2016 Postmortem

Related: About this forum$5 Billion in Political Contributions Bought Wall Street Freedom from Regulation, Restraint

The Republic, Justice and Democracy depend on Truth. Something you should know about the effects of money thereupon:

Steps to Financial Cataclysm Paved with Industry Dollars

March 4 - The financial sector invested more than $5 billion in political influence purchasing in Washington over the past decade, with as many as 3,000 lobbyists winning deregulation and other policy decisions that led directly to the current financial collapse, according to a 231-page report issued today by Essential Information and the Consumer Education Foundation.

The report, "Sold Out: How Wall Street and Washington Betrayed America," shows that, from 1998-2008, Wall Street investment firms, commercial banks, hedge funds, real estate companies and insurance conglomerates made $1.725 billion in political contributions and spent another $3.4 billion on lobbyists, a financial juggernaut aimed at undercutting federal regulation. Nearly 3,000 officially registered federal lobbyists worked for the industry in 2007 alone. The report documents a dozen distinct deregulatory moves that, together, led to the financial meltdown. These include prohibitions on regulating financial derivatives; the repeal of regulatory barriers between commercial banks and investment banks; a voluntary regulation scheme for big investment banks; and federal refusal to act to stop predatory subprime lending.

"The report details, step-by-step, how Washington systematically sold out to Wall Street," says Harvey Rosenfield, president of the Consumer Education Foundation, a California-based non-profit organization. "Depression-era programs that would have prevented the financial meltdown that began last year were dismantled, and the warnings of those who foresaw disaster were drowned in an ocean of political money. Americans were betrayed, and we are paying a high price -- trillions of dollars -- for that betrayal."

"Congress and the Executive Branch," says Robert Weissman of Essential Information and the lead author of the report, "responded to the legal bribes from the financial sector, rolling back common-sense standards, barring honest regulators from issuing rules to address emerging problems and trashing enforcement efforts. The progressive erosion of regulatory restraining walls led to a flood of bad loans, and a tsunami of bad bets based on those bad loans. Now, there is wreckage across the financial landscape."

12 Key Policy Decisions Led to Cataclysm

Financial deregulation led directly to the current economic meltdown. For the last three decades, government regulators, Congress and the executive branch, on a bipartisan basis, steadily eroded the regulatory system that restrained the financial sector from acting on its own worst tendencies. "Sold Out" details a dozen key steps to financial meltdown, revealing how industry pressure led to these deregulatory moves and their consequences:

1. In 1999, Congress repealed the Glass-Steagall Act, which had prohibited the merger of commercial banking and investment banking.

2. Regulatory rules permitted off-balance sheet accounting -- tricks that enabled banks to hide their liabilities.

3. The Clinton administration blocked the Commodity Futures Trading Commission from regulating financial derivatives -- which became the basis for massive speculation.

4. Congress in 2000 prohibited regulation of financial derivatives when it passed the Commodity Futures Modernization Act.

5. The Securities and Exchange Commission in 2004 adopted a voluntary regulation scheme for investment banks that enabled them to incur much higher levels of debt.

6. Rules adopted by global regulators at the behest of the financial industry would enable commercial banks to determine their own capital reserve requirements, based on their internal "risk-assessment models."

7. Federal regulators refused to block widespread predatory lending practices earlier in this decade, failing to either issue appropriate regulations or even enforce existing ones.

8. Federal bank regulators claimed the power to supersede state consumer protection laws that could have diminished predatory lending and other abusive practices.

9. Federal rules prevent victims of abusive loans from suing firms that bought their loans from the banks that issued the original loan.

10. Fannie Mae and Freddie Mac expanded beyond their traditional scope of business and entered the subprime market, ultimately costing taxpayers hundreds of billions of dollars.

11. The abandonment of antitrust and related regulatory principles enabled the creation of too-big-to-fail megabanks, which engaged in much riskier practices than smaller banks.

12. Beset by conflicts of interest, private credit rating companies incorrectly assessed the quality of mortgage-backed securities; a 2006 law handcuffed the SEC from properly regulating the firms.

Financial Sector Political Money and 3000 Lobbyists Dictated Washington Policy

During the period 1998-2008:

* Commercial banks spent more than $154 million on campaign contributions, while investing $363 million in officially registered lobbying:

* Accounting firms spent $68 million on campaign contributions and $115 million on lobbying;

* Insurance companies donated more than $218 million and spent more than $1.1 billion on lobbying;

* Securities firms invested more than $504 million in campaign contributions, and an additional $576 million in lobbying. Included in this total: private equity firms contributed $56 million to federal candidates and spent $33 million on lobbying; and hedge funds spent $32 million on campaign contributions (about half in the 2008 election cycle).

The betrayal was bipartisan: about 55 percent of the political donations went to Republicans and 45 percent to Democrats, primarily reflecting the balance of power over the decade. Democrats took just more than half of the financial sector's 2008 election cycle contributions.

The financial sector buttressed its political strength by placing Wall Street expatriates in top regulatory positions, including the post of Treasury Secretary held by two former Goldman Sachs chairs, Robert Rubin and Henry Paulson.

Financial firms employed a legion of lobbyists, maintaining nearly 3,000 separate lobbyists in 2007 alone.

These companies drew heavily from government in choosing their lobbyists. Surveying 20 leading financial firms, "Sold Out" finds 142 of the lobbyists they employed from 1998-2008 were previously high-ranking officials or employees in the Executive Branch or Congress.

* * *

Essential Information is a Washington, D.C. nonprofit that seeks to curb excessive corporate power. The Consumer Education Foundation is a California-based nonprofit that supports measures to prevent losses to consumers.

SOURCE: http://www.wallstreetwatch.org/soldoutreport.htm

The laws getting made to benefit what used to be crooks is a problem we used to call lobbying. Now the crooks are too big to jail. That's why I support Bernie Sanders.

Instead of freedom from prosecution for the Banksters, he wants to put them behind bars. Ask Bill Black.

FlatBaroque

(3,160 posts)Barney Fucking Frank.

Octafish

(55,745 posts)Guy today leads the Buy Partisan charge that Glass-Steagall had nothing to do with collapse of '08.

Ferd Berfel

(3,687 posts)sad. And very dangerous to democracy

rhett o rick

(55,981 posts)are fighting and the Clinton fans are embracing.

Octafish

(55,745 posts)Young Richard Milhous Nixon and Prescott Bush, Sr., back in the day.

Critics say even the largest settlement to date shows that the big banks never really pay for their financial crimes

byJon Queally

CommonDreams staff writer, Aug. 22, 2014

It's not nothing, say critics, but the U.S. government's announced $16.65 billion settlement with Bank of America announced on Thursday—so far the largest associated with the Wall Street-fueled mortgage malpractice that led to the 2008 financial meltdown—is more stage-acting than justice and more business-as-usual than real punishment.

Presented to the public as a victory for the Justice Department who negotiated the deal on behalf of the government, details of the BofA settlement—as with previous high-profile agreements with Citibank and JPMorgan—offer a clear view of how large banks have avoided responsibility for the behavior that sent the global economy into a tailspin just six years ago. Much of the money—as much as $7 billion of it—is not paid in cash as a fine, but is instead included as "soft money" in which banks are credited for writing down existing mortgages. Other large portions of the settlement are allowed to serve as business expenses which allows the banks to exploit them as tax write-offs.

SNIP...

Criticizing the BofA settlement and other similar deals, William D. Cohan, a former senior mergers and acquisitions banker who has written three books about Wall Street, wrote a scathing op-ed for the Times this week in which he called out Attorney General Eric Holder for trumpeting the agreements as wild success stories. Cohan wrote:

The fact is that by settling with the big Wall Street banks for billions of dollars — money that comes out of their shareholders’ pockets — Mr. Holder is allowing them to avoid the sunshine that Louis Brandeis wrote 100 years ago was the best disinfectant. Instead of shining the bright light on wrongdoing that took place at the Wall Street banks, Mr. Holder’s settlements allow them to cover it up permanently.

And that helps no one. The American people are deprived of knowing precisely how bad things got inside these banks in the years leading up to the financial crisis, and the banks, knowing they will be saved the humiliation caused by the public airing of a trove of emails and documents, will no doubt soon be repeating their callous and indifferent behavior.

Instead of the truth, we get from the Justice Department a heavily negotiated and sanitized “statement of facts” about what supposedly went wrong. In the case of JPMorgan, the statement of facts was 21 pages but contained little of substance beyond the fact that an unidentified whistle-blower at the bank tried to alert her superiors to her belief that shoddy mortgages were being packaged and sold as securities. Her warnings went unheeded and the mortgages were packaged and sold all the same.

Critics of both the banks and the government's effort to go after them in the wake of the crisis have repeatedly said that criminal prosecutions--including the threat of prison sentences for individual bankers and executives--would be the strongest and best response to activities that have unleashed so significant and widespread pain across society.

SNIP...

According to Yves Smith, who runs the Naked Capitalism blog, "the dirty secret" of these agreements is that "the Administration is not just protecting the banks. It now also needs to hide how cronyistic its behavior has been."

CONTINUED...

http://www.commondreams.org/news/2014/08/22/bank-america-settlement-only-proves-invincibility-wall-street

Something's not right when banks get away with bilking We the People as official policy.

Banksters plus secret inside information is Wall Street on the Potomac.

What a coincidence. It also explains the need for NSA Domestic Spy Ops and related sundry FASCISM

Secret police, spying on everyone.

Know who said what to whom.

Operate under secret laws, in secret and unaccountable.

Wars without end make them ever more powerful.

Their banksters hide trillions in loot offshore,

We don't even know all their names.

So we can't talk about them.

And they hold the most wealth and power ever wielded.

And no one voted them in.

rhett o rick

(55,981 posts)Ferd Berfel

(3,687 posts)Dustlawyer

(10,499 posts)In this election we are able to tell clearly who sold out and who did not! I still don't understand why so many so called Democrats and Progressives aren't concerned about all of the money and support Hillary has received from these bastards. Her statement that their money has no effect on her is laughable if I wasn't crying!

If she beats Trump we will be able to prove we were right, not that most would listen and not that it would do much good. The only thing is it will continue to add to our/Bernie's movement to get the money out of politics. Hillary owes some big payback (quid pro quo)!!!

Octafish

(55,745 posts)UBS is a Swiss bank that is enjoying better days, thanks to the US taxpayer and a number of key US political leaders.

Hillary Helps a Bank—and Then It Funnels Millions to the Clintons

The Wall Street Journal’s eyebrow-raising story of how the presidential candidate and her husband accepted cash from UBS without any regard for the appearance of impropriety that it created.

by CONOR FRIEDERSDORF, The Atlantic, JUL 31, 2015

The Swiss bank UBS is one of the biggest, most powerful financial institutions in the world. As secretary of state, Hillary Clinton intervened to help it out with the IRS. And after that, the Swiss bank paid Bill Clinton $1.5 million for speaking gigs. The Wall Street Journal reported all that and more Thursday in an article that highlights huge conflicts of interest that the Clintons have created in the recent past.

The piece begins by detailing how Clinton helped the global bank.

“A few weeks after Hillary Clinton was sworn in as secretary of state in early 2009, she was summoned to Geneva by her Swiss counterpart to discuss an urgent matter. The Internal Revenue Service was suing UBS AG to get the identities of Americans with secret accounts,” the newspaper reports. “If the case proceeded, Switzerland’s largest bank would face an impossible choice: Violate Swiss secrecy laws by handing over the names, or refuse and face criminal charges in U.S. federal court. Within months, Mrs. Clinton announced a tentative legal settlement—an unusual intervention by the top U.S. diplomat. UBS ultimately turned over information on 4,450 accounts, a fraction of the 52,000 sought by the IRS.”

Then reporters James V. Grimaldi and Rebecca Ballhaus lay out how UBS helped the Clintons. “Total donations by UBS to the Clinton Foundation grew from less than $60,000 through 2008 to a cumulative total of about $600,000 by the end of 2014, according to the foundation and the bank,” they report. “The bank also joined the Clinton Foundation to launch entrepreneurship and inner-city loan programs, through which it lent $32 million. And it paid former president Bill Clinton $1.5 million to participate in a series of question-and-answer sessions with UBS Wealth Management Chief Executive Bob McCann, making UBS his biggest single corporate source of speech income disclosed since he left the White House.”

The article adds that “there is no evidence of any link between Mrs. Clinton’s involvement in the case and the bank’s donations to the Bill, Hillary and Chelsea Clinton Foundation, or its hiring of Mr. Clinton.” Maybe it’s all a mere coincidence, and when UBS agreed to pay Bill Clinton $1.5 million the relevant decision-maker wasn’t even aware of the vast sum his wife may have saved the bank or the power that she will potentially wield after the 2016 presidential election.

SNIP...

As McClatchy noted last month in a more broadly focused article that also mentions UBS, “Ten of the world’s biggest financial institutions––including UBS, Bank of America, JP Morgan Chase, Citigroup and Goldman Sachs––have hired Bill Clinton numerous times since 2004 to speak for fees totaling more than $6.4 million. Hillary Clinton also has accepted speaking fees from at least one bank. And along with an 11th bank, the French giant BNP Paribas, the financial goliaths also donated as much as $24.9 million to the Clinton Foundation––the family’s global charity set up to tackle causes from the AIDS epidemic in Africa to climate change.”

CONTINUED...

http://www.theatlantic.com/politics/archive/2015/07/hillary-helps-a-bankand-then-it-pays-bill-15-million-in-speaking-fees/400067/

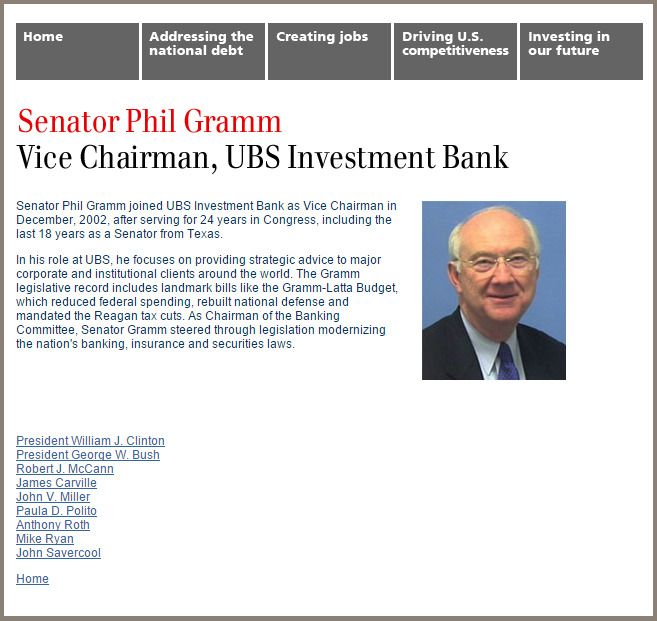

About UBS Wealth Management

It's Buy Partisan

After his exit from the US Senate, Phil Gramm found a job at Swiss bank UBS as vice chairman. He later brought on former President Bill Clinton. What a coincidence, they are the two key figures in repealing Glass-Steagal. Since the New Deal it was the financial regulation that protected the US taxpayer from the Wall Street casino. Oh well, what's a $16 trillion bailout among friends?

It's a Buy-Partisan Who's Who:

President William J. Clinton

President George W. Bush Heh heh heh.

Robert J. McCann

James Carville

John V. Miller

Paula D. Polito

Anthony Roth

Mike Ryan

John Savercool

SOURCE: http://financialservicesinc.ubs.com/revitalizingamerica/SenatorPhilGramm.html

One of my attorney chums doesn't like to see his name on any committees, event letterhead or political campaign literature. These folks, it seems to me, are past caring.

Some of why DUers and ALL voters should care about Phil Gramm.

I bring this up frequently, cousin Dustlawyer, because the nation's "news media" won't do it's Constitutionally mandated job of telling the truth.

Kittycat

(10,493 posts)Because we just can't get any more fucked up as a party than this.

https://twitter.com/davidsirota/status/728586527337385984

Forget the foxes watching the henhouse, the hyenas are standing inside and laughing right at us.

tularetom

(23,664 posts)But they aren't the only ones. We've been stuck with Geithner for quite a few years now and don't forget Summers just before or after Rubin.

It really isn't their fault, however. They are only do what they are trained to do. Our greater outrage must be reserved for the corrupt presidents who appointed them.

Octafish

(55,745 posts)Millions of Americans used as foam for the Banksters.

Neil Barofsky, the former special inspector general for the Troubled Asset Relief Program, has published a new book, “Bailout: An Inside Account of How Washington Abandoned Main Street While Rescuing Wall Street.” It presents a damning indictment of the Obama administration’s execution of the TARP program generally, and of HAMP in particular.

...

By delaying millions of foreclosures, HAMP gave bailed-out banks more time to absorb housing-related losses while other parts of Obama’s bailout plan repaired holes in the banks’ balance sheets. According to Barofsky, Treasury Secretary Tim Geithner even had a term for it. [font color="green"]HAMP borrowers would “foam the runway” for the distressed banks looking for a safe landing.[/font color] It is nice to know what Geithner really thinks of those Americans who were busy losing their homes in hard times.

CONTINUED w VIDEO and links and more letters...

http://washingtonexaminer.com/video-geithner-sacrificed-homeowners-to-foam-the-runway-for-the-banks/article/2502982

Rachel went on and on last night about some piker bankster Steven Mnuchin at Indymac Bank who kicked a measly 35,000 families out of their homes. She must not know.

rhett o rick

(55,981 posts)back? How about Greenspan? Maybe Clinton will have the head of Ayn Rand carved into Mt Rushmore.

cali

(114,904 posts)Octafish

(55,745 posts)An example:

The World’s Greatest Insurance Heist

by ELLEN BROWN

FEBRUARY 08, 2010

CounterPunch

EXCERPT...

Geithner has been under the House microscope for the decision of the New York Fed, made while he headed it, to buy out about $30 billion in credit default swaps (over-the-counter derivative insurance contracts) that AIG sold on toxic debt securities. The chief recipients of this payout were Goldman Sachs, Merrill Lynch, Societe Generale and Deutsche Bank. Goldman got $13 billion, roughly equivalent to its bonus pool for the first 9 months of 2009. Critics are calling the New York Fed’s decision a back-door bailout for the banks, which received 100 cents on the dollar for contracts that would have been worth far less had AIG been put through bankruptcy proceedings in the ordinary way. In a Bloomberg article provocatively titled “Secret Banking Cabal Emerges from AIG Shadows,” David Reilly writes:

(T)he New York Fed is a quasi-governmental institution that isn’t subject to citizen intrusions such as freedom of information requests, unlike the Federal Reserve. This impenetrability comes in handy since the bank is the preferred vehicle for many of the Fed’s bailout programs. It’s as though the New York Fed was a black-ops outfit for the nation’s central bank.

The beneficiaries of the New York Fed’s largesse got paid in full although they had agreed to take much less. In a November 2009 article titled “It’s Time to Fire Tim Geithner,” Dylan Ratigan wrote:

(L)ast November . . . New York Federal Reserve Governor Tim Geithner decided to deliver 100 cents on the dollar, in secret no less, to pay off the counter parties to the world’s largest (and still un-investigated) insurance fraud — AIG. This full payoff with taxpayer dollars was carried out by Geithner after AIG’s bank customers, such as Goldman Sachs, Deutsche Bank and Societe Generale, had already previously agreed to taking as little as 40 cents on the dollar. Even after the GM autoworkers, bondholders and vendors all received a government-enforced haircut on their contracts, he still had the audacity to claim the “sanctity of contracts” in the dealings with these companies like AIG.

Geithner testified that the Fed’s hands were tied and that the bank could not “selectively default on contractual obligations without courting collapse.” But if it was all on the up and up, why all the secrecy? The contention that the Fed had no choice is also belied by a recent holding in the Lehman Brothers bankruptcy, in which New York Bankruptcy Judge James Peck set aside the same type of investment contracts that Secretaries Paulson and Geithner repeatedly swore under oath had to be paid in full in the case of AIG. The judge declared that clauses in those contracts subordinating other claims to the holders’ claims were null and void in bankruptcy.

“And notice,” comments bank analyst Chris Whalen, “that the world has not ended when the holders of [derivative] contracts are treated like everyone else.” He calls the AIG bailout “a hideous political contrivance that ranks with the great acts of political corruption and thievery in the history of the United States.”

CONTINUED...

http://www.counterpunch.org/2010/02/08/the-world-s-greatest-insurance-heist/

While Goldman got gold, my friends got kicked out of their homes.

PS: Great to read ya, cali! Place wasn't the same.

polly7

(20,582 posts)Octafish

(55,745 posts)Haven't seen this discussed much on DU, much to my shame.

Financial Industry Lobbying To Shape Puerto Rico Bankruptcy Bill

by Clark Mindock and David Sirota

International Business Times, 04/13/16

EXCERPT...

Over the last few years, hedge funds and mutual funds have bought up large tranches of Puerto Rico’s bonds at cut-rate prices, hoping the island will pay back its debts in full, thereby giving those financial interests a big payout. That gamble, however, has relied in part on the bet that the island will make draconian cuts to social services and worker pensions and use the savings to pay back 100 cents on the dollar to its Wall Street creditors — a bet, in other words, that Congress will prevent the island from simply erasing some of its debt through the kind of bankruptcy protections that are afforded U.S. cities.

To that end, federal lobbying records show that major banks, bond insurers and hedge funds spent millions last year to try to shape bankruptcy proposals for the island. Two so-called dark money groups linked to the billionaire Koch brothers and Republican strategist Karl Rove are also working to influence the debate over Puerto Rico’s debt.

The Council for Citizens Against Government Waste (CAGW) spent a combined $130,000 in 2015 to lobby the federal government on issues including Puerto Rico’s bankruptcy proposal. CAGW receives funding from Koch-backed dark money organizations — nonprofits that conceal their donor network.

Several people identified as donors to the Koch network could lose money should the island territory’s government obtain bankruptcy rights. If Puerto Rico is allowed to retroactively change the rules of their bond obligations, its bondholders — like any creditors after a bankruptcy — could get back only part of the money they were owed.

That includes billionaire hedge fund manager Ken Griffin, whose investment firm Citadel has owned as much as 5.6 percent of the parent company of Puerto Rican bank Banco Popular — one of many institutions that could be thrust into financial turmoil with debt restructuring — according to filings with the Securities and Exchange Commission. Joining Griffin is the co-CEO of hedge fund Renaissance Technologies, Robert Mercer, whose firm had just over $2 million invested in Banco Popular’s parent company last year when CAGW lobbied on debt, but sold its stake in the company in September, according to Thomson Reuters data. Also among Koch network donors that have held a stake in the bonds themselves is Dick Weiss, of investment firm Wells Capital Management, which is ranked as the seventh-biggest mutual fund owner of Puerto Rican bonds.

The other dark-money-backed group lobbying on the issue is the Center for Individual Freedom (CFIF), which spent $39,000 lobbying the federal government in 2015. That organization has received $5 million from Crossroads GPS — the political nonprofit founded by Rove, who served as deputy White House chief of staff to former President George W. Bush — according to data compiled by the Center for Responsive Politics. So far, CFIF has spent at least $200,000 on ads opposing a Puerto Rico debt restructuring, which it called a bailout, according to the Sunlight Foundation. One other dark money donor to the group is the American Action Network, which frequently funds anti-Democrat ad campaigns.

Mercer, one of the Koch network donors, is known to have contributed at least $1 million to Crossroads GPS during the 2012 presidential election cycle. Other donors to the group include Griffin and Daniel Loeb, the founder of Third Point LLC, which has held Puerto Rican bonds.

SNIP...

Many other big financial institutions have lobbied lawmakers on the Puerto Rican debt issue. That includes:

- Investment banking and financial services corporation Citigroup, which spent $120,000 on lobbying efforts that included employing three former House officials.

- The Investment Company Institute, a trade association for the mutual fund industry, which has invested in Puerto Rican debt and which focused part of its $5.1 million congressional lobbying effort on the issue last year. Among the Investment Company Institute’s board members is the chairman of OppenheimerFunds, which has been a particularly aggressive investor in the island’s bonds.

- The Mass Mutual Life Insurance Company, whose assets include subsidiary OppenheimerFunds, which has been one of the largest holders of Puerto Rican debt, focused part of an over $3 million lobby effort last year on the issue.

- Insurance group Assured Guaranty spent $385,000 lobbying on the issue, according to lobbying reports that mention the bankruptcy. The company has provided insurance to roughly $13 billion worth of the bonds — and would have to pay out those insurance policies if Puerto Rico erased its debt through bankruptcy.

- BlueMountain Capital, which has held more than $400 million in bonds from the Puerto Rico Electric Power Authority, registered to lobby the issue but did not file any actual spending. It is one of at least 36 hedge funds that have purchased Puerto Rican bonds, according to Puerto Rico’s Center for Investigative Journalism.

- Investment firm Vanguard — which has held roughly $200 million worth of Puerto Rican bonds — said it was lobbying on “issues surrounding the fiscal situation with Puerto Rico and its impact on municipal bonds” in federal reports documenting $3.4 million worth of lobbying in 2014 and 2013.

CONTINUED...

http://www.ibtimes.com/political-capital/financial-industry-lobbying-shape-puerto-rico-bankruptcy-bill-2353392

amborin

(16,631 posts)Vulture investors have descended on the commonwealth, taking advantage of a debt crisis that has impoverished citizens and created massive unemployment.

David Dayen

“This is a distress call from a ship of 3.5 million American citizens that have been lost at sea,” ..... Puerto Rico now carries $73 billion in debt, a sum that García Padilla had termed “not payable” in June.

Successive governments have enacted punishing austerity measures to service the debt, despite a stubbornly depressed economy and poverty rates near 50 percent. Now, after defaulting on smaller loans, it’s likely that much of the $957 million due January 1 will go unpaid, bringing more chaos and suffering at the hands of Puerto Rico’s creditors.

.....Puerto Rico is just the latest battlefield for a phalanx of hedge funds called “vultures” ......

snip

Though Puerto Ricans pay the same payroll taxes as mainland workers, the island receives sharply lower reimbursement rates for Medicare and Medicaid.

Its poorest citizens are ineligible for the Earned Income Tax Credit.

snip

As unemployment soared and the economy crashed.....Wall Street asset managers and investors egged them on, because Puerto Rican municipal bonds are free from federal, state, and local taxes. Usually Americans must reside in the state whose bonds they purchase to get “triple tax-exempt” status. But anyone from Arizona to Maine can buy triple tax-exempt Puerto Rican bonds.

snip

To pay back the debt, Puerto Rico has delayed tax refunds and payments to suppliers, cut back on health care and public transportation services, fired 30,000 public-sector workers, closed 100 schools, increased the sales tax by more than 50 percent, and even forced community credit unions to take IOUs in exchange for cash.

..... The poverty rate on the island is around 45 percent, and only 40 percent of the labor force has a job. Trapped in an economic death spiral, the tax base has eroded, amid massive out-migration to the U.S.: Puerto Rico has lost 300,000 citizens since 2006......

snip

This was when “vulture” hedge funds like Fir Tree Partners and Appaloosa Management and Och-Ziff made their move. ..... “They see Puerto Rico as an opportunity for huge earnings.....

Hedge funds also became the sole investors willing to lend to the commonwealth, making up nearly all the participants in the 2014 sale of $3.5 billion in low-rated, 8.7 percent general obligation bonds, the biggest U.S. municipal junk bond sale in history. Hedge funds were prepared to lend even more to Puerto Rico in the summer of 2015, until the governor warned about inability to pay. But vulture funds DoubleLine Capital and Avenue Capital were still buying up discounted debt as recently as November. Jeffrey Gundlach of DoubleLine recently called Puerto Rican debt his “best idea” for investors.

snip

Mutual funds like Franklin Templeton and Oppenheimer, which together own $10.8 billion in Puerto Rican debt, bought the bonds at 100 percent and want to limit any losses, whereas vulture funds with discounted debt have more wiggle room to extract profits....

IN AN OCTOBER HEARING, Senator Bernie Sanders addressed a more obscure option for Puerto Rico. “I’ve heard that some of the debt was incurred in an unconstitutional way,” Sanders noted, echoing a sentiment for nullifying some debt that has been proposed by academics and a handful of Puerto Rican lawmakers. This may sound far-fetched, but it rests on solid constitutional ground.

http://prospect.org/article/how-hedge-funds-are-pillaging-puerto-rico

By Dealbook November 3, 2006 3:57 pm November 3, 2006 3:57 pm

Chelsea Clinton

Fresh off selling a stake to investment bank Morgan Stanley for about $300 million, Avenue Capital Group has linked up with another powerful name. The hedge fund, which has about $10.5 billion in assets, has added Chelsea Clinton as its newest employee, the New York Daily News reported Friday, citing unnamed sources.

Ms. Clinton is no stranger to finance, having served as a consultant at McKinsey & Company for several years. And the hedge fund, run by Marc Lasry, is no stranger to the Clintons. Avenue co-founders Mr. Lasry and Sonia Gardner are major Democratic Party donors who have each given extensively to Hillary Rodham Clinton’s Senate reelection campaign.

The younger Ms. Clinton is not the first in her family to enter the world of high finance: Her father serves as an adviser to billionaire Ron Burkle’s Yucaipa Companies.

http://dealbook.nytimes.com/2006/11/03/avenue-capital-and-the-clintons-a-two-way-street/

http://www.thenation.com/article/is-an-obama-donor-tying-the-presidents-hands-on-puerto-ricos-debt-crisis/

Octafish

(55,745 posts)The facts are facts laid bare. It's been a long time since the Family was in the olive oil business.

Mnpaul

(3,655 posts)I hear their BS adds attacking Sean Duffy every single day

http://www.politifact.com/wisconsin/statements/2016/may/13/sean-duffy/did-sean-duffy-flip-flop-what-should-be-done-about/

Octafish

(55,745 posts)The Center for Individual Freedom is a keeper for those who worship mammon and enjoy pederasty:

http://www.sourcewatch.org/index.php/Center_for_Individual_Freedom

Skwmom

(12,685 posts)Octafish

(55,745 posts)

Charles Ferguson

Huffington Post| Jul 16, 2012 08:23 AM EDT

Consider just (July's) news in financial services.

First, Barclay's has been manipulating the Libor, the main interest rate upon which most other interest rates and financial transactions are based, since 2005. Moreover, Barclay's traders were colluding with traders in many other banks to assist them in manipulating the Libor too, so that they could all profit from their bets on it.

Second, JP Morgan Chase is having a really great month. Recent reports describe how it is resisting Federal subpoenas related to price-fixing in U.S. electricity markets. It is also accused (by former employees among others) of deliberately inflating the performance of its investment funds to obtain business. And finally, JP Morgan's failed "London whale" trade, which has now cost over $5 billion, is being investigated to determine whether the loss was initially concealed from regulators and the public.

Third, HSBC is paying a fine because it allowed hundreds of millions, perhaps billions, of dollars of money laundering by rogue states and sanctioned firms, including some related to terrorist activities and Iran's nuclear efforts. But HSBC is only one of at least 12 banks now known to have tolerated, and in some cases aggressively courted, money laundering by rogue states, terrorist organizations, corrupt dictators, and major drug cartels over the last decade. Others include Barclay's, Lloyds, Credit Suisse, and Wachovia (now part of Wells Fargo). Several of the banks created special handbooks on how to evade surveillance, created special business units to handle money laundering, and actively suppressed whistleblowers who warned of drug cartel activities.

SNIP...

Just another month in financial services. Is it unusual? No, it's not. If we go back just a little further, we have UBS, HSBC, Julius Baer, and other banks actively marketing tax evasion services to wealthy U.S. and European citizens. We have senior executives of several banks (including JP Morgan Chase and UBS) strongly suspecting that Bernard Madoff was running a Ponzi scheme, but deciding to make money from him rather than turn him in. And then, of course, we have the financial crisis and everything that led to it. As I show in great detail in my book Predator Nation, we now possess overwhelming evidence of massive securities fraud, accounting fraud, perjury, and criminal Sarbanes-Oxley violations by mortgage lenders, investment banks, and credit insurers (including senior executives of Countrywide, Citigroup, Morgan Stanley, Goldman Sachs, Bear Stearns, AIG, and Lehman Brothers) during the housing bubble that caused the financial crisis. If we go back to the late 1990s, we have the massively fraudulent hyping of Internet stocks, and several banks (including Merrill Lynch and Citigroup) actively aiding Enron in committing its frauds.

CONTINUED...

http://www.huffingtonpost.com/mobileweb/charles-ferguson/bank-crimes_b_1675714.html

Don't worry, conservative Democrats! The 99-percent won't be left out. We the People get to pick up the bill and bar tab at the casino and enjoy lives of debt peonage in a dog-eat-dog economy directed by austerity and based on scarcity during the wealthiest times in human history.

My Friend, Skwmom, it's like we're channeling The Boss by James Brown.

Jitter65

(3,089 posts)Much easier to sit back a complain about tall the voters being fooled by the "insiders" than to get off butts and go register or use the Internet for researching the issues instead of texting stupid stuff to BFFEs.

Octafish

(55,745 posts)LOL!

felix_numinous

(5,198 posts)is headed for an iceburg, yeah go ahead and laugh.

JDPriestly

(57,936 posts)felix_numinous

(5,198 posts)was to the laughing photo..

Octafish

(55,745 posts)Somehow they believe what happens to others has no bearing on themselves. I guess when they have Washington in their pocket, they have solid reasons for feeling that way.

William K. Black explains how mass media are working to shift the Panama Papers blame from the corrupt Elite to the corrupt politicians and governments who, like the media, they also happen to own.

The WSJ and NYT Spin Elite Tax Fraud as “Good News”

William K. Black

TripleCrisis.com, April 7, 2016

A single Panamanian law firm—one of many hundreds of such firms in the world that specialize in aiding tens of thousands of elites to evade taxes—has had over a million of its documents leaked to a consortium of investigative journalists. Neither the New York Times nor the Wall Street Journal are part of that consortium, and neither seems embarrassed about that failure. Instead, they have filled their pages with pieces about the Panama leaks that are spun so brazenly and bizarrely that as a reader even I was shocked at their audacity.

The New York Times was late to the story, but its April 5, 2016, analytical piece Peter Eavis that bore this astonishing title: “In Panama Papers, Finding the Good News in Widespread Tax Cheating.” The Wall Street Journal, despite its less bizarre titles managed to surpass the NYT with the volume and the blatancy of its spin. In an April 5, 2016, article entitled “Panama Papers: Hiding Cash Has Become Crummy Business.” The thrust of that story is that laundering money and tax evasion is a “crummy business” not because it is immoral and destructive, but because it is purportedly experiencing reduced profitability.

But the WSJ’s editorial pages always trounce the increasing lunacy of their news pages. News of endemic fraud by elites is simply an opportunity to attack the paper’s enemies. Bret Stephens’ op ed has a title that exemplifies this attack syndrome: “‘C’ Is for Corruption: The Clintons are the Brazilianization of American politics.” A reader might wonder what all of this had to do with the Panamanian leak.

This is Stephens’ explanation.

“China: A leak of 11.5 million documents from Panama-based law firm Mossack Fonseca—instantly dubbed ‘the Panama Papers’—implicate relatives of President Xi Jinping along with other top officials of sheltering fortunes in offshore tax havens. Mr. Xi is supposed to be leading an anti-corruption campaign.

“The Panama Papers have also exposed billions in assets belonging to close friends of Vladimir Putin …

“But nobody can be surprised by any of this. And nobody should look away from the central lesson of the scandal, though they’re trying. To wit, the story here isn’t about tax evaders and offshore accounts, deplorable as they may be. It’s about public policies and incentives that make a career in politics an expedient route to personal enrichment.”

See, the story isn’t really about corrupt private elites—it’s about corrupt government elites. Except that from Murdoch’s perspective this means a chance to take a shot at the likely Democratic presidential nominee.

CONTINUED w/links, sources...

http://triplecrisis.com/the-wsj-and-nyt-spin-elite-tax-fraud-as-good-news/

For those watching the battle between the corrupt and those with integrity, I'd say the last seven years have shown the problem is Buy Partisan.

felix_numinous

(5,198 posts)It is an abusive sociopathic group, who taunt us while we petition for our very lives, demonstrating just what kind of people these people--and their followers--are. They have outed themselves, and will be abandoned to their own neo con party.

We are back to square one again, like we were with Bush&Co, we need regime change. These people are unwilling and incapable of filling the needs of the people. And just like the Bush years, the corruption is mind boggling and complex--by design--in order to keep out most people who are unable or don't have the time to slog through their intrigues.

Thank you again Octafish ![]()

amborin

(16,631 posts)840high

(17,196 posts)I can't vote for her.

Octafish

(55,745 posts)

Alfred McCoy explained why on Democracy Now, way back on May 1, 2009:

Historian Alfred McCoy: Obama Reluctance on Bush Prosecutions Affirms Culture of Impunity

EXCERPT...

AMY GOODMAN: Well, talk about President Obama’s approach, on the one hand, releasing the torture memos — and I’d like you to respond to specifically what’s in those torture memos —

ALFRED McCOY: Sure.

AMY GOODMAN: — but then saying he will not be holding the interrogators responsible, people involved with it; we have to move forward, not move back.

ALFRED McCOY: Right. That’s exactly how you get impunity. That’s what’s happened every single time in the past. For example, in 1970, the House and Senate of the United States discovered that the Phoenix Program had been engaged in systematic torture, that they had killed through extraditial executions 46,000 South Vietnamese. That’s about the same number of American combat deaths in South Vietnam. Nothing was done. There was no punishment, and the policy of torture continued.

In 1994, for example, the US ratified the Convention Against Torture. There was no investigation of past practice. So, when that ratification went through, it was done in a way that in fact legalized psychological torture, because when we ratified that convention, we also, if you will, passed a reservation, which then got codified into US federal law, Section 2340 of the US Federal Code. In that code, we said that psychological torture, which is actually the main form of torture practiced by the United States since the 1950s, is basically not torture.

And we defined, very cleverly, under that code, what psychological torture is. We simply said it’s four things. It’s extreme physical pain, forced injection of drugs, threats against another, or doing that to a third party. OK? That’s all that psychological torture is. In other words, everything in those torture memos, all those techniques of belly slaps, face slaps, face grabbing, waterboarding, is, under US law, supposedly not torture, because when we — President Clinton ratified the UN Convention Against Torture, he didn’t look into the past, he didn’t discover what the nature of American torture was. And so, we’re now at a moment where if we don’t prosecute or don’t punish or don’t seriously investigate, that this will be repeated again.

Another thing that emerges from the memos is, in fact, that the Bush Justice Department is very well aware. If you read the May 2005 memo by the head of the Office of Legal Counsel, Steven Bradbury, he says, “Look, I can’t assure you that waterboarding is not torture. You know, the courts may find that it is torture. But don’t worry about it. Because you know what? The courts aren’t going to rule on this.” So in other words, don’t worry about the law, because the law doesn’t apply to you. The law will not be brought to bear. And that’s the problem of President Obama’s procedure. The men were assured that they could torture, because it wouldn’t come before the courts.

There’s another problem with those memos, as well. Those memos argue again and again that the most extreme of all the authorized CIA techniques, waterboarding, is not torture, because it does not violate that same Section 2340 of US Federal Code. But it does. Waterboarding is the most cruel, the most extremely cruel form of torture known to man, very simply because of this — and people don’t understand, I think, waterboarding. Amy, if you and I were riding in a car, and we went off a bridge in January here in Wisconsin and crashed through the ice and went down to the bottom of the Ohio River, within three minutes you and I would be dead from drowning. If there were an infant in a car seat behind us, that infant could survive for twenty minutes under water. A weak, fragile three-month-old infant could survive twenty minutes under water, be plucked by the rescue crew from the waters and suffer no brain damage, be perfectly fine. Alright? How can this happen? It’s the mammalian diving reflex. The human being is so afraid of death by drowning that we are hardwired into our biology, into our…

JUAN GONZALEZ: I want to —

ALFRED McCOY: — brains with this bizarre mammalian diving reflex. So, therefore, waterboarding, which induces this primal fear of death by drowning, is the most painful form of torture you can concoct. That’s why it’s existed for 500 years.

CONTINUED...

http://www.democracynow.org/2009/5/1/torture_expert_alfred_mccoy_obama_reluctance

For whatever reason, President Obama has allowed Baby Doc Bush, Sneering Dick Cheney, and their fellow traitors get away with war crimes and who knows what else. McCoy's warned us that it's business-as-usual for Empire and it will happen again -- unless it's punished and those responsible held accountable.

JEB

(4,748 posts)Octafish

(55,745 posts)Like family, almost.

Harken Energy And Insider Trading

by Stephen Pizzo

Mother Jones, September / October 1992

EXCERPT...

Harken Energy was formed in l973 by two oilmen who would benefit from a successful covert effort to destabilize Australia's Labor Party government (which had attempted to shut out foreign oil exploration). A decade later, Harken was sold to a new investment group headed by New York attorney Alan G. Quasha, a partner in the firm of Quasha, Wessely & Schneider. Quasha's father, a powerful attorney in the Philippines, had been a staunch supporter of then-president Ferdinand Marcos. William Quasha had also given legal advice to two top officials of the notorious Nugan Hand Bank in Australia, a CIA operation.

After the sale of Harken Energy in 1983, Alan Quasha became a director and chairman of the board. Under Quasha, Harken suddenly absorbed Junior's struggling Spectrum 7 in 1986. The merger immediately opened a financial horn of plenty and reversed Junior's fortunes. But like his brother Jeb, Junior seemed unconcerned about the characters who were becoming his benefactors. Harken's $25 million stock offering in 1987, for example, was underwritten by a Little Rock, Arkansas, brokerage house, Stephens, Inc., which placed the Harken stock offering with the London subsidiary of Union Bank -- a bank that had surfaced in the scandal that resulted in the downfall of the Australian Labor government in 1976 and, later, in the Nugan Hand Bank scandal. (It was also Union Bank, according to congressional hearings on international money laundering, that helped the now-notorious Bank of Credit and Commerce International skirt Panamanian money-laundering laws by flying cash out of the country in private jets, and that was used by Ferdinand Marcos to stash 325 tons of Philippine gold around the world.)

SNIP...

Suddenly, in January 1990, Harken Energy became the talk of the Texas oil industry. The company with no offshore-oil-drilling experience beat out a more-established international conglomerate, Amoco, in bagging the exclusive contract to drill in a promising new offshore oil field for the Persian Gulf nation of Bahrain. The deal had been arranged for Harken by two former Stephens, Inc., brokers. A company insider claims the president's son did not initiate the deal -- but feels that his presence in the firm helped with the Bahrainis. "Hell, that's why he's on the damn board," the insider says. "...You say, 'By the way, the president's son sits on our board.' You use that. There's nothing wrong with that."

Junior has told acquaintances conflicting stories about his own involvement in the deal. He first claimed that he had "recused" himself from the deal; "George said he left the room when Bahrain was being discussed 'because we can't even have the appearance of having anything to do with the government.' He was into a big rant about how unfair it was to be the president's son. He said, 'I was so scrupulous I was never in the room when it was discussed.'"

Junior alternately claimed, to reporters for the Wall Street Journal and D Magazine, that he had opposed the arrangement. But the company insider says, to the contrary, that Junior was excited about the Bahrain deal. "Like any member of the board, he was thrilled," the associate says. "His attitude was, 'Holy shit, what a great deal!'"

CONTINUED...

http://www.georgewalkerbush.net/harkenenergyandinsidertrading.htm

Octafish

(55,745 posts)By JO BECKER and DON VAN NATTA Jr.

The New York Times, JAN. 31, 2008

EXCERPT...

Upon landing on the first stop of a three-country philanthropic tour, the two men were whisked off to share a sumptuous midnight banquet with Kazakhstan’s president, Nursultan A. Nazarbayev, whose 19-year stranglehold on the country has all but quashed political dissent.

Mr. Nazarbayev walked away from the table with a propaganda coup, after Mr. Clinton expressed enthusiastic support for the Kazakh leader’s bid to head an international organization that monitors elections and supports democracy. Mr. Clinton’s public declaration undercut both American foreign policy and sharp criticism of Kazakhstan’s poor human rights record by, among others, Mr. Clinton’s wife, Senator Hillary Rodham Clinton of New York.

Within two days, corporate records show that Mr. Giustra also came up a winner when his company signed preliminary agreements giving it the right to buy into three uranium projects controlled by Kazakhstan’s state-owned uranium agency, Kazatomprom.

The monster deal stunned the mining industry, turning an unknown shell company into one of the world’s largest uranium producers in a transaction ultimately worth tens of millions of dollars to Mr. Giustra, analysts said.

SNIP...

Mr. Giustra foresaw a bull market in gold and began investing in mines in Argentina, Australia and Mexico. He turned a $20 million shell company into a powerhouse that, after a $2.4 billion merger with Goldcorp Inc., became Canada’s second-largest gold company.

CONTINUED...

http://www.nytimes.com/2008/01/31/us/politics/31donor.html

JDPriestly

(57,936 posts)And please read this also.

http://www.democraticunderground.com/?com=view_post&forum=1074&pid=7854

We cannot survive as a country if this corruption continues.

It is this corruption that endangers our society and our democracy.

It is this corruption that has enabled the cynicism in our press and in our country.

It is this corruption that has enabled the candidacy of Trump.

We must nominate and then, in November, elect Bernie Sanders, not Donald Trump.

Bernie is the only one outside all that corruption.

Octafish

(55,745 posts)Justice is required for Democracy.

When money trumps peace and Democracy, this isn't the USA any more.

Thank you for grokking and putting into words, JDPriestly.

Uncle Joe

(58,520 posts)Thanks for the thread, Octafish.

EndElectoral

(4,213 posts)JEB

(4,748 posts)Thanks for sharing all your hard work.