Bill USA

Bill USA's JournalSuper rich hold $32 trillion in offshore havens

this is almost two years old but nothing has changed in that time so this is still worth reading and commenting on internet and emailing your Congressmen about.

http://uk.reuters.com/article/2012/07/22/uk-offshore-wealth-idUKBRE86L03W20120722

Rich individuals and their families have as much as $32 trillion (20 trillion pounds) of hidden financial assets in offshore tax havens, representing up to $280 billion in lost income tax revenues, according to research published on Sunday.

The study estimating the extent of global private financial wealth held in offshore accounts - excluding non-financial assets such as real estate, gold, yachts and racehorses - puts the sum at between $21 and $32 trillion.

The research was carried out for pressure group Tax Justice Network, which campaigns against tax havens, by James Henry, former chief economist at consultants McKinsey & Co.

He used data from the World Bank, International Monetary Fund, United Nations and central banks.

(more)

THE PRICE OF OFFSHORE REVISITED - NEW ESTIMATES FOR MISSING GLOBAL PRIVATE WEALTH, INCOME, INEQUALITY, AND LOST TAXES - Tax Justice Network

http://www.taxjustice.net/cms/upload/pdf/Price_of_Offshore_Revisited_120722.pdf

How The Government (Job Cuts) Killed The Middle Class, In 1 Chart

http://www.huffingtonpost.com/2014/04/28/government-jobs-recovery_n_5226029.html?ref=topbar(emphases my own)

Politicians at all levels of government claim they want to help the middle class, but few things lately have hurt the middle class more than government.

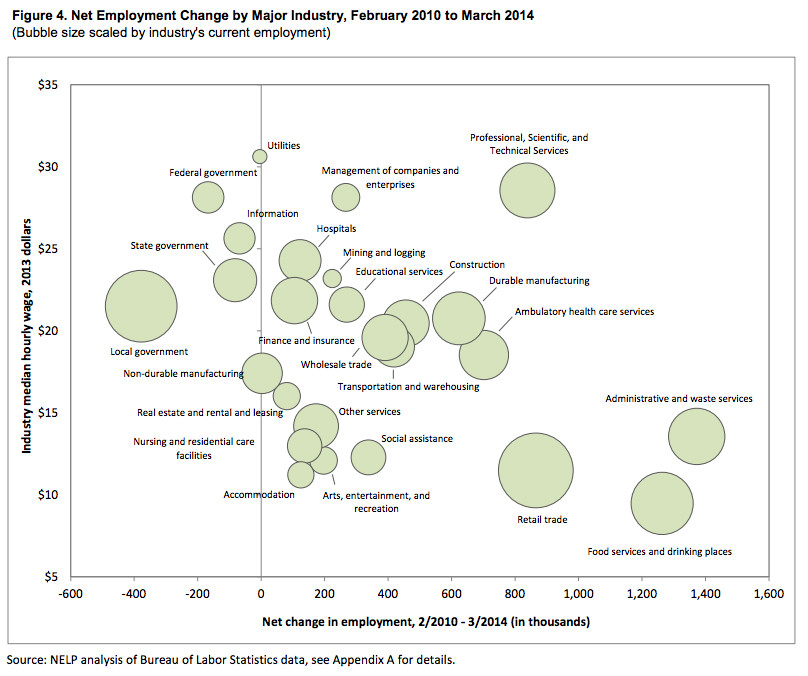

Government layoffs, specifically, have carved a deep gouge in middle-class hiring in the years since the Great Recession, as a new report by the National Employment Law Project, a think tank focused on helping low-wage workers, shows. In the chart below, you can see that federal, state and local governments have been the biggest -- and just about the only -- industries that have cut jobs in the past four years.

employment change

This is the direct result of the austerity obsession Republican politicians mysteriously developed after the inauguration of President Obama in the middle of the financial crisis in 2009. They pushed to slash government spending, leading to job cuts at all levels of government -- exactly the wrong thing to do in the wake of the worst recession since the Great Depression.

Austerity crimped access to the decent-paying, middle-class jobs that are typical of government work. As NELP notes, many of the jobs lost were replaced by low-wage jobs. Middle-wage jobs accounted for 37 percent of job losses and just 26 percent of job gains in the past four years, while low-wage jobs accounted for 22 percent of job losses and 44 percent of job gains, according to the NELP report.

(more)

Tea Party Grifters Get Noticed, Finally (WaPo shows some temerity in writing about this)

http://www.dailykos.com/story/2014/04/27/1295089/-Tea-Party-Grifters-Get-Noticed-Finally?detail=facebook

It's the perfect con because the rubes are the Bigoted, the Cruel and the Stupid.

Five years after Dick Armey laid out the blueprint for a racially fueled astroturf uprising as a last ditch gambit to save the Bush-devastated Grand Ole Party from extinction, four years since Glenn Beck's 'Sermon On The Mall' was witnessed by a mighty pilgrimage of the bigoted, the mean and the stupid, the Washington Post has now, finally, discover that the multitude of Tea Party Evangelists are nothing but grifters. That's some serious investigative reporting there. Breaking news. Now, who would have guessed?

Uh, ANYONE WITH A BRAIN!

Here's the WP's revelation:

[div class="excerpt" style="background: #ffccdd;" ]A Washington Post analysis found that some of the top national tea party groups engaged in this year’s midterm elections have put just a tiny fraction of their money directly into boosting the candidates they’ve endorsed.

This is yet another example why Daily Kos is the Best Damned Newspaper in the nation, reporting next months or next years headlines today. That isn't to say that the reporter, Matea Gold didn't do some nice work convincing her editor to publish this memo of obviousness and she looked up some relevant information:

[div class="excerpt" style="background: #ffccdd;" ]Out of the $37.5 million spent so far by the PACs of six major tea party organizations, less than $7 million has been devoted to directly helping candidates, according to the analysis, which was based on campaign finance data provided by the Sunlight Foundation.

(more!)

.. I can't say I'm too broke up about this though....

Tea party PACs reap money for midterms, but spend little on candidates - WaPo

An analysis of campaign finance expenditure reports by The Washington Post found that some of the top national tea party groups engaged in this year's midterm elections have spent a fraction of their PAC money directly on boosting the candidates they have endorsed. Read related article.

(more)

Kochs reverse course, start attacking Obamacare FROM THE LEFT! TRY keeping your head strait listning

... to attack ads accusing Democrats of passing Obamacare cuzz it's intended as a gift to Insurance companies[font size="6"]!

.... this from the gang who exists to prostitute themselves to the rich and powerful! whose m/o is to sell the U.S. Government to the highest bidder!!![/font]

http://www.dailykos.com/story/2014/04/23/1294095/-Kochs-reverse-course-start-attacking-Obamacare-from-the-left

&feature=player_embedded

Koch ad attacking Gary Peters for "standing with health insurance companies."

Steve Benen picks up on a new trend in the right's attacks on Obamacare: they're fighting it from the left.

(Tuesday), for example, Freedom Partners, a political operation that enjoys financial support from Charles and David Koch, launched a new attack ad in Michigan’s U.S. Senate race, targeting Rep. Gary Peters (D). The voice-over tells viewers: "Congressman Gary Peters says he’s standing up to health insurance companies. The truth? Peters voted for Obamacare, which will give billions of taxpayer dollars to health insurance companies." […]

Keep in mind, this truly ridiculous pitch isn't just popping up in Michigan.

* Earlier this month in Iowa, the Koch-financed Freedom Partners condemned Rep. Bruce Braley (D) for supporting a health care reform law through which "health insurance companies stand to make billions."

* The same day, the Koch-financed Freedom Partners launched an attack ad in Colorado: "Mark Udall worked with insurance companies to pass Obamacare. Now Udall claims he’s standing up to them."

(more)

KOCH BROTHERS TO PROTECT THE 'AVERAGE JOE' FROM THE DEMOCRAT CORPORATE STOOGES

COME WITH ME, LET ME PROTECT YOU FROM THOSE NASTY DEMOCRATS.....

[hr]

[font size="4"]OpenSecrets shows the Insurance industry since 1996 has contributed almost twice as much to the Republicans as to Democrats...[/font].. I chose 1996 as the start point as that is when Democrats started talking seriously about reforming the Medical Services delivery and Insurance industries.

https://www.opensecrets.org/industries/totals.php?cycle=2014&ind=F09

... and of the top 20 recipients in Congress (2013-2014) 16 are Republicans receiving about 6 times as much as the four Democrats and averaging about 1.5 times as much as the 4 Democrats.

http://www.opensecrets.org/industries/recips.php?cycle=2014&ind=F09

[font size="4"]Come let the Republicans protect you little one.....[/font]

the new tactic in the Global Warming war: Divestment - aimed at Oil & other fossil fuel companies

Since the Oil industry in particular 'owns' the Government on this issue, in desperation, some are advocating a direct attack on the main culprits in obstructing real action on AGW: Calling on Universities to divest themselves of stock of energy companies fighting action on Global Warming held in Endowment funds.

Certainly, there will be those who will say it won't work. but should we reject the idea without even trying?

http://billmoyers.com/episode/putting-the-freeze-on-global-warming/

(emphasis my own)

BILL MOYERS: Welcome. For growing numbers of people, the reality of global warming is so urgent they’ve given up waiting for governments to act, and they’ve decided it’s folly to expect the coal, oil, and gas companies ever to admit their products are burning up the earth. So these aroused citizens are going for the jugular – they’re directing their efforts directly at the one place held sacred by the industry -- the bottom line.

It’s called divestment. A campaign to persuade investors to take their money out of fossil fuel companies. Foundations, faith groups, pension funds, cities and universities are being urged to take the lead, to sell their shares in polluting industries and go “fossil free.”

On more than 300 college campuses, from Middlebury in Vermont to Berkeley in California, students are calling on their schools to divest. Sometimes they are rebuffed, as happened recently at Harvard, which at over $32 billion dollars has the largest university endowment in the country. Last fall, the school’s president said divestiture was neither, “warranted or wise.” But this month, nearly 100 faculty members sided with the students. They said, “Our University invests in the fossil fuel industry […] We now know that fossil fuels cause climate change of unprecedented destructive potential.”

Divestment has worked once before – and in a big way. Three decades ago, students, religious communities, and unions sustained a campaign against U.S. companies doing business with South Africa and helped put an end to apartheid. Only four months after his release from prison, Nelson Mandela came to California to say “thank you” to Americans who kept up the economic pressure.

(more)

watch the video-taped interview on Bill Moyers and Company

The Power of Piketty's 'Capital' - Eric Alterman (The Nation)

http://billmoyers.com/2014/04/25/the-power-of-piketty%e2%80%99s-capital/...Piketty’s Capital is simultaneously intellectually rigorous, historically grounded, culturally nuanced and, in important respects, politically visionary. Even nitpicky economists who take issue with some of his interpretations of the mountains of data he and his colleagues assembled feel compelled to shower the book with praise beforehand — and frequently after as well. Paul Krugman credits Piketty with inspiring “a revolution in our understanding of long-term trends in inequality.”

Piketty’s central thesis presents a profound challenge to our political system and its response to the economic crisis of the past decade. As he puts it, an “apparently small gap between the return on capital and the rate of growth can in the long run have powerful and destabilizing effects on the structure and dynamics of social inequality.” Moreover, “there is absolutely no doubt that the increase of inequality in the United States contributed to the nation’s financial instability.

Piketty’s central thesis presents a profound challenge to our political system and its response to the economic crisis of the past decade.The reason is simple: one consequence of increasing inequality was virtual stagnation of the purchasing power of the lower and middle classes in the United States, which inevitably made it more likely that modest households would take on debt, especially since unscrupulous banks and financial intermediaries, freed from regulation and eager to earn good yields on the enormous savings injected into the system by the well-to-do, offered credit on increasingly generous terms.”

While edifying intellectually, all this attention to inequality raises the question of what comes next — or, to borrow a phrase from another famous student of capital, what is to be done? Surprisingly for an academic economist, Piketty does not demur. On an entirely utopian plane, he imagines the effect of a progressive global tax on capital. “Such a tax would also have another virtue: it would expose wealth to democratic scrutiny, which is a necessary condition for effective regulation of the banking system and international capital flows.” On a minutely less unrealistic level, he argues for confiscatory tax rates on the wealthy of up to 80 percent. And on an ever-so-slightly more imaginable plane, he calls for boosting the minimum wage and improving the education and training opportunities of the poor and middle class, who are increasingly priced out of our faux-meritocracy, which is itself shaped by economic inequality.

But to be brutally honest, it’s hard to imagine any measurable impact from Piketty’s work on the problem it seeks to address — at least insofar as it relates to America today. “Inequality is not just the result of economic forces,” notes economist Joseph Stiglitz, “but political processes themselves are affected by the level and nature of inequality.” Stiglitz and others may treat this fact as cause for optimism. I do not. The chances that significant national action will be undertaken to improve the lives of the vast majority of our citizens have fallen to nearly zero, should such action be perceived to conflict with the interests of any subset of the super-rich, regardless of how small their number or how trivial its cost.

(more)

‘Capital in the Twenty-first Century’ by Thomas Piketty

http://www.washingtonpost.com/opinions/capital-in-the-twenty-first-century-by-thomas-piketty/2014/03/28/ea75727a-a87a-11e3-8599-ce7295b6851c_story.htmlJust when you thought Karl Marx had finally lost all political and economic relevance, a brilliant French economist has come along to pick up where the German philosopher left off — correcting for many of Marx’s mistakes, updating his analysis in light of subsequent experience and unearthing a bounty of modern economic data to support a theory about capitalism’s inherent and self-destructive contradictions.

The economist is Thomas Piketty, a professor at the Paris School of Economics, who with Emmanuel Saez of the University of California at Berkeley has recently turbocharged the debate about income inequality. Piketty and Saez gathered data from tax returns that confirm the story of stagnant middle-class incomes over the past 30 years while revealing how much the super-rich have pulled away from everyone else.

~~

~~

Piketty’s prediction of a 21st century of slow growth and extreme inequality is based on historic data and a simple equation. The data, which he assembled with various collaborators in several countries, show that over long periods of time, output per person — productivity — tends to grow at an average of 1 to 1.5 percent. The data also show that average return on investment over long periods of time ranges between 4 and 5 percent.

The problem with these two historic trends, Piketty explains, is that whenever the return on financial capital (investment) is higher than the return on human capital (productivity) for an extended period, it is a matter of simple arithmetic that growing inequality will result. The reason: Those with the highest incomes will save and invest, generating capital income that will allow them to pull away from those relying solely on wages and salaries. It takes only a few generations before this accumulating and accumulated wealth becomes a dominant factor in the economy and the social and political structure.

(more)

Rising wealth-to-income ratios, inequality, and growth - Thomas Piketty, Gabriel Zucman

Reducing inequality is one of the defining challenges of our time. In recent decades much of the discussion has centered on the need to invest in education (Goldin and Katz 2010). Fostering access to education is a powerful way to reduce the dispersion of wages in the long run, but it is not enough.

One issue is that in the US – as in many countries – the rise in income inequality has been driven by the top 1% of income earners, and not by the following 9%, although both groups have the same diplomas (Alvaredo et al., 2013).

An even more important problem is that looking at earned income is not enough. Economists used to believe that the ratio of aggregate wealth to income is constant over time, but it is not.

As we establish in a new paper, the wealth-to-income ratios of rich countries have been increasing since the 1970s (Piketty and Zucman 2013). In the top eight developed economies, according to official national balance sheets, aggregate private wealth has risen from about two to three times national income in 1970 to a range of four to seven times today (Figure 1). Capital is making a comeback. This evolution is not bad in itself, but it has far-reaching implications for inequality and calls for a whole new set of policies.

(more)

The short guide to Capital in the 21st Century

Can you give me Piketty's argument in four bullet points?

<> The ratio of wealth to income is rising in all developed countries.

<> Absent extraordinary interventions, we should expect that trend to continue.

<> If it continues, the future will look like the 19th century, where economic elites have predominantly inherited their wealth rather than working for it.

<> The best solution would be a globally coordinated effort to tax wealth.

What are Piketty's key concepts?

The main concepts Piketty introduces are the wealth-to-income ratio and the comparison of the rate of return on capital (r in his book) to the rate of nominal economic growth (g). A country's wealth:income ratio is simply the value of all the financial assets owned by its citizens against the country's gross domestic product. Piketty's big empirical achievement is constructing time series data about wealth:income ratios for different countries over the long term.

The rate of return on capital, r, is a more abstract idea. If you invest $100 in some enterprise and it returns you $7 a year in income then your rate of return is 7%. Piketty's r is the rate of return on all outstanding investments. A key contention of the book is that r is about 5 percent on average at all times. The growth rate (g) that matters is the overall rate of economic growth. That means that if g is less than 5 percent, the wealth of the already-wealthy will grow faster than the economy as a whole. In practice, g has been below 5 percent in recent decades and Piketty expects that trend to continue. Because r > g, the rich will get richer

(more)

Boehner: "Obamacare resulted in ‘net loss’ of people wth health insurance"- a Crock, WaPo factcheckr

http://www.washingtonpost.com/blogs/fact-checker/wp/2014/03/17/boehners-claim-that-obamacare-has-resulted-in-a-net-loss-of-people-with-health-insurance/(emphases my own)

Reporter: “Mr. Speaker, you said a minute ago there are fewer people today with health insurance than when the law was passed. I want to make sure I understand. You’re saying that Obamacare has resulted in a net loss of insurance?”

House Speaker John A. Boehner (R-Ohio): “I believe that to be the case. When you look at the 6 million Americans who have lost their policies and some — they claim 4.2 million people who have signed up — I don’t know how many have actually paid for it — that would indicate to me a net loss of people with health insurance. And I actually do believe that to be the case.”

– Exchange at Boehner’s weekly news conference, March 13

~~

~~

The Facts

~~

~~

A large percentage of the people whose old plans were canceled were automatically moved to new plans offered by the same insurance companies. These people may not be happy with their new coverage — and may have appeared in an ad sponsored by Americans for Prosperity — but they got a plan without going through HealthCare.gov. (Here’s an example of such a letter, courtesy of our colleagues at PolitiFact.)

~~

~~

Meanwhile, other people are being added to the insurance rolls who are not reflected in the HealthCare.gov numbers.

First, an estimated 3.1 million Americans younger than 26 joined their parents’ plans because of a provision that took effect in September 2010. One big caveat about that Health and Human Services Department estimate is that it is about two years old — and has never been updated.

~~

~~

[font size="3"]

There also are low-income Americans who are flocking to Medicaid because of the law’s expansion of that program.[/font]

The Fact Checker has been critical of the administration’s Medicaid numbers, but there is little doubt that many people are gaining insurance through this route. Through January, the health consulting firm Avalere estimates that at least 2.4 million people got insurance for the first time through the Medicaid expansion. That’s the lowest estimate — others put it as high as 5.6 million, including people previously eligible but not signed up, through mid-March. [font size="3"]But even so, that’s more than enough to demonstrate that no matter how you count it, there has been no net loss in insurance coverage.[/font]

(more)

Note there is much more to the WaPo article and it should be read in its entirety.

I posted this to make it known there are plenty of facts (which will acquire some firm numbers in the coming months) to show that the GOP claim that 5 million lost their coverage is simply a Big Lie. It's good to have some familiarity with these facts to help stuff such Bullshit down the throats of braying conservative Republican suckers - as the need arises.

Stunning report undermines central GOP Big Lie re Obamacare: people losing coverage, 5 Mil? -try 10k

this article is a few months old but I thought it was worth noting as the study it refers to goes right at the Repugnant Big Lie that 5 million will 'lose coverage' due to Obamacare (this of course also requires accepting the proposition that the fake insurance plans, called 'Junk' insurance by Consumers Reports, these people had were really providing coverage. In actuality, these plans likely were intended to separate suckers from their money and then deny them coverage the moment they needed it.)

http://www.washingtonpost.com/blogs/plum-line/wp/2013/12/31/stunning-new-report-undermines-central-gop-obamacare-claim/

A crucial GOP line of attack against the Affordable Care Act (ACA) is that millions of people will supposedly lose coverage thanks to shifting requirements on the health insurance exchanges — a flagrant violation of President Obama’s infamous “if you like your plan, you can keep it” proclamation. The truth has always been more complicated, of course. Republicans are constantly blurring the line between people who lose a plan and people who lose coverage. That is, many people might lose a particular insurance plan but immediately be presented with other options.

Now, a new report from the minority staff of the House Committee on Energy and Commerce has destroyed the foundation of that particular GOP claim. It projects that only 10,000 people will lose coverage because of the ACA and be unable to regain it — or in other words, 0.2 percent of the oft-cited 5 million cancellations statistic.

The report starts with an assumption that 4.7 million will receive cancellation notices about their 2013 plan. (Notably it doesn’t endorse that figure, just takes it on for the sake of argument.) But of those, who will get a new plan?:

• According to the report, half of the 4.7 million will have the option to renew their 2013 plans, thanks to an administrative fix this year.

• Of the remaining 2.35 million individuals, 1.4 million should be eligible for tax credits through the marketplaces or Medicaid, according to the report.

• Of the remaining 950,000 individuals, fewer than 10,000 people in 18 counties will lack access to an affordable catastrophic plan.

“This new report shows that people will get the health insurance coverage they need, contrary to the dire predictions of Republicans,” said Rep. Henry Waxman (D-Calif.), the ranking committee member. “Millions of American families are already benefiting from the law.”

(more)

63,000 bridges desperately need repair, Highway Trust Fund willbe insolvent this fall w/o more funds

The GOP's opposition to any actions which would stimulate the economy and help bring us out of this Republican Economic Dystopia has brought the nations highway infrastructure to a near crisis situtation. We now have "63,000 structurally compromised bridges" and the Highway Trust Fund "normally used to pay for roads and transit projects, could be insolvent by the fall unless Congress acts."

http://www.usatoday.com/story/news/usanow/2014/04/24/nations-bridges-need-work/8091313/

It happens nearly a quarter-billion times a day in the USA: A car, truck or other vehicle is driven across one of the nation's 63,000 structurally compromised bridges.

That's from a new analysis by the industry group the American Road & Transportation Builders Association, which is warning that the situation might worsen.

The report comes against the backdrop of growing cries of alarm that the federal Highway Trust Fund, normally used to pay for roads and transit projects, could be insolvent by the fall unless Congress acts.

"Without congressional action, there will not be any federal support for any new road or bridge projects in any state in fiscal year 2015, which starts on Oct. 1," said Alison Black, chief economist for the road builders group.

(more)

Profile Information

Member since: Wed Mar 3, 2010, 05:25 PMNumber of posts: 6,436