TomCADem

TomCADem's JournalThe genius Larry Kudlow during the 2007 financial catastrophe: 'There's no recession coming.'

Just a reminder, we have been here before with some of the same characters from the Dubya Great Recession years. Remember the Bush Boom?

https://www.dailykos.com/stories/2018/3/15/1749039/-The-genius-Larry-Kudlow-during-the-2007-financial-catastrophe-There-s-no-recession-coming

Presenting the economic super-genius Larry Kudlow, who took to the National Review in December, 2007, to explain that there was no recession.There is no recession. Despite all the doom and gloom from the economic pessimistas, the resilient U.S economy continues moving ahead ’”quarter after quarter, year after year’” defying dire forecasts and delivering positive growth. In fact, we are about to enter the seventh consecutive year of the Bush boom.

There’s no recession coming. The pessimistas were wrong. It’s not going to happen. At a bare minimum, we are looking at Goldilocks 2.0. (And that’s a minimum). Goldilocks is alive and well. The Bush boom is alive and well. It’s finishing up its sixth consecutive year with more to come. Yes, it’s still the greatest story never told.

In December of 2007, the mortgage crisis was in full swing. The recession itself officially began that very month, according to the National Bureau of Economic Research. By the time it was over it would be the most severe financial crisis since the Great Depression; multiple of the nation's largest financial firms and other industry titans would require bailouts by the federal government, to say nothing of the effect on small businesses, storefronts, workers, retirees and nearly everyone else.

Not only did Larry Kudlow insist it was not happening, as it did, he wrote columns mocking those that considered the economy less than robust.Earlier today, a doom and gloom economic forecast from Macro Economic Advisors was released predicting zero percent growth in the fourth quarter. This report is off by at least two percentage points. These guys are going to wind up with egg on their faces.

Real wages are down over the year -- but Republican satisfaction is spiking

This reminds me of 2007 when Fox News and the business media, including Larry Kudlow, where bending over backwards to insist that the economy was doing great.

https://www.washingtonpost.com/news/politics/wp/2018/08/15/real-wages-are-down-over-the-year-but-republican-satisfaction-is-spiking/?utm_term=.0b59ceda2de4

Except for a little hiccup in October, average hourly earnings in the United States have increased month after month while President Trump has been in office. In January 2017, the average hourly earnings were $25.99. In July 2018, the most recent month for which data are available, it was $27.05 — an increase of more than a dollar.

But there’s a down side. While wages have gone up, inflation (as measured by the consumer price index) has gone up faster.

The Bureau of Labor Statistics tallies something called real earnings, hourly and weekly earnings that take inflation into account. In January 2017, real hourly earnings were at $10.65. In July, real earnings hit $10.76. Since the tax bill was signed in December — a bill which Trump insisted would spur rapid growth in wages — inflation-adjusted hourly earnings have increased by only 0.2 percent. During Barack Obama’s second term, they increased by 3.9 percent.

The BLS generally considers year-over-year changes in real earnings. On that metric, comparing July 2017 with July 2018, real hourly earnings are down 0.2 percent according to data released Wednesday. Real weekly earnings increased slightly year-over-year — at the slowest pace since March 2017.

https://www.bls.gov/news.release/pdf/realer.pdf

Real average hourly earnings for production and nonsupervisory employees decreased 0.1 percent from

June to July, seasonally adjusted. This result stems from a 0.1-percent increase in average hourly

earnings combined with a 0.1-percent increase in the Consumer Price Index for Urban Wage Earners

and Clerical Workers (CPI-W).

After combining the change in real average hourly earnings with no change in average weekly hours,

real average weekly earnings were unchanged over the month.

U.S. consumer sentiment hits 11-month low, inflation in focus

Source: Reuters

WASHINGTON (Reuters) - U.S. consumer sentiment fell to an 11-month low in early August, with households expressing concerns about the rising cost of living, potentially signaling a slowdown in consumer spending.

The University of Michigan on Friday said its consumer sentiment index fell to a reading of 95.3 early this month, the weakest since September 2017, from 97.9 in July. The survey’s current conditions sub-index of consumer expectations dropped to 107.8 from July’s reading of 114.4.

It said the decline in sentiment was concentrated among households in the bottom third of the income distribution, adding that consumers’ views on prices for big-ticket household goods were the least favorable in nearly 10 years.

Inflation has been rising in recent months, driven in part by strong domestic demand and a labor market that is viewed as being near or at full employment.

Read more: https://www.reuters.com/article/us-usa-economy-confidence/u-s-consumer-sentiment-hits-11-month-low-inflation-in-focus-idUSKBN1L21N6

Wages aren't growing when adjusted for inflation, new data finds

While Trump takes a "victory lap" and Republicans prepare to give another huge tax cut to the rich and explode the deficit, the middle class is continuing to take body blow after body blow during the so-called Trump-boom. Oh well, Trump will just blame it on immigrants and trade.

https://www.marketwatch.com/story/wages-arent-growing-when-adjusted-for-inflation-new-data-finds-2018-07-17

?uuid=c0b66924-89eb-11e8-9260-ac162d7bc1f7

Wages aren’t growing when adjusted for inflation, a new report released Tuesday showed.

According to the Labor Department, median weekly earnings fell 0.6% in inflation-adjusted dollars in the second quarter, compared to the same time period of 2017.

That’s now the third straight quarter where inflation has outpaced wage growth.

The issue of inflation-adjusted wages stagnating came up in the hearing with Federal Reserve Chairman Jerome Powell on Tuesday. He was asked by Sen. Sherrod Brown, the Ohio Democrat, whether the typical worker really is better off than he or she was a year ago.

Consumer debt is at an all-time high. Should banks be worried?

With Republicans extending billions in tax cuts to the rich, as well as rolling back consumer protections and financial regulations, is it any wonder that average Americans are going deeper and deeper in debt while wages stagnate. Of course, Trump and Republicans are too busy taking a "victory lap" with the mainstream media playing along.

https://www.americanbanker.com/news/consumer-debt-is-at-an-all-time-high-should-banks-be-worried

September 2008 was one of those rare interludes when the world shifts beneath your feet. Markets froze. Fabled banks stood on the precipice. The U.S. government, after initially standing by idly, brought out its bazooka. After a generation of deregulation, it genuinely seemed possible that the U.S. banking system would be nationalized.

The crisis had immense economic and political consequences over the following decade. It helped fuel the rise of the Tea Party, and later, both Trumpism and the anti-corporate left. It led to new regulations that transformed banking into a safer, far more boring industry. And it wreaked havoc in tens of millions of American lives. Foreclosures became an epidemic. College graduates were forced to move into their parents' basements. Aging workers had their retirement plans upended.

But 10 years later, what's remarkable is how little the financial crisis changed Americans' relationship to debt and savings. We still borrow more and save far less than prudence would dictate.

U.S. household debt, which declined between 2008 and 2013, has rebounded sharply. By the first quarter of 2018, it was at an all-time high of $13.2 trillion. The composition of our debt has changed, and we've been better able to manage our obligations, thanks in substantial part to an extended period of low interest rates. But the crisis did not teach us a lesson about the perils of borrowing too much.

U.S. government on course to borrow the most money since the financial crisis

Source: Morningstar

The Treasury Department predicted the U.S. government’s borrowing needs in the second half of this year will jump to the most since last decade’s financial crisis as the nation’s fiscal health deteriorates despite a strong economy.

The department expects to issue $329 billion in net marketable debt from July through September, the fourth-largest total for that quarter on record and higher than the $273 billion estimated in April, Treasury said in a report Monday.

The department’s forecast for the October-December quarter is $440 billion, bringing the second-half borrowing estimate to $769 billion, the highest since $1.1 trillion in July-December 2008.

The estimates were “quite a bit higher than our expectations,” Thomas Simons, senior money-market economist at Jefferies, said in a note.

Read more: http://www.latimes.com/business/la-fi-treasury-borrowing-20180730-story.html

I can understand deficit spending and tax cuts as stimulus during the Great Recession, but doing so when the economy was near full employment? Also, to implement such tax cuts in a manner that only benefits the rich?

Don't worry. When the economy takes a dive, watch Republicans suddenly start crowing that its time to cut social security and Medicare.

GDP Is Growing, but Workers' Wages Aren't

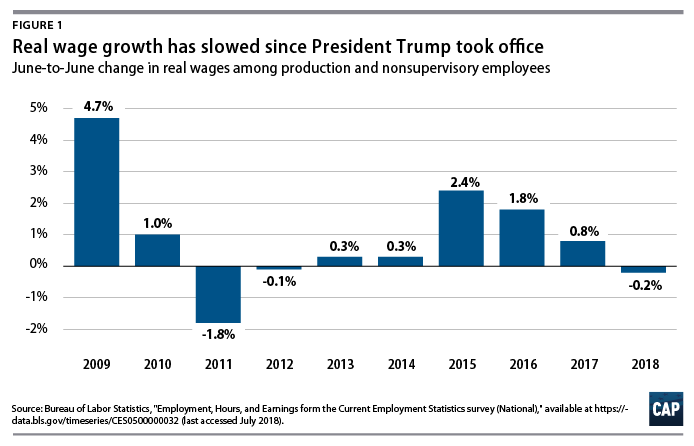

Even as Republicans plunge the Country deeper into debt to goose the GDP, American workers are losing ground under Trump close to a decade after the Great Recession. Note in the graph that in 2011, House Republicans instituted austerity measures after winning control of Congress even as the Nation was climbing out of recession. In sharp contrast, even as the Nation is near full employment, Republicans passed massive tax cuts under Trump, which benefit the rich but with no real benefit to workers.

https://www.americanprogress.org/issues/economy/reports/2018/07/26/454087/gdp-growing-workers-wages-arent/

President Donald Trump recently said that the U.S. economy is “stronger than ever before” and points to his tax plan as one of the major reasons why. But the fact is that workers are not getting ahead in the Trump economy. Official data released in recent weeks have shown that workers’ wages are flat or even slightly down, in real terms, over the last year.2 These data fly in the face of many tax plan boosters who have claimed that the bill’s passage has already been a boon to middle-class workers.

This Friday, the U.S. Department of Commerce will release its first estimate of the nation’s economic output in the second quarter of 2018. For a number of reasons, second-quarter gross domestic product (GDP) growth is expected to be relatively strong. But one quarter’s GDP estimates hardly indicate that the economy is experiencing the sustained, broad-based growth that tax cut proponents promised would happen. Indeed, as the wage data show, the economy’s gains have not trickled down to regular workers. In fact, President Trump’s policies have only made it harder for them to get ahead.

GDP growth is the biggest-picture view of the economy; it’s important for macroeconomists who focus on long-term shifts in what the U.S. economy produces. GDP, however, is only one measure of economic progress, so its effectiveness at measuring workers’ well-being is limited. In the modern economy, benefits are shared unequally. As economic benefits have gone increasingly to those at the top, overall economic growth tells us less than it once did about how the living standards of all Americans are changing. To be sure, economic growth is an important goal, but it’s naïve to ignore the growing disconnect between changes in economic output and living standards for the vast majority of workers—especially when there are much more applicable measures of how workers are faring.

Outside of the very wealthy, virtually all working Americans’ income and standard of living is determined by wages. Unfortunately, wage growth has been at best mediocre for most of the last four decades. Since the Great Recession, nominal wage growth has been worryingly low, exceeding 2.5 percent only a handful of times through the end of 2017—growing barely faster than inflation.3 But with the unemployment rate continuing to fall, many experts predicted workers were poised to finally see gains outpace inflation this year. That hasn’t happened. In fact, when adjusting for inflation, wages have actually fallen this year. It’s not that wages haven’t ticked up at all—they have, in part due to increases in the minimum wage. But even with slightly faster nominal wage growth, workers have lost ground because inflation has picked up more than wage growth.

GDP Is Growing, but Workers' Wages Aren't

Even as Republicans plunge the Country deeper into debt to goose the GDP, American workers are losing ground under Trump close to a decade after the Great Recession. Note in the graph that in 2011, House Republicans instituted austerity measures after winning control of Congress even as the Nation was climbing out of recession. In sharp contrast, even as the Nation is near full employment, Republicans passed massive tax cuts under Trump, which benefit the rich but with no real benefit to workers.

https://www.americanprogress.org/issues/economy/reports/2018/07/26/454087/gdp-growing-workers-wages-arent/

President Donald Trump recently said that the U.S. economy is “stronger than ever before” and points to his tax plan as one of the major reasons why. But the fact is that workers are not getting ahead in the Trump economy. Official data released in recent weeks have shown that workers’ wages are flat or even slightly down, in real terms, over the last year.2 These data fly in the face of many tax plan boosters who have claimed that the bill’s passage has already been a boon to middle-class workers.

This Friday, the U.S. Department of Commerce will release its first estimate of the nation’s economic output in the second quarter of 2018. For a number of reasons, second-quarter gross domestic product (GDP) growth is expected to be relatively strong. But one quarter’s GDP estimates hardly indicate that the economy is experiencing the sustained, broad-based growth that tax cut proponents promised would happen. Indeed, as the wage data show, the economy’s gains have not trickled down to regular workers. In fact, President Trump’s policies have only made it harder for them to get ahead.

GDP growth is the biggest-picture view of the economy; it’s important for macroeconomists who focus on long-term shifts in what the U.S. economy produces. GDP, however, is only one measure of economic progress, so its effectiveness at measuring workers’ well-being is limited. In the modern economy, benefits are shared unequally. As economic benefits have gone increasingly to those at the top, overall economic growth tells us less than it once did about how the living standards of all Americans are changing. To be sure, economic growth is an important goal, but it’s naïve to ignore the growing disconnect between changes in economic output and living standards for the vast majority of workers—especially when there are much more applicable measures of how workers are faring.

Outside of the very wealthy, virtually all working Americans’ income and standard of living is determined by wages. Unfortunately, wage growth has been at best mediocre for most of the last four decades. Since the Great Recession, nominal wage growth has been worryingly low, exceeding 2.5 percent only a handful of times through the end of 2017—growing barely faster than inflation.3 But with the unemployment rate continuing to fall, many experts predicted workers were poised to finally see gains outpace inflation this year. That hasn’t happened. In fact, when adjusting for inflation, wages have actually fallen this year. It’s not that wages haven’t ticked up at all—they have, in part due to increases in the minimum wage. But even with slightly faster nominal wage growth, workers have lost ground because inflation has picked up more than wage growth.

Glenn Greenwald Tells Russians Liberals Are Blaming Them As Excuse for Clinton

There is definitely a market for liberals, as well as conservatives, who are willing to sell out the U.S., though I have never considered Greenwald to be a liberal, and always wondered why he was referenced so often on DU.

http://nymag.com/daily/intelligencer/2018/07/glenn-greenwald-tells-russia-liberals-are-scapegoating-them.html

In his recent appearance at a panel on “fake news” in Moscow, the Intercept’s Glenn Greenwald described his bold iconoclastic policy of speaking truth to power, and then proceeded to repeat an absurd lie told by the leader of the American government. In Greenwald’s telling, the notion that Russia interfered in the 2016 presidential election came about as a desperate way for media elites to explain why their preferred candidate, Hillary Clinton, did not prevail.

“The American political system needed an explanation about why something like that could happen, and why they got it so wrong,” began Greenwald. “One of the explanations about why it happened was the favorite tactic of governments, which was to say, it wasn’t anything wrong with our country, it was this other foreign country over there that was to blame. And that’s a major reason why fingers continue to be pointed at the Russian government.”

Greenwald was very clear about his belief that the whole theory of Russian involvement was a postelection exercise in blame-shifting: “Excuses were needed, villains were required, people needed to point fingers at someone other than themselves for this very shocking event, and that’s why there became this obsession with the Russian government.”

This also happens to be President Trump’s theory of the case. Democrats needed an excuse, he argues, so rather than admit “Crooked Hillary” was a terrible candidate, they concocted the notion that Russia helped Trump win.

Politico - Beto-mania Sweeps Texas

It is a longshot given how deeply many Republicans cling to racism along with the fear of many men about the rising political voices of women, particularly with fear and resentment be fanned 24/7 by Sinclair Broadcasting and Fox News. But, it is nice to see real people make a difference against the RW infrastructure.

https://www.politico.com/magazine/story/2018/07/09/beto-mania-sweeps-texas-218961

FORT WORTH, Texas — Beto O’Rourke is running to replace Ted Cruz. Literally. Sweat pours off his lean, 6-foot-4-inch frame as the El Paso Democrat jogs along the southern bank of the Trinity River surrounded by 300-odd supporters and curious voters jogging along with him. Incredibly, they have shown up at 8 a.m. on a Sunday to join him for a double shot of politics and cardio. In between panting breaths, O’Rourke explains to me the origins of this novel campaign event, which has him running several miles under the Texas sun, stopping in the middle to take questions and lingering at the end to pose for selfies. “Some sadistic member of our team,” he recalls, “was like, ‘So we’re doing like six town halls a day in six different counties. We’re driving hundreds of miles every day, we’re visiting all 254 counties. What more could we do? Ah, get up earlier and have running town halls.’”

This, in short, is how O’Rourke plans to pull off his long-shot bid to take away Cruz’s Senate seat: by outhustling his opponent. O’Rourke, a third-term congressman, often boasts that he has hired no consultants or pollsters. He is his own strategist, and his strategy is simple: campaign relentlessly, project vitality and hope his raw charisma combines in just the right proportion with anti-Cruz animus, Texas’ changing demographics and national Democratic momentum to put him over the top.

It’s a lot to hope for. Cruz is among the country’s shrewdest politicians. He may be reviled in Washington and on the left, but his approval rating remains above water in most polls of Texas, which has not elected a Democrat to the Senate since 1988. Liberals have been fantasizing about turning the state blue for a decade, to no avail. And Cruz retains a double-digit lead in recent polls.

But something is catching here. Fueled by millions in small-dollar donations, O’Rourke is outraising Cruz. In recent weeks, President Donald Trump’s policy of separating migrant families detained at the border has given his campaign a jolt of moral clarity. And voters are responding in a way that Texas Democrats say they have not seen before in modern times.

Profile Information

Member since: Fri May 8, 2009, 12:59 AMNumber of posts: 17,390