Democratic Primaries

Related: About this forumOne example of how our for-profit health insurance model drives costs skyward

Insurance policyHow an industry shifted from protecting patients to seeking profit

Then his doctor switched hospitals.

The cost of Kivi’s infusions ballooned, soon surpassing $132,000 a month. He still wasn’t responsible for any of the cost, but he was stunned. What could account for this disparity in price?

Plenty of factors, writes Elisabeth Rosenthal, MD, in her new book An American Sickness. The new hospital spent more on amenities and marketing. It held the patent on Remicade, and stood to benefit from its administration if profits were high enough. And Kivi’s insurer didn’t push back against the higher price — instead, it paid three-quarters of it. Kivi was so appalled he switched to a medication he could take at home.

...Why did EmblemHealth agree to pay nearly $100,000 for each of Jeffrey Kivi’s infusions, even though they cost only $19,000 at another hospital just down the street? First, it’s less trouble for insurers to pay it than not. NYU is a big client that insurers don’t want to lose, and an insurer can compensate for the high price in various ways — by raising premiums, co-payments, or deductibles. Second, now that they suddenly have to use 80 to 85 percent rather than, say, 75 percent of premiums on patient care, insurers have a new perverse motivation to tolerate such big payouts.

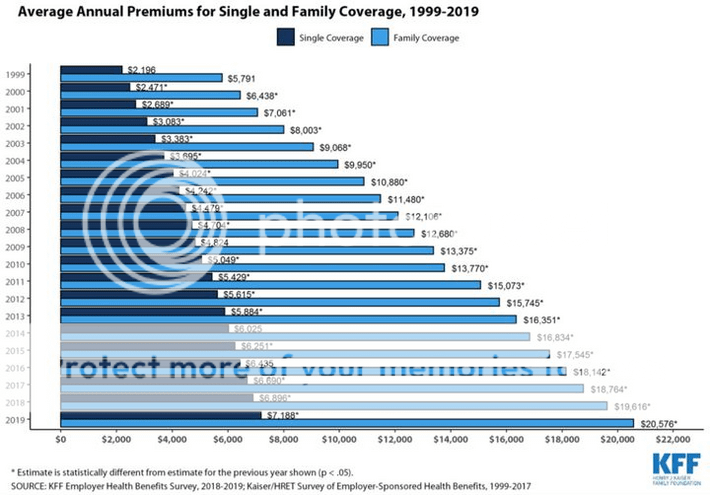

In order to make sure their 15 percent take is still sufficient to maintain salaries and investor dividends, insurance executives have to increase the size of the pie. To cover shortfalls, premiums are increased the next year, passing costs on to the consumers. And 15 percent of a big sum is more than 15 percent of a smaller one. No wonder 2017 premiums for the most common type of ACA plan are slated to rise by double digits in many cities, despite economists’ assurances that the growth of health care spending is slowing.

To some extent insurers do better if they negotiate better rates for your care. But that is true only under certain circumstances and in a limited way. “They are methodical money takers, who take in premiums and pay claims according to contracts — that’s their job,” said Barry Cohen, who owns an Ohio-based employee benefits company. “They don’t care whether the claims go up or down 20 percent as long as they get their piece. They’re too big to care about you.”

https://stanmed.stanford.edu/2017spring/how-health-insurance-changed-from-protecting-patients-to-seeking-profit.html

This is from 2017 but undoubtedly still common otherwise we wouldn't be spending 2X as much person on health care as other developed countries. Any health care plan that doesn't attack the root causes of rising costs is just kicking the can down the road. I'm not posting this as an advertisement for MFA or as an attack on any of the alternatives, I'm just trying to broaden the discussion here. The health care industrial complex is addicted to this form of bloat and will deploy any and all forms of argument to protect its interests. I encourage you to read the full article, which outlines the history of health insurance in America and the impact of employer-based plans on the "business" of health insurance, which only became a profit-driven business after WWII. The scope and scale of this problem is immense and we can't learn enough.

primary today, I would vote for: Undecided

guillaumeb

(42,641 posts)Profit before patient is the US insurance industry model.

And they spend billions in advertising to speak about how much they care about their customers.

primary today, I would vote for: Joe Biden

guillaumeb

(42,641 posts)So far this year, the eight publicly traded companies have made more than $21 billion, a 31% increase over the same period last year.

With few exceptions, most performed noticeably stronger during the third quarter of 2018 compared to last year, despite facing a whirlwind of regulatory changes while bracing for open enrollment and the midterm election.

https://www.fiercehealthcare.com/payer/big-eight-insurers-set-to-finish-strong-year-raking-132-4-billion-total-q3

primary today, I would vote for: Joe Biden

George II

(67,782 posts)Put another way, that's $7 billion on a total cost of $125.4 billion.

Comparatively speaking, in 2017 the gross profit of life insurance is 3%-9.6%, casualty insurance is 3%-8%, and the same year health insurance was 4%-5.25%.

https://www.investopedia.com/ask/answers/052515/what-usual-profit-margin-company-insurance-sector.asp

On the other hand,

https://smallbusiness.chron.com/average-manufacturers-gross-profit-percent-15827.html

primary today, I would vote for: Joe Biden

BeyondGeography

(39,351 posts)There’s a strong argument that they should be relegated to a strictly controlled supporting/supplemental role. My point in posting is to show the problem is bigger than insurance co’s but also to show how they enable an unsustainable, out-of-control system.

primary today, I would vote for: Undecided

guillaumeb

(42,641 posts)Big Pharma is also part of the US healthcare disaster.

And you are comparing net and gross here. Interesting.

primary today, I would vote for: Joe Biden

Uncle Joe

(58,300 posts)A new study from the Harvard School of Medicine says that 45,000 people die every year due to a lack of health insurance, and therefore a lack of access to ongoing medical care for a wide variety of treatable conditions. This seems so obvious as to not need documenting, but studies like this are still very important.

Nearly 45,000 annual deaths are associated with lack of health insurance, according to a new study published online today by the American Journal of Public Health. That figure is about two and a half times higher than an estimate from the Institute of Medicine (IOM) in 2002.

The study, conducted at Harvard Medical School and Cambridge Health Alliance, found that uninsured, working-age Americans have a 40 percent higher risk of death than their privately insured counterparts, up from a 25 percent excess death rate found in 1993.

“The uninsured have a higher risk of death when compared to the privately insured, even after taking into account socioeconomics, health behaviors, and baseline health,” said lead author Andrew Wilper, M.D., who currently teaches at the University of Washington School of Medicine. “We doctors have many new ways to prevent deaths from hypertension, diabetes, and heart disease — but only if patients can get into our offices and afford their medications.”

(snip)

https://www.patheos.com/blogs/dispatches/2018/10/15/study-45000-deaths-per-year-due-to-lack-of-health-insurance/

Thanks for the thread BeyondGeography.

primary today, I would vote for: Undecided

yellowdogintexas

(22,235 posts)Having worked in the profit and non profit types of insurance I know that non profit plans are more efficient, cost effective, accurate and have the best turnaround time. No large CEO salaries, no heavy advertising costs.

Medicare Part B is the only non profit plan of which I am aware. If I want better coverage I still need a supplement for copay and deductible.

I could bite the bullet and take a Medicare C Advantage plan but I hate the idea of supporting a for profit plan which was planned to be such.

primary today, I would vote for: Joe Biden

demigoddess

(6,640 posts)it was 20 dollars or so. Then our health care system had a new coverage from insurance. All of a sudden it was 60 dollars a month and rapidly rose to 160 dollars a month. Of course we then went through the insurance to get it. I do know that it was over 200 dollars a month at one point then. Heaven only knows what it is now!!!!! Looks to me like it is the insurance that makes it so expensive.

primary today, I would vote for: Joe Biden

DBoon

(22,340 posts)primary today, I would vote for: Joe Biden

genxlib

(5,518 posts)Yes, the profit margin is capped by the ACA which gives a perverse profit motivation to payout more. As noted, 15% of a larger pot is a bigger profit.

However, in most markets, the plans still have to compete with each other. Paying out more would require them to increase their premiums. So it only works if they are all doing it in sequence.

Personally, I would be raising holy hell with the Doctor. I would be looking for a new Doctor at the old facility. At that price, it would be cheaper to see Doctors at both but only get the medication at the cheaper.

The whole thing is a racket.

primary today, I would vote for: Joe Biden

redqueen

(115,103 posts)primary today, I would vote for: Undecided