n2doc

n2doc's JournalIf Earth Had a Ring Like Saturn

by Ron Miller

If we had rings in the same proportion to our planet that Saturn's are to it, it is pretty easy to figure out what they would like like from different places on the earth. From the equator the rings would be passing directly overhead. Since you'd be looking in the same plane as the rings, all you would see is a bright line arching from horizon to horizon. Here is what the rings might look like from Quito, Ecuador:

If we travel just a little further north to Guatemala, the rings begin to spread across the sky. The earthlight illuminating the dark side of the moon is many times brighter than we are accustomed to, due to the increased sunlight being reflected from the rings.

Moving to somewhere in Polynesia on the Tropic of Capricorn—at 23° south latitude a 180° panorama gives an idea of what a magnificent sight the rings would be. The dark, oval-shaped break in the middle of the ring is the earth's shadow. During the course of every night you would be able watch it sweep across the ring like the hand of a God's own wristwatch. Here it is midnight, with the shadow at its fullest extent. The edge of the shadow is tinged an orangish-pink as sunlight passes through the earth's atmosphere.

more

http://io9.com/if-earth-had-a-ring-like-saturn-508750253

Harry Potter and the Chamber of Money: A First Edition Sells for $227,421

JEN DOLL MAY 22, 2013

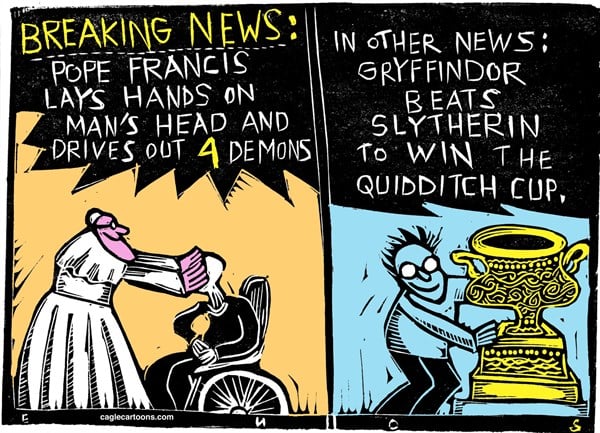

Everyone loves Harry Potter, but some people love Harry Potter more. A first edition of Harry Potter and the Philosopher's Stone, the first book in J.K. Rowling's phenomenally selling 7-part series, has been acquired for 150,000 pounds (or $227,421) at a London charity auction held by Sotheby's and organized with the English PEN writers' association.

This is not just any Harry Potter, it's a special one, because only 500 first editions of the book, published in 1997, exist (they are dear!). And this particular tome is more special yet, because it includes handwritten notes and original illustrations from Rowling, as well as "a 43-page 'second thoughts' commentary by the author," reports Reuters' Piya Sinha-Roy. "Rowling’s personal annotations range from notes on the series as a whole and the film adaptations, to commentary on the unpopularity of the first chapter and an anomaly in chapter four about snapped wands. Her illustrations include a sleeping baby Harry on the Dursleys’ door step, an Albus Dumbledore Chocolate Frog Card, and Norbert the Norwegian Ridgeback dragon," writes Eileen Kinsella at ArtInfo. Oh, and there's "a note on how she came to create the game of Quidditch."

In accordance with all this extra good stuff, $227,421 is the highest price to date for one of Rowling's print books. The new owner of the book has not been identified, but he or she outbid the rest — there was a bidding war, of course — via telephone.

The auction included 50 first editions with their own author annotations and commentary, among them, Roald Dahl's Matilda, featuring new illustrations by Quentin Blake, for $45,470; Kazuo Ishiguro's The Remains of the Day for $27,278; and Julian Barnes' Metroland for $21,216, as well as books by Margaret Atwood, Helen Fielding, Nadine Gordimer, Seamus Heaney, Lionel Shriver, Tom Stoppard, Jeanette Winterson, and others. The entire auction brought in 439,000 pounds ($665,410) to benefit English PEN, a global literary network that promotes freedom of expression.

http://www.theatlanticwire.com/entertainment/2013/05/harry-potter-first-edition-sells-record-227421/65481/

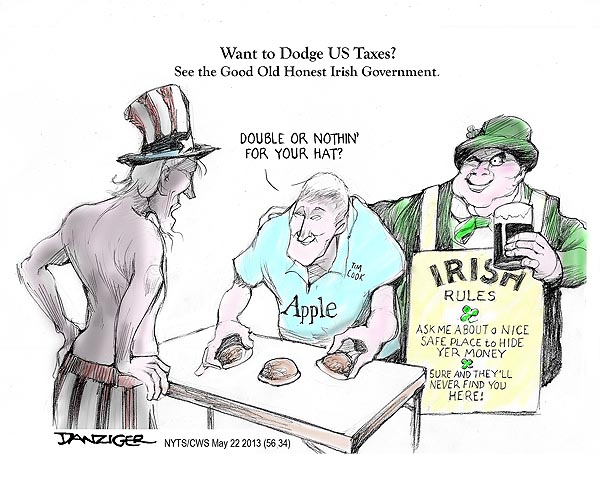

Apple avoids taxes, then complains US schools are lousy

BY ALEC MACGILLIS

It’s remarkable how quickly the storm of outrage over Apple’s epic tax avoidance has passed over Washington. All it took was for Apple CEO Tim Cook (2011 compensation: $378 million) to share some yuks with senators about their love for his company’s products (“I love Apple. I love Apple,” enthused Claire McCaskill) and to cast Apple’s extreme measures to avoid taxes (paying not a cent on $30 billion in global profits parked in an Irish subsidiary that has as much physical reality as a leprechaun) as a mere matter of subjective perspective: “The way that I look at this is there’s no shifting going on that I see at all,” Cook told John McCain. “I see this differently than you do, I believe.”

There’s one aspect of the Apple tax avoidance that I’m particularly surprised has been allowed to slip unscrutinized. As you’re probably aware, the Silicon Valley giants have been in Washington a lot of late for something other than explaining the postmodern relativism of tax liability: to lobby for immigration reform. They're interested, in particular, in greatly expanding the number of H-1B visas, which Apple, Google, Facebook and the rest of the tech behemoths rely on to hire foreign software engineers. They need to bring these workers over from India, China and elsewhere, the companies say, because there simply aren’t enough qualified native ones being trained here at home. One of the biggest champions of this demand was none other than Steve Jobs, Cook's predecessor, who made the pitch directly to President Obama in 2011. Sometimes, the companies phrase it euphemistically: The lack of H-1B visas, Google’s public policy shop explains, is “preventing tech companies from recruiting some of the world’s brightest minds.” Mark Zuckerberg was slightly more candid in his big Washington Post op-ed, throwing his weight behind immigration reform: “To lead the world in this new economy, we need the most talented and hardest-working people” (you hear that, Middle America?) And sometimes it comes out just plain awkward: “There are simply more smart Indians and Chinese than there are Americans,” Google CEO Eric Schmidt said over the weekend on CNN. (Yes, he is of course literally correct, sample size and all—there are more dumb people over there too!—but still…)

We’ve become so used to hearing our educational system disparaged from all corners that we have insufficiently zeroed in on this part of the Silicon Valley argument. There are many reasons why our schools fall far short of the ideal—students arriving unprepared, bureaucracies constrained by hidebound rules, etc. And one reason is, yes, inadequate resources, more in some parts of the country than others. Which brings us to Apple. From the deeply-reported New York Times story that laid bare its tax avoidance last year:

''I just don't understand it,'' he said in an interview. ''I'll bet every person at Apple has a connection to De Anza. Their kids swim in our pool. Their cousins take classes here. They drive past it every day, for Pete's sake. ''But then they do everything they can to pay as few taxes as possible.''

As that piece reported, Apple not only does its utmost to avoid paying federal taxes in the U.S., but also to minimize its taxes at the state and local level. One favorite trick: Nevada. The Times: “With a handful of employees in a small office here in Reno, Apple has done something central to its corporate strategy: it has avoided millions of dollars in taxes in California and 20 other states. Apple’s headquarters are in Cupertino, Calif. By putting an office in Reno, just 200 miles away, to collect and invest the company’s profits, Apple sidesteps state income taxes on some of those gains. California’s corporate tax rate is 8.84 percent. Nevada’s? Zero.”

more

http://www.newrepublic.com/article/113276/apple-avoids-us-taxes-then-complains-our-schools-are-lousy

Thursday Toon roundup 5- The Rest

Weiner

Penn

Workers

Spying

Students

Gold Bugs

Pope

Cats

Profile Information

Gender: Do not displayMember since: Tue Feb 10, 2004, 01:08 PM

Number of posts: 47,953