from the bible that said Christians who donated money to the church but stole from the state were leading a “double life and deserved to be tied to a rock and cast into the sea".

Conservative heads are exploding now:

Clean up on aisle Riiiight.

Sadly, I feel the same at times. *stop torturing me with teh stoopid, dammit!* EarlG got it:

Bet Louie picked DERP#1. Just sayin'

I always avoided them since my college biology teacher explained the problem.

His version of what the liver would say being forced to process them:

'What am I supposed to do with this? She ate wax!'

After that it was butter and olive oil for me, as the body does know what to do with that.

He also said the birth control pills of the era put the body out of balance, were not as complex as they should have been.

'It's like burning down the barn to get rid of rats,' he said.

They weren't made as they are now, they were changed to lower doses of hormones for safety.

We can live without the transfats, they are mostly, AFAIK, a commercial product, not based on good nutrition.

Profile Information

Member since: Fri Dec 10, 2010, 11:36 PMNumber of posts: 53,661