Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

Octafish

Octafish's Journal

Octafish's Journal

July 17, 2012

Positively Darth Vadress!

Most incredible imagery and profound prose yours, woo me with science.

Oceania has always been at war with Hugo Boss, er, Ralph Lauren...

July 17, 2012

Motorists may have been paying too much for their petrol because banks and other traders are likely to have tried to manipulate oil prices in the same way they rigged interest rates, an official report has warned.

Concerns are growing about the reliability of oil prices, after a report for the G20 found the market is wide open to “manipulation or distortion”.

Traders from banks, oil companies or hedge funds have an “incentive” to distort the market and are likely to try to report false prices, it said.

Politicians and fuel campaigners last night urged the Government to expand its inquiry into the Libor scandal to see whether oil prices have also been falsely pushed up.

CONTINUED...

http://www.telegraph.co.uk/earth/energy/fuel/9401934/Was-the-petrol-price-rigged-too.html

Anyone up for an investigation? Sen. Sanders?

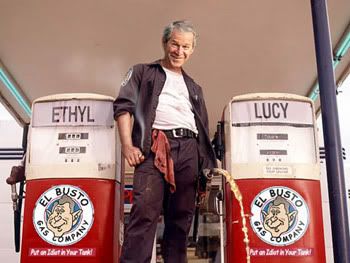

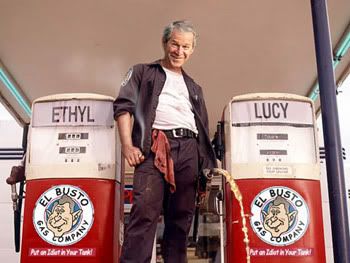

Were Gas Prices Rigged, too? LIBOR-like?

Motorists may have been paying too much for their petrol because banks and other traders are likely to have tried to manipulate oil prices in the same way they rigged interest rates, an official report has warned.

Concerns are growing about the reliability of oil prices, after a report for the G20 found the market is wide open to “manipulation or distortion”.

Traders from banks, oil companies or hedge funds have an “incentive” to distort the market and are likely to try to report false prices, it said.

Politicians and fuel campaigners last night urged the Government to expand its inquiry into the Libor scandal to see whether oil prices have also been falsely pushed up.

CONTINUED...

http://www.telegraph.co.uk/earth/energy/fuel/9401934/Was-the-petrol-price-rigged-too.html

Anyone up for an investigation? Sen. Sanders?

July 15, 2012

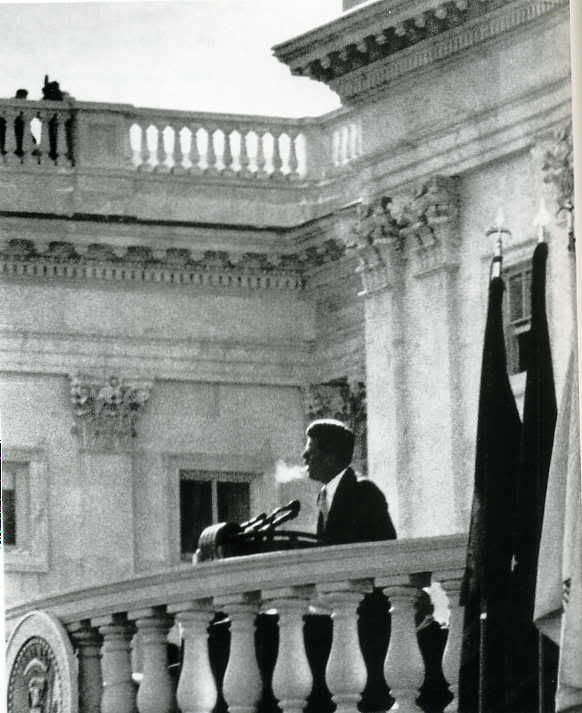

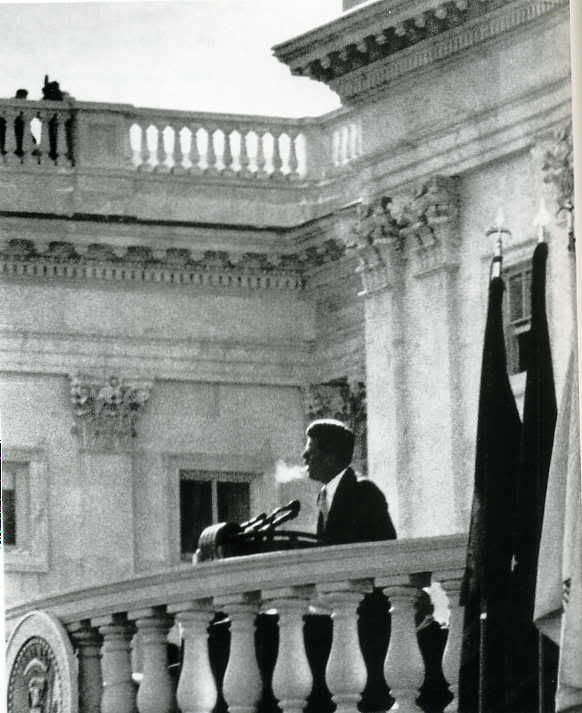

President John F. Kennedy, Friday, January 20, 1961, in his Inaugural Address

More for those new to the subject:

JFK battled Wall Street and Big Business

So, in the short time he had, President Kennedy did what he could to balance the interests of concentrated wealth with the interests of the average American -- necessary for the good of the country.

Professor Donald Gibson detailed the issues in his 1994 book, Battling Wall Street: The Kennedy Presidency.

From the book:

"What (J.F.K. tried) to do with everything from global investment patterns to tax breaks for individuals was to re-shape laws and policies so that the power of property and the search for profit would not end up destroying rather than creating economic prosperity for the country."

-- Donald Gibson, Battling Wall Street. The Kennedy Presidency

More on the book, by two great Americans:

"Gibson captures what I believe to be the most essential and enduring aspect of the Kennedy presidency. He not only sets the historical record straight, but his work speaks volumes against today's burgeoning cynicism and in support of the vision, ideal, and practical reality embodied in the presidency of John F. Kennedy - that every one of us can make a difference." -- Rep. Henry B. Gonzalez, Chair, House Committee on Banking, Finance, and Urban Affairs

"Professor Gibson has written a unique and important book. It is undoubtedly the most complete and profound analysis of the economic policies of President Kennedy. From here on in, anyone who states that Kennedy was timid or status quo or traditional in that field will immediately reveal himself ignorant of Battling Wall Street. It is that convincing." -- James DiEugenio, author, Destiny Betrayed. JFK, Cuba, and the Garrison Case --This text refers to an out of print or unavailable edition of this title.

Had he lived to serve a second term, I'd bet on JFK putting people ahead of The Fed. Bet also there'd be a heckuva lot more leaders, er, politicians who'd do the same.

"If a free society cannot help the many who are poor, it cannot save the few who are rich."

President John F. Kennedy, Friday, January 20, 1961, in his Inaugural Address

More for those new to the subject:

JFK battled Wall Street and Big Business

So, in the short time he had, President Kennedy did what he could to balance the interests of concentrated wealth with the interests of the average American -- necessary for the good of the country.

Professor Donald Gibson detailed the issues in his 1994 book, Battling Wall Street: The Kennedy Presidency.

From the book:

"What (J.F.K. tried) to do with everything from global investment patterns to tax breaks for individuals was to re-shape laws and policies so that the power of property and the search for profit would not end up destroying rather than creating economic prosperity for the country."

-- Donald Gibson, Battling Wall Street. The Kennedy Presidency

More on the book, by two great Americans:

"Gibson captures what I believe to be the most essential and enduring aspect of the Kennedy presidency. He not only sets the historical record straight, but his work speaks volumes against today's burgeoning cynicism and in support of the vision, ideal, and practical reality embodied in the presidency of John F. Kennedy - that every one of us can make a difference." -- Rep. Henry B. Gonzalez, Chair, House Committee on Banking, Finance, and Urban Affairs

"Professor Gibson has written a unique and important book. It is undoubtedly the most complete and profound analysis of the economic policies of President Kennedy. From here on in, anyone who states that Kennedy was timid or status quo or traditional in that field will immediately reveal himself ignorant of Battling Wall Street. It is that convincing." -- James DiEugenio, author, Destiny Betrayed. JFK, Cuba, and the Garrison Case --This text refers to an out of print or unavailable edition of this title.

Had he lived to serve a second term, I'd bet on JFK putting people ahead of The Fed. Bet also there'd be a heckuva lot more leaders, er, politicians who'd do the same.

July 15, 2012

Elites say that we need inequality to encourage the rich to invest and the creative to invent. That's working out well -- for 1% pooches.

By Gerald Friedman, AlterNet

Posted on July 8, 2012, Printed on July 15, 2012

Summer 2009. Unemployment is soaring. Across America, millions of terrified people are facing foreclosure and getting kicked to the curb. Meanwhile in sunny California, the hotel-heiress Paris Hilton is investing $350,000 of her $100 million fortune in a two-story house for her dogs. A Pepto Bismol-colored replica of Paris’ own Beverly Hills home, the backyard doghouse provides her precious pooches with two floors of luxury living, complete with abundant closet space and central air.

SNIP...

The slowdown in growth since the abandonment of egalitarian New Deal policies has cost Americans about 30 percent of their income. And the massive redistribution of income away from average Americans and toward the rich has destroyed the sense that America is a land of opportunity for all. Quality of life has plunged because the shredding of social protections has exposed average Americans to much higher levels of risk. The substitution of defined contribution pensions, such as Individual Retirement Accounts or 401K plans, for defined benefit pensions has reduced retirement security for individuals while reducing the risk borne by employers or other social institutions. Just as important as declining income for many Americans, the stress and anxiety associated with the risk shift has contributed to rising levels of depression and morbidity and a decline in life expectancy for Americans compared with residents of other countries.

Workers’ security has been abandoned. But the government has let financial markets run wild. In 1982, Congress deregulated the thrift industry, freeing thrifts to engage in reckless and fraudulent behavior. In 1994, it removed restrictions on interstate banking. In 1998 it allowed Citigroup to merge with Travelers’ Insurance to create the world’s largest financial services company. And in the Gramm-Leach-Bliley Act of 1999, it repealed the remaining Glass-Steagall barriers between commercial and investment banking. Acting with the virtual consent of Congress and the president, in 2004, the Securities and Exchange Commission established a system of voluntary regulation that in essence allowed investment banks to set their own capital and leverage standards.

By then our financial regulatory system had largely returned to the pre-New Deal situation in which we trusted financial institutions to self-police. Advocates of deregulation, like Federal Reserve chair Alan Greenspan, were unconcerned because they expected banks and other financial firms to limit their risk for fear of failure. Either they misunderstood the incentives facing company managers, or they did not care. In practice, financiers are playing with other people’s money (ours). When they do well, their compensation is tied to profits and they can earn huge sums. But when their investments fail, they are protected because monetary authorities and the United States Treasury cannot allow "too big to fail" financial companies to go bust. So long as risky investments would have periods of high returns, the managers of deregulated financial firms have an incentive to increase their risk, profiting from success while passing the costs of failure to the public. We have all been suffering from the consequences of their failures since the financial crisis of 2007-'08.

The share of income going to the top 1 percent has doubled since the 1970s, returning to the levels of the 1920s. The greatest gains have gone to the very wealthiest and to executives and managers, especially of financial firms. From 1973 to 2008, the average income of the bottom 90 percent of American households fell even while the rich gained. The wealthiest 1 percent gained 144 percent or over $600,000 per household; and the richest 1 percent of the 1 percent, barely 30,000 people, gained over 455 percent or over $19,000,000.

CONTINUED...

http://www.alternet.org/story/156143/

What Les McCann said about that stinking mutt.

How Paris Hilton's Dogs Ended Up Better Off Than 99-percent of us.

The Great Capitalist Heist: How Paris Hilton's Dogs Ended Up Better Off Than YouElites say that we need inequality to encourage the rich to invest and the creative to invent. That's working out well -- for 1% pooches.

By Gerald Friedman, AlterNet

Posted on July 8, 2012, Printed on July 15, 2012

Summer 2009. Unemployment is soaring. Across America, millions of terrified people are facing foreclosure and getting kicked to the curb. Meanwhile in sunny California, the hotel-heiress Paris Hilton is investing $350,000 of her $100 million fortune in a two-story house for her dogs. A Pepto Bismol-colored replica of Paris’ own Beverly Hills home, the backyard doghouse provides her precious pooches with two floors of luxury living, complete with abundant closet space and central air.

SNIP...

The slowdown in growth since the abandonment of egalitarian New Deal policies has cost Americans about 30 percent of their income. And the massive redistribution of income away from average Americans and toward the rich has destroyed the sense that America is a land of opportunity for all. Quality of life has plunged because the shredding of social protections has exposed average Americans to much higher levels of risk. The substitution of defined contribution pensions, such as Individual Retirement Accounts or 401K plans, for defined benefit pensions has reduced retirement security for individuals while reducing the risk borne by employers or other social institutions. Just as important as declining income for many Americans, the stress and anxiety associated with the risk shift has contributed to rising levels of depression and morbidity and a decline in life expectancy for Americans compared with residents of other countries.

Workers’ security has been abandoned. But the government has let financial markets run wild. In 1982, Congress deregulated the thrift industry, freeing thrifts to engage in reckless and fraudulent behavior. In 1994, it removed restrictions on interstate banking. In 1998 it allowed Citigroup to merge with Travelers’ Insurance to create the world’s largest financial services company. And in the Gramm-Leach-Bliley Act of 1999, it repealed the remaining Glass-Steagall barriers between commercial and investment banking. Acting with the virtual consent of Congress and the president, in 2004, the Securities and Exchange Commission established a system of voluntary regulation that in essence allowed investment banks to set their own capital and leverage standards.

By then our financial regulatory system had largely returned to the pre-New Deal situation in which we trusted financial institutions to self-police. Advocates of deregulation, like Federal Reserve chair Alan Greenspan, were unconcerned because they expected banks and other financial firms to limit their risk for fear of failure. Either they misunderstood the incentives facing company managers, or they did not care. In practice, financiers are playing with other people’s money (ours). When they do well, their compensation is tied to profits and they can earn huge sums. But when their investments fail, they are protected because monetary authorities and the United States Treasury cannot allow "too big to fail" financial companies to go bust. So long as risky investments would have periods of high returns, the managers of deregulated financial firms have an incentive to increase their risk, profiting from success while passing the costs of failure to the public. We have all been suffering from the consequences of their failures since the financial crisis of 2007-'08.

The share of income going to the top 1 percent has doubled since the 1970s, returning to the levels of the 1920s. The greatest gains have gone to the very wealthiest and to executives and managers, especially of financial firms. From 1973 to 2008, the average income of the bottom 90 percent of American households fell even while the rich gained. The wealthiest 1 percent gained 144 percent or over $600,000 per household; and the richest 1 percent of the 1 percent, barely 30,000 people, gained over 455 percent or over $19,000,000.

CONTINUED...

http://www.alternet.org/story/156143/

What Les McCann said about that stinking mutt.

July 14, 2012

Bilderberg 2012: were Mitt Romney and Bill Gates there?

Another conference over. Charlie Skelton talks to some of the 800 activists outside the gates to find out what they learned

A banner welcomes Republican presidential nominee Mitt Romney to the 2012 Bilderberg conference. Photograph: Hannah Borno for the Guardian

What a Bilderberg it's been. Big names, big money, big decisions, big crowds. Somewhere around 800 activists outside the gates (up from about a dozen in 2009), and inside? Well, here's what we learned.

A Mitt Romney attendance?

Four eyewitnesses on the hotel staff told me Willard Mitt Romney was here at Bilderberg 2012. My four eyewitnesses place him inside. That's one more than Woodward and Bernstein used. Romney's office initially refused to confirm or deny his attendance as Bilderberg is "not public". His people later said it wasn't him.

So, was he being crowned, or singing for his supper? Will Mitt Romney follow in the august footsteps of Clinton, Cameron and Blair to have attended Bilderberg and then shortly become leader? Four years ago, Senator Obama shook off his press detail and nipped (many think) into Bilderberg. This exact same hotel.

Did Romney have to get down on one knee in front of David Rockefeller? This sounds flippant, but it's a serious question: has Bilderberg switched allegiance? Are they going to toss away Obama after just one term?

CONTINUED...

http://www.guardian.co.uk/world/us-news-blog/2012/jun/05/bilderberg-2012-chantilly-occupy

This subject of Willard's rise to the top of the rat heap, seemingly out of thin air, should be of interest to those wondering about how well-off the Well-Off always seem to be.

Romney is just another stooge of the Ownership Class

A great guy at the right club.

Bilderberg 2012: were Mitt Romney and Bill Gates there?

Another conference over. Charlie Skelton talks to some of the 800 activists outside the gates to find out what they learned

A banner welcomes Republican presidential nominee Mitt Romney to the 2012 Bilderberg conference. Photograph: Hannah Borno for the Guardian

What a Bilderberg it's been. Big names, big money, big decisions, big crowds. Somewhere around 800 activists outside the gates (up from about a dozen in 2009), and inside? Well, here's what we learned.

A Mitt Romney attendance?

Four eyewitnesses on the hotel staff told me Willard Mitt Romney was here at Bilderberg 2012. My four eyewitnesses place him inside. That's one more than Woodward and Bernstein used. Romney's office initially refused to confirm or deny his attendance as Bilderberg is "not public". His people later said it wasn't him.

So, was he being crowned, or singing for his supper? Will Mitt Romney follow in the august footsteps of Clinton, Cameron and Blair to have attended Bilderberg and then shortly become leader? Four years ago, Senator Obama shook off his press detail and nipped (many think) into Bilderberg. This exact same hotel.

Did Romney have to get down on one knee in front of David Rockefeller? This sounds flippant, but it's a serious question: has Bilderberg switched allegiance? Are they going to toss away Obama after just one term?

CONTINUED...

http://www.guardian.co.uk/world/us-news-blog/2012/jun/05/bilderberg-2012-chantilly-occupy

This subject of Willard's rise to the top of the rat heap, seemingly out of thin air, should be of interest to those wondering about how well-off the Well-Off always seem to be.

July 14, 2012

Conspiratorial Wink (detail) by Michael Samuels

The Truth in Plain English:

Picking Our Pockets and Lining Theirs

Banksters Take Us to the Brink

by BILL MOYERS and MICHAEL WINSHIP

CounterPunch

Weekend Edition July 13-15, 2012

EXCERPT...

And what a business! You’ve most likely been hearing about the newest scandal in banking, centering on Barclays Bank in Great Britain and something called Libor. That stands for London Interbank Offered Rate and involves a group of bankers who set a daily interest rate affecting trillions of dollars of transactions around the world. Your home mortgage, your college debt, your credit card fees; all of these could have been affected by Libor.

Now you would think the rates would be set by market forces, right? Aren’t they what makes the world go ‘round? But it turns out some of those insiders were manipulating the index for their own gain, to make their banks look better off during the financial crisis, lower their borrowing costs, and raise their profits – by cheating. Picking our pockets and lining theirs.

SNIP...

“In testimony last week before the British Parliament, former Barclays chief executive Robert E. Diamond said the bank had repeatedly brought to the attention of U.S. regulators — as well as U.K. regulators — the problems that the bank was experiencing in the Libor market.

“He said the bank’s warnings to regulators that Libor was artificially low did not lead to action. Barclays’ regulator in the United States is the Federal Reserve Bank of New York, which was run at the time by current Treasury Secretary Timothy F. Geithner.”

CONTINUED...

http://www.counterpunch.org/2012/07/13/banksters-take-us-to-the-brink/

Gosh. I'm so old that I can remember when America had more than a few leaders who put the People ahead of profits.

Picking Our Pockets and Lining Theirs - Banksters Take Us to the Brink (Moyers and Winship)

Conspiratorial Wink (detail) by Michael Samuels

The Truth in Plain English:

Picking Our Pockets and Lining Theirs

Banksters Take Us to the Brink

by BILL MOYERS and MICHAEL WINSHIP

CounterPunch

Weekend Edition July 13-15, 2012

EXCERPT...

And what a business! You’ve most likely been hearing about the newest scandal in banking, centering on Barclays Bank in Great Britain and something called Libor. That stands for London Interbank Offered Rate and involves a group of bankers who set a daily interest rate affecting trillions of dollars of transactions around the world. Your home mortgage, your college debt, your credit card fees; all of these could have been affected by Libor.

Now you would think the rates would be set by market forces, right? Aren’t they what makes the world go ‘round? But it turns out some of those insiders were manipulating the index for their own gain, to make their banks look better off during the financial crisis, lower their borrowing costs, and raise their profits – by cheating. Picking our pockets and lining theirs.

SNIP...

“In testimony last week before the British Parliament, former Barclays chief executive Robert E. Diamond said the bank had repeatedly brought to the attention of U.S. regulators — as well as U.K. regulators — the problems that the bank was experiencing in the Libor market.

“He said the bank’s warnings to regulators that Libor was artificially low did not lead to action. Barclays’ regulator in the United States is the Federal Reserve Bank of New York, which was run at the time by current Treasury Secretary Timothy F. Geithner.”

CONTINUED...

http://www.counterpunch.org/2012/07/13/banksters-take-us-to-the-brink/

Gosh. I'm so old that I can remember when America had more than a few leaders who put the People ahead of profits.

July 12, 2012

What's not to love? Mitt will fit right in with the kids of the people who tried to overthrow FDR.

PS: Thank you for the detailed reports on the Olympics scam-wa. Incredible to those who are new to the subject. Business as usual for the plutocracy.

Shadowy Years. Shadowy Business. Shadowy Government.

What's not to love? Mitt will fit right in with the kids of the people who tried to overthrow FDR.

PS: Thank you for the detailed reports on the Olympics scam-wa. Incredible to those who are new to the subject. Business as usual for the plutocracy.

July 11, 2012

The Geithner mystery solved

By Glenn Greenwald

Salon.com Monday, Sep 19, 2011 06:20 ET

Reviewing "Confidence Men" -- Ron Suskind's new book critically examining President Obama's management of the financial crisis -- The New York Times' Michiko Kakutani ponders this mystery raised by Suskind:

Of course, one might ask the same of Obama's penchant for filling the most important positions in his administration -- including his Vice President, Secretary of State, and Defense Secretary -- with supporters of the Iraq War. But about Geithner, Suskind unwittingly solved the mystery he raised: Kakutani notes that "one top banker quoted in these pages refers to as 'our man in Washington' for helping avert more systemic changes affecting Wall Street."

CONTINUED...

http://www.salon.com/news/timothy_geithner/index.html?story=/opinion/greenwald/2011/09/19/geithner

So, please don't smear Greenwald as a "Black Propagandist." He's only reporting things as experts who follow systemic bank fraud see them.

''Consider this a friendly warning.''

Interesting choice of words. Here's why I support Glen Greenwald over the "He's a Douchebag" crowd:

The Geithner mystery solved

By Glenn Greenwald

Salon.com Monday, Sep 19, 2011 06:20 ET

Reviewing "Confidence Men" -- Ron Suskind's new book critically examining President Obama's management of the financial crisis -- The New York Times' Michiko Kakutani ponders this mystery raised by Suskind:

Mr. Suskind suggests that the administration's problems in dealing with the fiscal crisis began with the president's choice of his economic team. He wonders why Mr. Obama turned away from the advisers who had seen him through the campaign (including more progressive thinkers like Mr. Stiglitz, Robert Reich and Austan Goolsbee), and relied instead on two men associated with the deregulatory policies of the past, Mr. Geithner, the Treasury secretary, and Mr. Summers, the chief economic adviser. Both men had served in the Clinton administration (with Treasury Secretary Robert E. Rubin, who would later join Citigroup as a senior adviser and board member); their actions, Mr. Suskind contends, "had contributed to the very financial disaster they were hired to solve."

Of course, one might ask the same of Obama's penchant for filling the most important positions in his administration -- including his Vice President, Secretary of State, and Defense Secretary -- with supporters of the Iraq War. But about Geithner, Suskind unwittingly solved the mystery he raised: Kakutani notes that "one top banker quoted in these pages refers to as 'our man in Washington' for helping avert more systemic changes affecting Wall Street."

CONTINUED...

http://www.salon.com/news/timothy_geithner/index.html?story=/opinion/greenwald/2011/09/19/geithner

So, please don't smear Greenwald as a "Black Propagandist." He's only reporting things as experts who follow systemic bank fraud see them.

Profile Information

Gender: MaleMember since: 2003 before July 6th

Number of posts: 55,745