Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday,21 July 2015

[font size=3]STOCK MARKET WATCH, Tuesday, 21 July 2015[font color=black][/font]

SMW for 20 July 2015

AT THE CLOSING BELL ON 20 July 2015

[center][font color=green]

Dow Jones 18,100.41 +13.96 (0.08%)

S&P 500 2,128.28 +1.64 (0.08%)

Nasdaq 5,218.86 +8.72 (0.17%)

[font color=red]10 Year 2.38% +0.01 (0.42%)

[font color=black]30 Year 3.10% 0.00 (0.00%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

MattSh

(3,714 posts)There's some good reading on yesterday's Stock Market Watch.

http://www.democraticunderground.com/111669685

MattSh

(3,714 posts)When it comes to the favorable aspects of capitalism, one thing is clear: with the largest concentration of millionaires and billionaires from around the globe, the US is second to none when it comes to letting the entrepreneurial spirit flourish and rewarding it (and letting the rich get even richer).

Unfortunately, when it comes to the malignant, "crony" aspects of capitalism, the US is also the world's undisputed leader.

Because while we have shown previously that over the past 30 years median incomes in the US have barely grown (indicative of a middle class whose income has been largely stagnant for some 35 years), we have never before shown just what how this middle class "stasis" looks like in comparison to other developed nations. Now, thanks to Max Roser and "Our world in Data", we know. Sadly, in this particular sample of median income growth since 1980, the US is dead last, behind such countries as the UK, Canada and even Spain and France!

Complete story at - http://www.zerohedge.com/news/2015-07-20/charting-slow-30-year-death-us-middle-class-global-context

MattSh

(3,714 posts)The thought police are out in full force, and from both sides of the political aisle.

Say something radically different than the wishes of the president, and you belong in prison says retired general and former Democrat presidential candidate Wesley Clark.

Prepare to Vomit

Please be prepared to vomit over Wesley Clark's call for Internment Camps for "Radicalized" Americans.

Retired general and former Democratic presidential candidate Wesley Clark on Friday called for World War II-style internment camps to be revived for “disloyal Americans.”

He called for a revival of internment camps to help combat Muslim extremism, saying, “If these people are radicalized and they don’t support the United States and they are disloyal to the United States as a matter of principle, fine. It’s their right and it’s our right and obligation to segregate them from the normal community for the duration of the conflict.”

The comments were shockingly out of character for Clark, who after serving as supreme allied commander of NATO made a name for himself in progressive political circles. In 2004, his campaign for the Democratic presidential nomination was highly critical of the Bush administration’s excessive response to the 9/11 terror attacks. Since then, he has been a critic of policies that violate the Geneva Convention, saying in 2006 that policies such as torture violate “the very values that [we] espouse.”

Read more at http://globaleconomicanalysis.blogspot.com/2015/07/democrat-nutcase-former-us-presidential.html#Zyg9M1kIAdPlaemo.99

And hey Wesley, just why would these people become radicalized? Do you think that maybe the US policy of bombing the rest of the planet on only the slightest whim might have anything to do with that?

Punx

(446 posts)So we'll make sure they get none! ![]()

I would have expected better out of WC, but he appears to have become a frightened little man. Beyond the constant killing in the middle east and support of repressive dictatorships, and hypocrisy (Iran vs. Saudi Arabia anyone?) creating radicals, how do we go about identifying the so called bad guys?

Just round up anyone who is a Muslim? And put them in a camp. And then what, re-education? This is not what this country should be about and I would expect it to be completely unconstitutional though scum like Alito on the Supreme Court will no doubt disagree.

Oh, and why stop there, must go after the Occupy crowd, or anyone else that doesn't agree with TPTB.

MattSh

(3,714 posts)Terrible Greek economy is making the college-educated emigrate

The 22-year-old, now an exchange student studying counterterrorism at Mercy College in New York, has carefully plotted her own personal "Grexit" since entering the American College of Greece in Athens in 2012. First, she snared business internships in Istanbul and Berlin in order to get work experience. Then she applied for academic scholarships so she could study in the U.S.

Her long-term goal: to get a job anywhere in the world where she can utilize her skills. It won't be in Greece.

"I don't ever want to go back to Greece," Nefeli admits. "There is no opportunity. The unemployment rate for job seekers under 24 years old is 50 percent."

Nefeli's tale is common. It pulls back the curtain on the real Greek tragedy overlooked by many mainstream economists: the brain drain, or flight of home-grown talent. A groundswell of individuals with bachelor's, master's and Ph.D. degrees—in fields ranging from computer science, economics, engineering and medicine—are planting stakes abroad and getting out. The result: a bankrupting of the country's intellectual assets.

The trend may hold even more dire consequences for Greece's economic future than its 245 billion euro ($270 billion) debt burden, which has pushed it into seven years of depression and wiped out 25.9 percent of GDP.

Complete story at - http://www.cnbc.com/2015/02/25/the-real-greek-tragedy-the-worlds-biggest-brain-drain.html

MattSh

(3,714 posts)I do have other things to do, really, I do!

Demeter

(85,373 posts)Barclay's bank froze a Rossiya Segodnya news agency account without explaining its reasons. The agency’s head Dmitry Kiselyov has called it “censorship.”

“To close the account of one of the world’s leading news agencies is censorship, the direct obstruction of journalists’ work,” Dmitry Kiselyov said. “What kind of press freedom and democracy can Britain claim to have if it prevents one of the world's largest news agencies from working in the country?”

No formal notification of the move or justification for it was immediately provided. A source in the banking sector told the agency the Exchequer has put Dmitry Kiselyov on an anti-Russian sanctions list, which could have led to the news agency’s account being frozen.

“This is illegal,” Rossiya Segodnya’s Editor-in-Chief Margarita Simonyan tweeted. “The sanctions imply that Kiselyov cannot travel to Europe and have personal bank accounts there. No sanctions were imposed on Rossiya Segodnya news agency.”

Kiselyov is one of the people subjected to financial and travel sanctions in the EU. These restrictions have been imposed on a number of Russian officials in connection with Moscow’s stance over Ukraine crisis. The sanctions list, which includes the head of Rossiya Segodnya news agency, was published on March 21. It characterizes Kiselyov as “central figure of the government propaganda supporting the deployment of Russian forces in Ukraine.” Russia’s ambassador in the UK, Alexander Yakovenko, tweeted that the move is an example of using censorship against media that provides an alternative point of view. This is not the first time authorities in Europe have taken measures to disrupt Russian media from operating there...

Demeter

(85,373 posts)

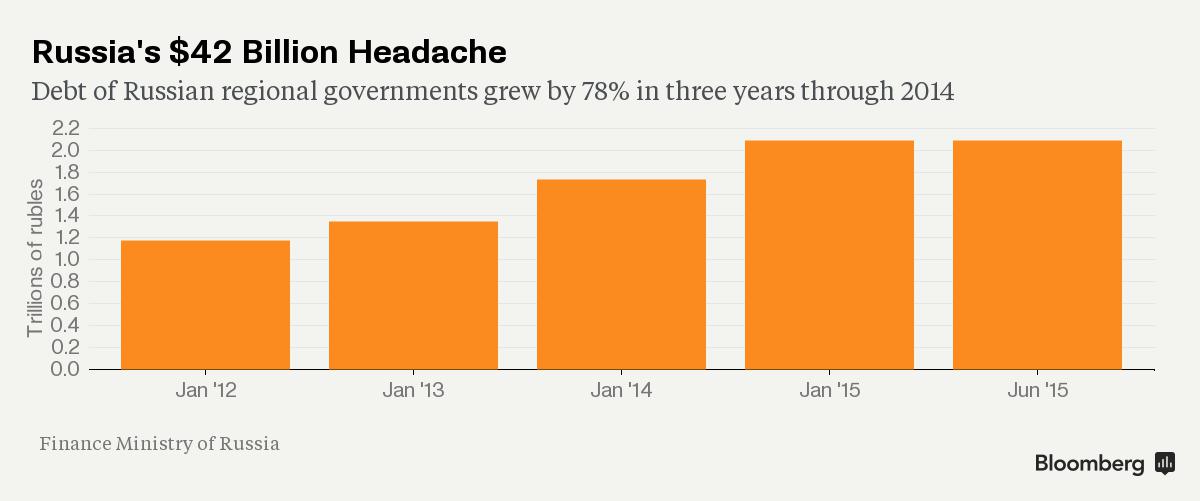

The clock is ticking for President Vladimir Putin to defuse a situation he set off in 2012 with decrees to raise social spending. That contributed to a doubling in the debt load of Russia’s more than 80 regions to 2.4 trillion rubles ($42 billion) in the past five years. Strains on their finances will grow critical in two or three years, raising the risk of bailouts from a federal budget already running a deficit for the first time since 2010, according to S&P.

“A default by a large region could block market access for the Finance Ministry itself,” said Karen Vartapetov, associate director of S&P’s Moscow office. “Right now the federal center has an opportunity to help regions. In three years, there may be fewer resources, while regional debt may be bigger, and that will result in greater risks.”

...Threats to municipal finances are snowballing as sanctions over Ukraine choke access to capital markets, forcing local governments to fund social outlays with costlier bank loans.

While regional debt sales are down 53 percent so far this year, Moody’s Investors Service estimates borrowing will grow as much as 25 percent in 2015, driven by spending on health care, education and utilities....

Demeter

(85,373 posts)You really have to be paying attention to see what’s truly going on these days. The keepers of the system, that is the banking elites, now openly control everything — though you’d never know that by listening to the media.

Consider this:

Jul 16, 2105

Eurozone ministers have agreed to give Greece a €7bn (£5bn) bridging loan from an EU-wide fund to keep its finances afloat until a bailout is approved.

The loan is expected to be confirmed on Friday by all EU member states.

In another development, the European Central Bank (ECB) agreed to increase emergency funding to Greece for the first time since it was frozen in June.

The decisions were made after Greek MPs passed tough reforms as part of a eurozone bailout deal.

How generous of the finance ministers of all those EU member states to agree to a “bridge loan” that will help Greece “keep its finances afloat”. This should provide the people of Greece with a bit of breathing room, right? Maybe access to their bank accounts (finally!), perhaps? No, not at all. Here’s what the entirety of the “”loan”” will go towards instead:

Ummmm…that “money” will not ever go anywhere near Greece.

This is all merely electronic window-dressing for entirely esoteric bookkeeping purposes. Servers will blink at one location in Europe as digital 1s and 0s are transmitted to another. The electronic balances at the ECB and the IMF will change, but not much else. The people of Greece will see none of it. Nor will they see their bank accounts unfrozen. This act of banker “largess” is, of course, of, by, and entirely for the bankers. It has nothing to do with Greece or its people, about whom the banker class cannot care less. But, they hide this disdain under and increasingly thin and condescending veneer of graciousness. Take, for example, the recently-announced ‘generosity’ of the powers that be — that is, the banking powers that be — which will permit the long suffering depositors to…*cough*…deposit more money into the banks:

Jul 17, 2015

Greek banks will reopen Monday after a three-week closure, the country’s deputy finance minister says, though withdrawal restrictions will stay in place. Bank customers “can deposit cash, they can transfer money from one account to the other,” but they can’t withdraw money except at ATMs, the official says, and a withdrawal limit of 60 euros ($67) a day will stay in place, he said, though Greek authorities are working on a plan to allow people to roll over access to their funds so that if they don’t make it to a bank machine one day, they can take out 120 euros the next day.

Yeah, depositing more money into the Greek banking system is exactly what all 12 remaining Greek idiots are clamoring to do…everybody else just wants their money back, thank-you-very-much.

Obviously, the only rational response of anybody in Europe watching this charade of theft continue would be to sell gold, right? (which has happened vigorously ever since the Greek crisis began) Because, you know, nothing says “confidence” quite like selling your gold so you can then park that money in a bank that may not let you withdraw it again.

Of course, we here at Peak Prosperity hold to the view that everything, and we mean everything, in our ””markets”” is stage-managed. And that especially includes gold. The central banks are demanding and commanding complete fealty to their story line, no exceptions tolerated. We are at that all-or-nothing moment in history when everything either works out perfectly or it all falls apart.

Savers have to be punished so debtors can be saved.

Why? Because if debtors are rescued, that makes it possible for more debts to be issued in the future..

And why is that important? Because the banking system needs ever more loans in order to survive.

Why do we slavishly feed a banking system that is rapacious, insatiable and always threatening calamity whenever it doesn’t get exactly everything it wants, when it wants it? That is a question nobody in power is willing to address.

MORE RANTING AT LINK

Demeter

(85,373 posts)http://www.internationalman.com/articles/how-empires-end

“Experience hath shewn, that even under the best forms of government those entrusted with power have, in time, and by slow operations, perverted it into tyranny.” – Thomas Jefferson

The very same events occur, falling like dominoes, more or less in order, in any empire, in any age:

- The reach of government leaders habitually exceeds their grasp.

- Dramatic expansion (generally through warfare) is undertaken without a clear plan as to how that expansion is to be financed.

- The population is overtaxed as the bills for expansion become due, without consideration as to whether the population can afford increased taxation.

- Heavy taxation causes investment by the private sector to diminish, and the economy begins to decline.

- Costs of goods rise, without wages keeping pace.

- Tax revenue declines as the economy declines (due to excessive taxation). Taxes are increased again, in order to top up government revenues.

- In spite of all the above, government leaders personally hoard as much as they can, further limiting the circulation of wealth in the business community.

- Governments issue bonds and otherwise borrow to continue expansion, with no plan as to repayment.

- Dramatic authoritarian control is instituted to assure that the public continues to comply with demands, even if those demands cannot be met by the public.

- Economic and social collapse occurs, often marked by unrest and riots, the collapse of the economy, and the exit of those who are productive.

- In this final period, the empire turns on itself, treating its people as the enemy.

...Once an empire has reached stage eight above, it never reverses. It is a “dead empire walking” and only awaits the painful playing-out of the final three stages. At that point, it is foolhardy in the extreme to remain and “wait it out” in the hope that the decline will somehow reverse. At that point, the wiser choice might be to follow the cue of the Chinese, the Romans, and others, who instead chose to quietly exit for greener pastures elsewhere...

HISTORICAL EXAMPLES AT LINK, AND MORE

Demeter

(85,373 posts)Instances of the United States overthrowing, or attempting to overthrow, a foreign government since the Second World War. (* indicates successful ouster of a government)

China 1949 to early 1960s

Albania 1949-53

East Germany 1950s

Iran 1953 *

Guatemala 1954 *

Costa Rica mid-1950s

Syria 1956-7

Egypt 1957

Indonesia 1957-8

British Guiana 1953-64 *

Iraq 1963 *

North Vietnam 1945-73

Cambodia 1955-70 *

Laos 1958 *, 1959 *, 1960 *

Ecuador 1960-63 *

Congo 1960 *

France 1965

Brazil 1962-64 *

Dominican Republic 1963 *

Cuba 1959 to present

Bolivia 1964 *

Indonesia 1965 *

Ghana 1966 *

Chile 1964-73 *

Greece 1967 *

Costa Rica 1970-71

Bolivia 1971 *

Australia 1973-75 *

Angola 1975, 1980s

Zaire 1975

Portugal 1974-76 *

Jamaica 1976-80 *

Seychelles 1979-81

Chad 1981-82 *

Grenada 1983 *

South Yemen 1982-84

Suriname 1982-84

Fiji 1987 *

Libya 1980s

Nicaragua 1981-90 *

Panama 1989 *

Bulgaria 1990 *

Albania 1991 *

Iraq 1991

Afghanistan 1980s *

Somalia 1993

Yugoslavia 1999-2000 *

Ecuador 2000 *

Afghanistan 2001 *

Venezuela 2002 *

Iraq 2003 *

Haiti 2004 *

Somalia 2007 to present

Libya 2011*

Syria 2012

Q: Why will there never be a coup d’état in Washington?

A: Because there’s no American embassy there.

http://williamblum.org/

Demeter

(85,373 posts)September 09, 2014 "ICH" - " In April 2014, fresh from riots in Maidan Square and the February 22 coup, and less than a month before the May 2 massacre in Odessa, the IMF approved a $17 billion loan program to Ukraine’s junta. Normal IMF practice is to lend only up to twice a country’s quote in one year. This was eight times as high.

Four months later, on August 29, just as Kiev began losing its attempt at ethnic cleansing against the eastern Donbas region, the IMF signed off on the first loan ever to a side engaged in a civil war, not to mention rife with insider capital flight and a collapsing balance of payments. Based on fictitiously trouble-free projections of the ability to pay, the loan supported Ukraine’s hernia currency long enough to enable the oligarchs’ banks to move their money quickly into Western hard-currency accounts before the hernia plunged further and was worth even fewer euros and dollars.

This loan demonstrates the degree to which the IMF is an arm of U.S. Cold War politics...

Demeter

(85,373 posts)

Demeter

(85,373 posts)Greece has initiated the process for the payment of a total 6.25 billion euros ($6.78 billion) to the European Central Bank (ECB) and the International Monetary Fund (IMF), finance ministry officials told Reuters on Monday.

Greece is paying 4.2 billion euros in principal and interest to the ECB due on Monday and 2.05 billion euros to the IMF that has been in arrears since June 30, the officials said. It is also repaying a 500 million euro loan to the Greek central bank.

The country secured a 7.16 billion euro bridge financing from the European Financial Stability Mechanism (EFSM) last week - enough to see Athens through July - and the opening of negotiations with its lenders on a third bailout programme. ($1 = 0.9223 euros)

http://www.bloomberg.com/news/articles/2015-07-20/greece-said-to-order-creditor-payments-as-banks-reopen

Greece gave the order to repay 6.8 billion euros ($7.4 billion) to creditors after last week’s tentative bailout deal, the Finance Ministry said, as Greek banks reopened three weeks after closing to prevent economic collapse.

The payments ordered Monday by the Greek government include money owed to the European Central Bank, the International Monetary Fund and Greece’s central bank, said a Finance Ministry official who asked not to be identified in line with government policy. Greek financial markets remain closed, the country’s market regulator said in an e-mailed statement.

As withdrawal limits and restrictions on transfers remain in place, people in Athens lined up at banks for basic services such as payment orders and check deposits. While Greeks are seeing the first signs of stabilization, talks on the aid program lie ahead and German Chancellor Angela Merkel said any debt relief has to wait until Greece meets the terms of the first round of the new bailout.

“When the first successful assessment of the program being negotiated now is completed, exactly this question will be discussed,” Merkel said Sunday in an interview on German television. “Not now, but then.”

While the bailout agreed upon last weekend has split the government of Prime Minister Alexis Tsipras, it also cleared the ECB to inject more funds into Greece’s financial system. Banks can now replace the daily cash withdrawal limit of 60 euros with a weekly limit of 420 euros, though transfers abroad from Greek accounts remain banned...

MORE

Demeter

(85,373 posts)Don’t pack away the currency presses just yet, Greece’s euro exit may be back on the table next year.

There’s still a danger that Greece will be forced out of the euro region by the end of 2016, according to 71 percent of respondents in a Bloomberg survey of 34 economists. Seventy percent said they reckon Greece should be safe for the rest of 2015, though almost half said they thought the 86 billion-euro ($93 billion) bailout package Prime Minister Alexis Tsipras is targeting will prove to be too small.

While Tsipras is checking off the requirements to qualify for a third bailout, the flaws in the agreement he hammered out with euro-area leaders last week are fueling concerns that Greece will struggle to implement the three-year program.

The European creditors are refusing to firm up their commitment to restructuring Greece’s debts, a move the International Monetary Fund says is essential for the country to stabilize its finances. There are also doubts about the 50 billion-euro target for asset sales and, more fundamentally, the merits of forcing more austerity on a shattered economy.

“Without some form of debt relief, the package will never be big enough,” Peter Dixon, a global economist at Commerzbank AG in London, said in his response to the survey. “Loading additional loans onto a country which cannot afford to repay them corresponds to Einstein’s definition of insanity: Trying the same thing over and over again in the expectation of different results.”

Markets Closed

Greek bonds plummeted during Tsipras’s six-month clash with the country’s creditors, with the yield on the 2017 bonds exceeding 30 percent before most trading was halted on June 26. The same debt was yielding less than 4 percent in October and about 10 percent when Tsipras took power in January. Greek financial markets will remain closed at least until parliament has voted on a second package of bailout measures on Wednesday, according to two officials. The government is drafting a decree to allow selective waivers on capital controls, and the best-case scenario is for markets to reopen Thursday, one of them said. The government submitted a bill detailing its next set of measures to parliament in the early hours of Tuesday. The bill includes the implementation of a European Union directive on how to resolve failing banks.

Tsipras did manage to reopen the country’s banks on Monday and he will ease somewhat the restrictions on withdrawals over the next two weeks. The government also cleared its 2 billion euros of arrears with the IMF, made an overdue payment of 470 million to the Greek central bank and covered 4.2 billion euros of interest and principal payments to the European Central Bank. The creditors plan to wrap up talks on the terms attached to the country’s new bailout by Aug. 6, and disburse the first tranche from the program to the debt-stricken country by Aug. 17, an international official with knowledge of the matter said. Greece has to pay the ECB another 3.2 billion euros on Aug. 20.

MORE GERMAN INTRANSIGENCE AT LINK

Demeter

(85,373 posts)THERE AREN'T THAT MANY IDIOTS IN GREECE (ALTHOUGH THE SMARTEST, LUCKIEST HAVE LEFT ALREADY, WITH OR WITHOUT THEIR SAVINGS)

http://www.dw.com/en/banks-call-for-greeks-to-return-40-billion-in-savings/a-18596203

Banks say their liquidity problems would be solved if the 40 billion euros that was emptied over the past seven months is returned to accounts. Much of the cash is believed to be held overseas or in safes at home....

AND THAT'S WHERE IT WILL BE STAYING, CHAPS. YOU BLEW YOUR CREDIBILITY AND THE EU LET YOU

Demeter

(85,373 posts)AFTER ALL, WHY BUY SOMETHING REAL AND USEFUL, WHEN YOU CAN GAMBLE ON FUNKY PIECES OF PAPER?

http://www.bloomberg.com/news/articles/2015-07-20/commodities-drop-as-dollar-gain-routs-gold-on-fed-rate-prospects

The rout in commodities deepened with prices touching the lowest since 2002 as the prospect of higher U.S. interest rates sent gold tumbling.

Raw materials are losing favor with investors as the dollar gains amid signals from Federal Reserve Chair Janet Yellen that the central bank may raise rates this year on the back of an improving U.S. economy. Higher borrowing costs curb the attractiveness of commodities such as gold, which doesn’t pay interest or give returns like assets including bonds and equities.

The Bloomberg Commodity Index dropped as much as 1.4 percent, falling for a fifth day in the longest stretch of declines since March. Gold futures sank to the weakest in more than five years while industrial metals, grains, Brent crude and U.S. natural gas also slid as a measure of the dollar climbed to the highest since April 13.

“Any increase in U.S. interest rates should further strengthen the dollar, prompting more fund outflows from commodities, metals and emerging-market assets,” Vattana Vongseenin, the chief executive officer of Phillip Asset Management Co. in Bangkok, said by phone...

Demeter

(85,373 posts)Last edited Tue Jul 21, 2015, 03:44 PM - Edit history (2)

Liberland, or the Free Republic of Liberland to give it its full title, is a would-be sovereign state founded April 13 by Vit Jedlicka and two fellow libertarians. Its total area of approximately seven square kilometers would make it the third smallest sovereign state in the world, after the Vatican and Monaco.

Where is Liberland?

It's sandwiched between Croatia and Serbia on the western bank of the Danube River. On some maps, this area is referred to as “Gornja Siga.”

So isn’t it part of Croatia or Serbia?

Not according to the founders. When the former Yugoslavia was split into new countries this small patch of land was forgotten about. Neither Croatia nor Serbia claimed it, making it a “terra nullius” or no man’s land.

What is a micronation anyway?

A micronation is an entity that claims to be an independent nation, but is not officially recognized by world governments or major international organizations. Micronations are different from other kinds of social communes because they make a formal claim of sovereignty over a physical territory.

Who is in charge?

The current president is Eurosceptic politician Jedlicka, 31, a member of the Czech Republic's Conservative Party of Free Citizens. Despite abstaining from Liberland’s first presidential election, he was still elected by the two other founding members, one of whom is his girlfriend, and now the country’s first lady.

Why was Liberland founded?

According to the founders the objective is to build a country where honest people can prosper with minimal interference from a centralized government. “We need more countries like Hong Kong, Singapore and Monaco, especially in Europe,” Jedlicka says. “We really needed another tax heaven, not tax haven.”

So there won’t be any taxes?

All taxes will be voluntary, and the nation’s services - such as power, healthcare and waste disposal - will be run either by private enterprises or through crowdfunding campaigns.

THE FLAG OF LIBERLAND

What is Liberland hoping to achieve?

Quite simply to have Liberland recognized by already-established nations as a sovereign state, paving the way for what the founders are calling a “European Singapore.” To do this Jedlicka is appointing ambassadors from Liberland to countries all over the globe to drum up support for the idea.

Has it actually established embassies in other nations?

According to Jedlicka, Liberland has established embassies in several countries including the U.S., the U.K., France and the Czech Republic. He plans to open embassies in “a hundred more countries by the end of the year."

Is it even legal?

Liberland is attempting to use the homestead principle, which states that unclaimed and undeveloped land can be legally claimed by any group willing to develop it. But some legal experts have stated that even though the land may appear unclaimed, it is most probably already part of Serbia.

Is anyone actually living in Liberland?

Not yet. Croatian border police are arresting anyone who sets foot in Liberland. However, this has not deterred members of the Liberland Settlers Association, which attempts to reach it on a daily basis and often clashes with local police in the process.

What is the Liberland Settlement Association?

The Liberland Settlement Association (LSA) is an NGO based in Serbia, funded by the Liberland Settlement Corp. It is made up primarily of volunteers who attempt to maintain an active presence on Liberland to help it become a recognized country.

So what is the Liberland Settlement Corp.?

According to CEO Niklas Nikolassen, the Liberland Settlement Corp. (LSC) “is a group of liberty-minded investors who are funding the LSA.” The corporation, based in Switzerland, has a claim on 80,000 square meters of Liberland and is hoping that the actions of the LSA will help Liberland achieve recognition as a sovereign state and thus make the land valuable.

How many people will be able to live there if it’s recognized?

Liberland has already received almost 400,000 applications for citizenship, however only around 45,000 of these are considered to be serious. According to Jedlicka there will probably be a total of 30,000-40,000 Liberlandians, not all of whom will actually live in Liberland.

How are you supposed to run a country through crowd funding?

Liberland's government says it has already raised over $45,000 through crowdfunding on it's website, where they take donations in both regular currency and Bitcoin. This has paid for government offices in Praque and Serbia, a personal assistant for the president and his recent trips to the G-7 in Germany and Freedom Fest in the U.S.

http://www.bloomberg.com/news/articles/2015-07-21/inside-liberland-the-place-of-no-taxes-where-crowdfunding-rules

tclambert

(11,087 posts)If even gold isn't safe, what should doomsayers invest in? Must be all those people selling their old jewelry. They created a glut trading in their trinkets at "We Buy Gold" stores.

Demeter

(85,373 posts)Just playing games with your mind and your currency...

If gold is so out-of-date, useless and foolish to own, why do all the Central Banks hoard it and try to increase their supply?

Fuddnik

(8,846 posts)Bought at $700 and sold at just over $1100.