Economy

Related: About this forumSTOCK MARKET WATCH -- Friday, 20 March 2015

[font size=3]STOCK MARKET WATCH, Friday, 20 March 2015[font color=black][/font]

SMW for 19 March 2015

AT THE CLOSING BELL ON 19 March 2015

[center][font color=red]

Dow Jones 17,959.03 -117.16 (-0.65%)

S&P 500 2,089.27 -10.23 (-0.49%)

[font color=green]Nasdaq 4,992.38 +9.55 (0.19%)

[font color=red]10 Year 1.97% +0.03 (1.55%)

30 Year 2.53% +0.01 (0.40%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Tansy_Gold

(17,891 posts). . . . I don't know what the dotted blue line means either.

(Horsey must have been hanging around the local Starbucks. That's the sort of thing you'd see around here, though maybe in LA, too? ![]() )

)

Demeter

(85,373 posts)Looks like the support level...the point that nobody's willing to cross, at the moment.

I am especially anxious about the 65% chance of all hell breaking loose come September. I'm trying to figure out what conditions generate a 35% chance that hell WON'T break loose, assuming it's not a wishful-thinking delusion.

My favorite cartoon of all time sums it up nicely:

Hugin

(33,222 posts):headscratch:

Demeter

(85,373 posts)As in, I dare you to sell your oil cheaper....and then all hell breaks loose.

Demeter

(85,373 posts)

Of course without context, the above maps are useless, so those eager to learn more and invited to read our thousands of articles covering just this topic since 2009, while beginners can find a revised edition of Zoltan Pozsar's seminal "Shadow Banking" at the following link:

http://www.newyorkfed.org/research/epr/2013/0713adri.pdf

Demeter

(85,373 posts)in other words, Spring!

I expect it will eventually arrive here, in the deep freeze (35F at 10 PM), just in time for Memorial Day.

Demeter

(85,373 posts)I have a useful application for the $1T platinum coin.

Make a smaller denomination, the $1B platinum coin. Make a law that anyone with a net worth exceeding $2B must buy one coin from the Treasury. The wealthier people must convert half their cash to platinum. These handsome coins, true collectors' items, can be framed and mounted, or imbedded in concrete, or some similar display, for bragging rights.

Instantly, the Treasury could pay off national debt AND maintain social services.

Demeter

(85,373 posts)By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street.

The Fed speaks, the dollar crashes. The dollar was ripe. The entire world had been bullish on it. Down nearly 3% against the euro, before recovering some. The biggest drop since March 2009. Everything else jumped. Stocks, Treasuries, gold, even oil. West Texas Intermediate had been experiencing its biggest weekly plunge since January, trading at just above $42 a barrel, a new low in the current oil bust. When the Fed released its magic words, WTI soared to $45.34 a barrel before re-sagging some. Even natural gas rose 1.8%. Energy related bonds had been drowning in red ink; they too rose when oil roared higher. It was one heck of a party. But it was too late for some players mired in the oil and gas bust where the series of Chapter 11 bankruptcy filings continues.

Next in line was Quicksilver Resources. It had focused on producing natural gas. Natural gas was where the fracking boom got started. Fracking has a special characteristic. After a well is fracked, it produces a terrific surge of hydrocarbons during first few months, and particularly on the first day. Many drillers used the first-day production numbers, which some of them enhanced in various ways, in their investor materials. Investors drooled and threw more money at these companies that then drilled this money into the ground. But the impressive initial production soon declines sharply. Two years later, only a fraction is coming out of the ground. So these companies had to drill more just to cover up the decline rates, and in order to drill more, they needed to borrow more money, and it triggered a junk-rated energy boom on Wall Street.

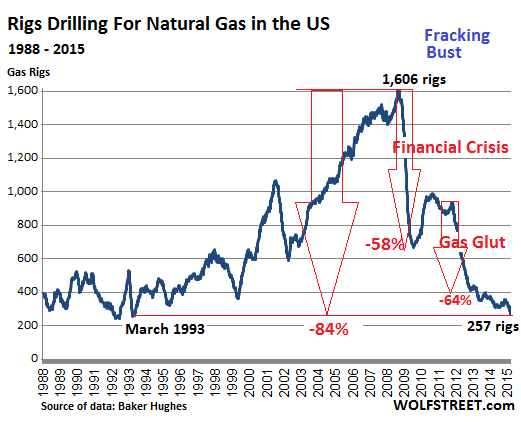

At the time, the price of natural gas was soaring. It hit $13 per million Btu at the Henry Hub in June 2008. About 1,600 rigs were drilling for gas. It was the game in town. And Wall Street firms were greasing it with other people’s money. Production soared. And the US became the largest gas producer in the world. But then the price began to plunge. It recovered a little after the Financial Crisis but re-plunged during the gas “glut.” By April 2012, natural gas had crashed 85% from June 2008, to $1.92/mmBtu. With the exception of a few short periods, it has remained below $4/mmBtu – trading at $2.91/mmBtu today. Throughout, gas drillers had to go back to Wall Street to borrow more money to feed the fracking orgy. They were cash-flow negative. They lost money on wells that produced mostly dry gas. Yet they kept up the charade. They aced investor presentations with fancy charts. They raved about new technologies that were performing miracles and bringing down costs. The theme was that they would make their investors rich at these gas prices.

The saving grace was that oil and natural-gas liquids, which were selling for much higher prices, also occur in many shale plays along with dry gas. So drillers began to emphasize that they were drilling for liquids, not dry gas, and they tried to switch production to liquids-rich plays. In that vein, Quicksilver ventured into the oil-rich Permian Basin in Texas. But it was too little, too late for the amount of borrowed money it had already burned through over the years by fracking for gas below cost...During the terrible years of 2011 and 2012, drillers began reclassifying gas rigs as rigs drilling for oil. It was a judgement call, since most wells produce both. The gas rig count plummeted further, and the oil rig count skyrocketed by about the same amount. But gas production has continued to rise since, even as the gas rig count has continued to drop. On Friday, the rig count was down to 257 gas rigs, the lowest since March 1993, down 84% from its peak in 2008.

Quicksilver’s bankruptcy is a consequence of this fracking environment. It listed $2.35 billion in debts. That’s what is left from its borrowing binge that covered its negative cash flows. It listed only $1.21 billion in assets. The rest has gone up in smoke. Its shares are worthless. Stockholders got wiped out. Creditors get to fight over the scraps. Its leveraged loan was holding up better: the $625 million covenant-lite second-lien term loan traded at 56 cents on the dollar this morning, according to S&P Capital IQ LCD. But its junk bonds have gotten eviscerated over time. Its 9.125% senior notes due 2019 traded at 17.6 cents on the dollar; its 7.125% subordinated notes due 2016 traded at around 2 cents on the dollar. Among its creditors, according to the Star Telegram: the Wilmington Trust National Association ($361.6 million), Delaware Trust Co. ($332.6 million), US Bank National Association ($312.7 million), and several pipeline companies, including Oasis Pipeline and Energy Transfer Fuel. Last year, it hired restructuring advisors. On February 17, it announced that it would not make a $13.6 million interest payment on its senior notes and invoked the possibility of filing for Chapter 11. It said it would use its 30-day grace period to haggle with its creditors over the “company’s options.” Now, those 30 days are up. But there were no other “viable options,” the company said in the statement. Its Canadian subsidiary was not included in the bankruptcy filing; it reached a forbearance agreement with its first lien secured lenders and has some breathing room until June 16. Quicksilver isn’t alone in its travails. Samson Resources and other natural gas drillers are stuck neck-deep in the same frack mud...

Industry soothsayers claimed vociferously over the years that natural gas drillers can make money at these prices due to new technologies and efficiencies. They said this to attract more money. But Quicksilver along with Samson Resources and others are proof that these drillers had been drilling below the cost of production for years. And they’d been bleeding every step along the way. A business model that lasts only as long as new investors are willing to bail out old investors. But it was the crash in the price of “liquids” that made investors finally squeamish, and they began to look beyond the hype. In doing so, they’re triggering the very bloodletting amongst each other that ever more new money had delayed for years. Only now, it’s a lot more expensive for them than it would have been three years ago. While the companies will get through it in restructured form, investors get crushed.

MORE AT Junk-Rated Oil & Gas Companies in a “Liquidity Death Spiral”

Demeter

(85,373 posts)A CHANGE-OVER ELECTION, PROBABLY

http://www.nakedcapitalism.com/2015/03/bill-black-take-get-fired-sec.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

By Bill Black, the author of The Best Way to Rob a Bank is to Own One and an associate professor of economics and law at the University of Missouri-Kansas City. Originally published at New Economic Perspectives

“Yves Smith” has a distressingly wonderful column in her blog, NakedCapitalism, on the SEC’s Andrew Bowden. The SEC Chair, Mary Jo White, needs to read it and walk to Bowden’s office and tell him she needs his resignation letter on her desk by noon or she will terminate his employment. When the SEC appointed Bowden as its lead examiner it put out a press release that purported that his unit was hiring folks from the industry like Bowden, which was going to make it a competent, kick-ass regulator.

The reality was that under the Clinton, Bush, and Obama administrations huge areas of finance had been left with minimal regulation. As “Yves Smith’s” article explained, as soon as the SEC actually looked at these areas it found wholesale non-compliance “with U.S. securities laws,” endemic fraud, and unmonitored risk at private equity firms. In sum, the private equity firms were ripping off their investors.

As I have long stressed, a regulatory agency must always worry about being made ineffective due to the three “de’s” – deregulation, desupervision, and de facto decriminalization. Bowden exemplifies two of these routes to regulatory failure – desupervision and decriminalization. He found substantial problems, many of them criminal, at most private equity firms. How many recommendations for enforcement action did he make? How many criminal referrals did he make? Neither number should be confidential.

The reason why White should demand Bowden’s resignation comes from Bowden’s recent public statements that make it clear that he is unfit for office. He does not believe in supervision. He does not believe in holding frauds and abusers accountable through criminal prosecutions and enforcement actions. He is an apologist and a literal cheerleader for the industry he is supposed to regulate. He is also incapable of financial analysis due to his cheerleader syndrome. “Yves Smith” provides the context for Bowden’s remarks.

At a minimum, Bowden reveals himself to be captured to an embarrassing degree. His remarks about the industry aren’t merely fawning; a former Goldman staffer called them ‘fellating’. Even worse, Bowden comes uncomfortably close to the line of offering to play the revolving door game at an unheard-of level of crassness, putting his son, and by implication himself, into the job market at an industry conference.

Bowden, along with Erin Schneider of the SEC’s enforcement staff in its San Francisco office, senior private equity investment professionals Sarah Corr from CalPERS and Margot Wirth of CalSTRS, and John Monsky, general counsel of private equity firm Oak Hill, appeared on March 5 at a conference at Stanford Law School,Emerging Regulatory Issues in Private Equity, Venture Capital, & Capital Formation in Silicon Valley. In a sign of undue chumminess, the moderator, former SEC commissioner and Stanford law professor Joseph Grundfest, didn’t see fit to disclose that he is a board member of KKR.

I have watched the video excerpts of Bowden’s remarks and can confirm that “Yves Smith’s” quotations below are accurate.

And even when I was in the industry, I’d always look at them and say, like, “What are you talking about? This is the greatest business you could possibly be in. You’re helping your clients.”

I think if you look at McKinsey studies, the average asset manager, I’m not even talking about private equity, the average asset manager has margins of 25 or 30 percent. Like what, who else out there is in a business that’s that good? And I reckon, it’s sort of interesting for me for private equity in terms of all we’ve seen, and what we have seen, where we have seen some misconduct and things like that, ’cause I always think like, to my simple mind, that the people in private equity, they’re the greatest, they’re actually adding value to their clients, they’re getting paid really really well, you know, if I was in that position, the one thing I would think to myself as I skipped to work was like just “Let’s not mess it up. You know, this is the greatest thing there, I’m helping people, I’m doing OK myself.”

And so my view on the small ones is, I still think this is one of…I tell my son, I have a teenaged son, I tell him, “Cole, you want to be in private equity. That’s where to go, that’s a great business, that’s a really good business. That’ll be good for you.”

So for me personally, as we share our opinions…

Questioner [interrupting]: I’d love to hire your son, by the way. That’s a deal.

I would have asked for the resignation of any of my staff who made remarks even remotely like Bowden’s remarks. As financial regulators, particularly if we have the disadvantage of coming from the industry, we maintain at all times a professional distance from those we regulate. The remarks about his son are so beyond the pale that they demonstrate he is incapable of even pretending to maintain such a professional distance. His cheerleader nature is on full display. But there are two additional factors as a regulator that would have caused me to ask for his resignation. First, he engages in classic “neutralization” techniques designed to minimize the seriousness of the staggering violations by private equity firms’ senior officers that SEC investigators found without any full-scale investigation backed by subpoenas and taking testimony under oath. The violations they found were the facially obvious violations. In his remarks, Bowden treats these violations as so trivial that they (perversely) demonstrate to his cheerleader mind that “the people in private equity, they’re the greatest.” More than half the private equity firms had significant violations that the grotesquely understaffed SEC was able to identify on the face of the documents without any serious investigation – and that proves that “the people in private equity, they’re the greatest.” So I ask again, how many enforcement and criminal referrals did Bowden make against private equity leaders in response to the SEC findings?

MORE SCANDAL AT LINK

COMMENT FROM Tom Stone March 19, 2015 at 8:04 am

Make even a half hearted attempt to enforce the law or regulations and you will be fired from the SEC in an eyeblink.

Demeter

(85,373 posts)Ocwen Financial Corp (OCN.N) said it was selling residential mortgage servicing rights worth $9.6 billion to a subsidiary of Walter Investment Management Corp (WAC.N). The deal is the latest in a series of steps by Ocwen to slim down its operations amid regulatory scrutiny over its business practices. Ocwen, which delayed filing its full-year results, also said it was reviewing the ability of its affiliate, Home Loan Servicing Solutions Ltd (HLSS.O), to meet obligations to fund new servicing advances. A failure by HLSS could hurt Ocwen's financial condition, the company said in a filing. Ocwen's shares were down about 1.7 percent, while Walter Investment was up about 11 percent. Home Loan Servicing's shares were down about 2 percent.

Ocwen has grown exponentially since the financial crisis by buying up the rights to service mortgages after new capital regulations made the business too costly for banks to maintain. But investments in systems and procedures did not keep pace with the company's expansion, causing headaches for many homeowners. Ocwen had to pay $150 million in penalties in December related to improper foreclosures. As part of the settlement, the company's founder and chief executive stepped down.

The mortgage servicing rights sold to Walter Investment's Green Tree Loan Servicing LLC comprise about 55,500 loans owned by government-controlled mortgage finance firm Freddie Mac (FMCC.OB). The financial terms of the deal were not disclosed. The sale comes close on the heels of Ocwen's deal to offload mortgage servicing rights on $45 billion of Fannie Mae (FNMA.OB) loans. Bloomberg reported on Tuesday that the buyer was JPMorgan Chase & Co (JPM.N). Ocwen also sold servicing rights on loans worth $9.8 billion to Nationstar Mortgage Holdings Inc (NSM.N) in February. The transaction with Green Tree is expected to close by April 30.

Demeter

(85,373 posts)A bare majority of large Japanese companies will increase pay by at least the same levels as last year, a Nikkei Inc. survey shows, a development expected to stimulate consumer spending and help the country beat deflation.

Major corporations gave their responses to their unions' demands for wage hikes and bonuses all together Wednesday, in the final stages of annual spring wage negotiations.

Toyota Motor agreed to increase monthly standard pay by 3.2%, or 11,300 yen ($92.37). Base pay accounts for 4,000 yen of this raise -- well above last year's 2,700 yen and the most since the current format for negotiations was introduced in 2002. Toyota also met labor's bonus demands in full. Nissan Motor agreed to boost base pay by 5,000 yen in response to labor's request for 6,000 yen.

Six major comprehensive electrical machinery companies, including Hitachi, Panasonic and Toshiba, agreed to lift base pay by a record 3,000 yen -- up from 2,000 yen last year. Hitachi also consented to a record bonus of 1.74 million yen, or 5.72 months' pay.

"We've started to pave the way toward an escape from deflation and a virtuous economic cycle," said Nobuaki Koga, president of the Japan Trade Union Confederation, or Rengo.

AFTER TRYING EVERY POSSIBLE WRONG SOLUTION, THAT IS...

Demeter

(85,373 posts)Over the next few years, it will become obvious that the Bank of Japan (BOJ) has monetized several trillion dollars of government debt. The orthodox fear is that printing money to fund current and past fiscal deficits inevitably leads to dangerous inflation. The result in Japan probably will be a small uptick in inflation and growth. And the financial markets’ most likely reaction will be a simple yawn. Japanese government debt stands at more than 230 percent of gross domestic product and at about 140 percent even after deducting holdings by various government-related entities such as the social security fund. This debt mountain is the inevitable result of the large fiscal deficits that Japan has run since 1990. And it is debt that will never be “repaid” in the normal sense of the word. Figures provided by the International Monetary Fund illustrate why.

For Japan to pay down its net debt even to 80 percent of GDP by 2030, it would have to turn a 6 percent-of-GDP primary budget deficit (before interest payments on existing debt) in 2014 into a 5.6 percent-of-GDP surplus by 2020, and maintain that surplus throughout the 2020s. If this was attempted, Japan would be condemned to sustained deflation and recession. Even a modest step in that direction — the sales-tax increase of April 2014, for example — produced a severe setback to economic recovery. Instead of being repaid, the government’s debt is being bought by the BOJ, whose purchases of 80 trillion yen (US$658.7 billion) per year now exceed the government’s new debt issues of about 50 trillion yen.

Total debt, net of BOJ holdings, is therefore falling slowly. Indeed, if current trends persist, the debt held neither by the BOJ nor other government-related entities could be down to 65 percent of GDP by 2017. And because the government owns the BOJ, which returns the interest it receives on government bonds to the government, it is only the declining net figure that represents a real liability for future Japanese taxpayers.

The stated aim of the BOJ’s giant quantitative easing operation is to raise asset prices, reduce interest rates, weaken the yen’s exchange rate and thus stimulate business investment and exports. These indirect transmission mechanisms are certainly having some positive impact on inflation and growth: private credit has turned positive since QE was launched. But the bigger economic stimulus derives from the government’s continued large fiscal deficits, effectively funded with BOJ-created money. That reality is not yet openly admitted. The official doctrine is that the BOJ eventually will sell back all of the government bonds that it has acquired but it need not do so. Indeed, the BOJ could maintain its current level of government debt holdings indefinitely, making new purchases as existing bonds mature. And if the money created — in the form of commercial bank reserves at the BOJ — ever threatened to support excessive credit growth and inflation, the BOJ could offset that danger by imposing reserve requirements on the banks.

The Japanese authorities are thus doing what former US Federal Reserve chairman Ben Bernanke proposed in 2003 — using monetized fiscal deficits to put spending power directly into the hands of companies and households. The BOJ rejected Bernanke’s advice at the time, insisting instead that all deficits must be financed with bonds; now, however, the BOJ is effectively monetizing past and current deficits alike. If it had done so earlier, Japan would have experienced less deflation and slightly higher growth and would now have a smaller public debt. But better late than never.

MORE BLASE' ATTITUDE AND A FINGER-POINTING AT THE EURO, AT LINK

Demeter

(85,373 posts)Greece’s battle to stay solvent and in the eurozone is becoming a game of dangerous brinkmanship. Beyond the war of words between Athens and Berlin, the dark arts of diplomacy are also being played. On Tuesday, only hours after Greece’s leftist-led government announced that the prime minister, Alexis Tsipras, had accepted an offer by the German chancellor, Angela Merkel, to visit Berlin, it was revealed that he would also be making a similar tour to Moscow. “The prime minister will visit the Kremlin on 8 April after being invited by the Russian president, Vladimir Putin,” his office said.

Before the sun had set over the Acropolis, the top US diplomat Victoria Nuland had waded in, holding talks with Greece’s foreign minister, Nikos Kotzias, in Athens. Nuland, who is assistant secretary of state for European and Eurasian affairs, flew into the capital amid mounting US concerns that the great euro debt crisis has begun to pose a geopolitical threat. Allowed to veer out of control, Greece could end up in the ambit of Russia, financially bereft and without the EU links that keep it bounded to the west. Nato’s south-eastern flank would be immeasurably weakened at a time of mounting global security worries over Islamic fundamentalists in the Middle East.

Under Tsipras’s steely leadership, the country has worked hard to stoke such fears. Exploiting his far-left Syriza party’s traditionally good ties with Moscow, the young leader has allowed his ministers to suggest openly that they would turn to Moscow as a strategic protector in the event of Athens being ejected from the 19-nation currency bloc. Russia, in turn, has said it would happily consider a Greek request for aid – despite its own financial woes – should its fellow Orthodox state ask

“We want a deal with creditors,” asserted Panos Kammenos, the rightwing nationalist who leads the ruling coalition’s small Independent Greeks party. “But if there is no deal, and if we see that Germany remains rigid and wants to blow Europe apart, then we will have to go to plan B.”

As negotiations with Brussels and Berlin have become ever more tortuous, Kotzias has increasingly played up Athens’ geostrategic role. Creditors, he recently warned, would cut off Greece at their peril. “There will be millions of immigrants and thousands of jihadis flocking to Europe if the Greek economy collapses,” he told EU counterparts 10 days ago. “There is no stability in the western Balkans and then we have problems in Ukraine, Syria, Iraq and north Africa.”

Seasoned euro crisis watchers fear that in his bid to extract concessions over the country’s monumental debt, Tsipras is overplaying his hand...

NO, I DON'T THINK SO...IT IS GERMANY THAT HAS OVER-PLAYED

If Athens were to turn its back on the west, Turkey could be next. “Greece is much more important than people think,” the former US ambassador to Greece, Daniel Speckhard, told a recent edition of Fortune magazine. “The conventional wisdom is now that we can allow a Grexit and just cauterise the wound, but it’s not that simple.”

TSIPRAS HAS THROWN DOWN THE GAUNTLET...LET'S SEE WHO PICKS IT UP!

Ghost Dog

(16,881 posts)... The issuance of unredeemable government debt and bonds are the ultimate control mechanism by the Western interests utilized in order to keep politicians, national leaders and nations in line and march in lockstep to their economic programs. Russia under Putin is not over indebted like almost all other western nations thus allowing Putin to exercise leadership independent of European and Washington demands and this makes Russia in their eyes a threat to the continuation of the fake debt democracy system across the West.

The ultimate goal is to destabilize Russia by destroying the economy and limiting government revenue and growth by holding oil prices at historically low levels. To do this they must depose Putin, the national leader with the highest poll approval rating in the world and replace him with a compliant quisling type of leadership submissive to western interests as has been done in Ukraine. This goal could be achieved due to Russia's extreme over dependence on energy resource revenue...

... Washington is indeed acting rationally if their goal is to preserve their power base as well as the support of powerful banking and economic interests. The US Empire has indeed reached it's zenith of power and authority in the world and as America heads downhill as have all major empires in the past. Therefore it is crucial to buy time by attempting to conquer or control energy resources around the world hence why the US is involved across the Middle East and increasingly in the Ukraine and is surrounding Russia and Iran.

Their goal for Russia, now the ultimate ally of a resurgent China is economic vassalage, territorial dismemberment and the development of "spheres of influence" just like Great Britain did to India and the western countries including Russia did to a weakened China in the 19th century...

... To date Russia only reacts to western sanctions and economic warfare against your energy industry thus there is neither real pain for the west nor any reason for them not to ratchet up the sanctions against individuals, banking and other interests. They are logically attacking your weakest link, the energy and financial sectors and they certainly do not expect a major response from your side. Still, dumping Treasury debt by Russia or China would probably be counter productive and both nations would be smart to liquidate US dollar debt in an organized regular fashion during this near term period of tremendous dollar strength. This is probably your last chance to unload US Treasury debt at a profit...

... The weakness of the Western banking and economic interests are massive government debt, the end of the dollar as the world reserve currency and nationalism within the EU. There is no way citizens or companies can escape the high taxes, massive debt service costs and the inability of citizens or companies within Europe to escape their high tax, regulatory environment that is killing the economy of Europe in order to defend the primarily German banking interests. Financial privacy and all wealth in Europe are at risk from future bail-ins where depositor's funds are used to pay for excessive bank lending losses. We've already seen it in Cyprus and soon it will happen in Greece and the PIIGS countries.

To win, you must have other powerful economic interests outside Russia who can benefit and profit from a sovereign independent Russia. The US has destroyed financial privacy and confidentially around the world and no nation can stand up to their powerful threats to other banking interests which means the private wealth of the entire West will eventually be at risk of bank bail-ins, confiscation of retirement funds and confiscatory tax rates when the bond crisis finally hits because there is no secure alternative for protecting honest earned wealth...

... Finally Russia must get aggressive in the economic war. You can win this economic contest in 24 months, if certain special zones in Russia simply are allowed to copy Swiss banking rules and regulations, as wealth will always flow to secure locations where taxes are low. You know what banking privacy and security did for Switzerland, it made a poor country with few natural resources the wealthiest nation in the world. You will have foreign banks and financial institutions lining up to open offices in Russia if you can guarantee financial privacy to a degree and wealth protection in total.

This will break the monopoly of West in financial and banking as well as their power to threaten you. The coming bond debacle guarantees this will work as I've written earlier every nation has wealthy interests and their own oligarchs so why not build support for Russia from wealthy foreigners as they transfer a portion of their wealth as taxable income at a very low rate to your nation. This will end the economic war...

/... http://www.zerohedge.com/news/2015-03-18/guest-post-how-putin-can-win-economic-war-against-west

Heh, heh ![]()

Demeter

(85,373 posts)when the IRS/FBI/NSA went after the tax evaders, I wondered what was up.

but they haven't gone after the British havens, nor the Caribbean....or Monaco. Or Lichtenstein.

Selective ratting out...

It also refers to countries which have a system of financial secrecy in place. It should be noted that, financial secrecy can be used by foreign individuals to circumvent certain taxes (such as inheritance tax on money, and income tax of the interest on the money you have on your bank account). Due to the fact that the requirement of paying taxes on these funds can not be transmitted, as the funds themselves are invisible to the country the individual is from, such taxes can be avoided. Earnings from income generated from real estate (i.e. by renting houses you own abroad) can also be eliminated this way. Despite this occasional abuse, the countries themselves stand in their right to have a system of financial secrecy in place, and it is up to the individual to fill in the required paperwork (i.e. double taxation forms). If the proper double taxation forms are filled in, and taxes are paid, companies can avoid much taxes, even if they hence pay their taxes legally. This is because the tax rates on income can be much lower than the tax rate in their own country. It should be noted that some taxes (such as inheritance tax on the real estate, VAT on the initial purchase price of the real estate -aka Transfer tax-, annual immovable property taxes, municipal real estate taxes, ...) can not be avoided or reduced, as these are levied by the country the real estate you own is in, and hence need to be paid just the same as any other resident of that country. The only thing that can be done is picking a country that has the smallest rates on these taxes (or even no such taxes at all) before you buy any real estate.

Individuals or corporate entities can find it attractive to establish shell subsidiaries or move themselves to areas with reduced or nil taxation levels relative to typical international taxation. This creates a situation of tax competition among governments. Different jurisdictions tend to be havens for different types of taxes, and for different categories of people or companies. States that are sovereign or self-governing under international law have theoretically unlimited powers to enact tax laws affecting their territories, unless limited by previous international treaties. There are several definitions of tax havens. The Economist has tentatively adopted the description by Geoffrey Colin Powell (former economic adviser to Jersey): "What ... identifies an area as a tax haven is the existence of a composite tax structure established deliberately to take advantage of, and exploit, a worldwide demand for opportunities to engage in tax avoidance." The Economist points out that this definition would still exclude a number of jurisdictions traditionally thought of as tax havens. Similarly, others have suggested that any country which modifies its tax laws to attract foreign capital could be considered a tax haven.

According to other definitions, the central feature of a haven is that its laws and other measures can be used to evade or avoid the tax laws or regulations of other jurisdictions. In its December 2008 report on the use of tax havens by American corporations, the U.S. Government Accountability Office was unable to find a satisfactory definition of a tax haven but regarded the following characteristics as indicative of it: nil or nominal taxes; lack of effective exchange of tax information with foreign tax authorities; lack of transparency in the operation of legislative, legal or administrative provisions; no requirement for a substantive local presence; and self-promotion as an offshore financial center.

A 2012 report from the Tax Justice Network estimated that between USD $21 trillion and $32 trillion is sheltered from taxes in unreported tax havens worldwide. If such wealth earns 3% annually and such capital gains were taxed at 30%, it would generate between $190 billion and $280 billion in tax revenues, more than any other tax shelter. If such hidden offshore assets are considered, many countries with governments nominally in debt are shown to be net creditor nations. However, despite being widely quoted, the methodology used in the calculations has been questioned, and the tax policy director of the Chartered Institute of Taxation also expressed skepticism over the accuracy of the figures. Another recent study estimated the amount of global offshore wealth at the smaller - but still sizeable - figure of US$7.6 trillion. A study of 60 large US companies found that they deposited $166 billion in offshore accounts during 2012, sheltering over 40% of their profits from U.S. taxes.

http://en.wikipedia.org/wiki/Tax_haven

Demeter

(85,373 posts)We've never touched on such a thing before, and my curiosity is burning....

DemReadingDU

(16,001 posts)Hmmmm, I wonder that too. Just the Swiss, interesting.

Looking forward to the weekend thread!

Demeter

(85,373 posts)Last week, Arsen Avakov, head of the Ukrainian Ministry of Internal Affairs (MVD) announced that Kiev is working with Washington to create a unified special police force analogous to American SWAT teams. The force is to be called KORD (Korpus operativno-raptovoy diy—Instantaneous Tactical Actions Corps). Following its American counterpart, KORD will consist of “assault teams” that execute high-risk police actions with a 15-to-20-minute response time.

The announcement came as the US began sending military equipment to Ukraine. In addition, this week, Ukraine’s parliament voted to approve the presence of foreign peacekeeping forces and military units of foreign states on the country’s soil. The move lays the groundwork for the holding of joint military exercises on Ukrainian territory with US and Polish forces planned for this year. ALSO COLONIZATION BY INTERVENTION

The creation of US-trained SWAT teams in Ukraine makes clear that Kiev is preparing to suppress popular opposition to its right-wing austerity program and the brutal war the government is waging in the country’s southeast. Earlier this month, the parliament announced plans to cut pensions for working retirees by 15 percent, a move that will impact 20 million Ukrainians.

Plans to create a Ukrainian SWAT force were first announced last October by the public relations office of the People’s Front, a political party formed last year by current prime minister Arseniy Yatsenyuk. MVD head Avakov is also a member of the People’s Front. According to the October announcement, the Ukrainian SWAT force will be formed primarily out of the Ministry of Internal Affairs volunteer battalions and squadrons, which began serving as special forces units in the country in April 2014. Since last August, these units have been armed with heavy weaponry from the country’s Ministry of Defense and have played a key role in fighting the ongoing civil war. Many of them, such as the Azov Battalion (now a unit of the Ukrainian National Guard), have gained worldwide notoriety for their open embrace of fascist insignia, as well as murderous attacks on civilian targets.

There are more than 30 such units in the Ministry of Internal Affairs, ranging up to 500 members each. Other volunteer units exist within the Ukrainian Defense Ministry and National Guard. Still others have not been formally incorporated into state structures but have fought alongside government forces. KORD will bring all of the Ministry of Internal Affairs special units into a unified national force.

POOR UKRAINE!

MORE AT LINK

Demeter

(85,373 posts)On the day that Mario Draghi opened the ECB’s overly opulent new €1.3 billion palatial building(s) in Frankfurt, which led to fierce and fiery protests with hundreds arrested, amongst others from the Blockupy movement, and the IMF for some reason found it necessary to tell the eurozone that Greece is its most unhelpful client ever (really? let’s see the others) and to leak that finding to the press to boot, the Greek parliament voted in an anti-poverty law with a huge majority.

Oh, and it was also the day that a San Francisco church decided to dismantle an elaborate system of outdoor showerheads it had installed to get rid of those pesky homeless on its property. The showerheads would get the ‘rough sleepers’ soaking wet every hour or so. As one tweet said: “It’s what Jesus would do, right?” Anyway, enough protest was enough to get them backtracking.

I don’t know what the shower system cost, and who really cares, but I do know the price tag for the Greek law to help its poorest: €200 million. Or about 14% of what that one building cost (the EU has much more construction going on). Which, by the way, was announced as, I paraphrase and kid you not, “an example of what Europe is capable of”.

No comment there, I couldn’t have put it any better myself. One thing’s for sure: the building is not meant for the poor. There were thousands of cops at the opening alone to prevent them from entering. Cops paid for with taxpayer money, including that from the poor.

***********************************************************EDIT**

We’ve not just lost Jesus, we’ve lost our way. That SF church has, the EU has, and most of us have too. We were never ‘blessed’ with some divine right to let people suffer, no matter who they are. There’s not a single religion I can think of that says it’s fine to do that, or even that you’re superior to your suffering brother or sister, so it can’t be a religious issue. Therefore, I’m going to have to guess that it’s all down to sheer hubris, to people being so full of themselves they will never ever be able to pass through the eye of any needle, no matter how big or wide. See, my problem is, I don’t want to live in this kind of world. It doesn’t just degrade Greece’s, and San Francisco’s, and the world’s, poor, it degrades me too. And I’m not even a religious person.

Demeter

(85,373 posts)...American “confidence” in the three classic check-and-balance branches of government, as measured by polling outfits, continues to fall. In 2014, Americans expressing a “great deal of confidence” in the Supreme Court hit a new low of 23%; in the presidency, it was 11%, and in Congress a bottom-scraping 5%. (The military, on the other hand, registers at 50%.) The figures for “hardly any confidence at all” are respectively 20%, 44%, and more than 50%. All are in or near record-breaking territory for the last four decades.

It seems fair to say that in recent years Congress has been engaged in a process of delegitimizing itself. Where that body once had the genuine power to declare war, for example, it is now “debating” in a desultory fashion an “authorization” for a war against the Islamic State in Syria, Iraq, and possibly elsewhere that has already been underway for eight months and whose course, it seems, will be essentially unaltered, whether Congress authorizes it or not.

What would President Harry Truman, who once famously ran a presidential campaign against a “do-nothing” Congress, have to say about a body that truly can do just about nothing? Or rather, to give the Republican war hawks in that new Congress their due, not quite nothing. They are proving capable of acting effectively to delegitimize the presidency as well. House Majority Leader John Boehner’s invitation to Israeli Prime Minister Benjamin Netanyahu to undercut the president's Iranian nuclear negotiations and the letter signed by 47 Republican senators and directed to the Iranian ayatollahs are striking examples of this. They are visibly meant to tear down an “imperial presidency” that Republicans gloried in not so long ago.

The radical nature of that letter, not as an act of state but of its de-legitimization, was noted even in Iran, where fundamentalist Supreme Leader Ali Khamenei proclaimed it “a sign of a decline in political ethics and the destruction of the American establishment from within.” Here, however, the letter is either being covered as a singularly extreme one-off act (“treason!”) or, as Jon Stewart did on “The Daily Show,” as part of a repetitive tit-for-tat between Democrats and Republicans over who controls foreign policy. It is, in fact, neither. It represents part of a growing pattern in which Congress becomes an ever less effective body, except in its willingness to take on and potentially take out the presidency.

In the twenty-first century, all that “small government” Republicans and “big government” Democrats can agree on is offering essentially unconditional support to the military and the national security state. ...MORE

Demeter

(85,373 posts)German Vice Chancellor Sigmar Gabriel said this week in Homburg that the U.S. government threatened to cease sharing intelligence with Germany if Berlin offered asylum to NSA whistleblower Edward Snowden or otherwise arranged for him to travel to that country. “They told us they would stop notifying us of plots and other intelligence matters,” Gabriel said.

The vice chancellor delivered a speech in which he praised the journalists who worked on the Snowden archive, and then lamented the fact that Snowden was forced to seek refuge in “Vladimir Putin’s autocratic Russia” because no other nation was willing and able to protect him from threats of imprisonment by the U.S. government (I was present at the event to receive an award). That prompted an audience member to interrupt his speech and yell out: “Why don’t you bring him to Germany, then?”

There has been a sustained debate in Germany over whether to grant asylum to Snowden, and a major controversy arose last year when a Parliamentary Committee investigating NSA spying divided as to whether to bring Snowden to testify in person, and then narrowly refused at the behest of the Merkel government. In response to the audience interruption, Gabriel claimed that Germany would be legally obligated to extradite Snowden to the U.S. if he were on German soil.

Afterward, however, when I pressed the vice chancellor (who is also head of the Social Democratic Party, as well as the country’s economy and energy minister) as to why the German government could not and would not offer Snowden asylum — which, under international law, negates the asylee’s status as a fugitive — he told me that the U.S. government had aggressively threatened the Germans that if they did so, they would be “cut off” from all intelligence sharing. That would mean, if the threat were carried out, that the Americans would literally allow the German population to remain vulnerable to a brewing attack discovered by the Americans by withholding that information from their government...

MORE

Blue_Tires

(55,445 posts)But don't let that spoil Greenwald's narrative...The German government cooled on Snowden a long time ago, and that was *before* Ukraine got hot...And I thought he was happy living in Moscow anyway, so who cares?

I do love the irony of Greenwald's reliance on a solitary government source, which he has endlessly pilloried other journalists who printed stories mostly reliant on government sources...I guess it all comes down to what they're saying, doesn't it, Glennie?

Demeter

(85,373 posts)The city of Sacramento is in the fourth year of a record drought - yet the Nestlé Corporation continues to bottle city water to sell back to the public at a big profit, local activists charge. The Nestlé Water Bottling Plant in Sacramento is the target of a major press conference on Tuesday, March 17, by a water coalition that claims the company is draining up to 80 million gallons of water a year from Sacramento aquifers during the drought. The coalition, the crunchnestle alliance, says that City Hall has made this use of the water supply possible through a "corporate welfare giveaway," according to a press advisory.

A coalition of environmentalists, Native Americans and other concerned people announced the press conference will take place at March 17 at 5 p.m. at new Sacramento City Hall, 915 I Street, Sacramento. The coalition will release details of a protest on Friday, March 20, at the South Sacramento Nestlé plant designed to "shut down" the facility. The coalition is calling on Nestlé to pay rates commensurate with their enormous profit, or voluntarily close down.

"The coalition is protesting Nestlé's virtually unlimited use of water – up to 80 million gallons a year drawn from local aquifers – while Sacramentans (like other Californians) who use a mere 7 to 10 percent of total water used in the State of California, have had severe restrictions and limitations forced upon them," according to the coalition.

"Nestlé pays only 65 cents for each 470 gallons it pumps out of the ground – the same rate as an average residential water user. But the company can turn the area's water around, and sell it back to Sacramento at mammoth profits," the coalition said.

Activists say that Sacramento officials have refused attempts to obtain details of Nestlé's water used. Coalition members have addressed the Sacramento City Council and requested that Nestle’ either pay a commercial rate under a two tier level, or pay a tax on their profit. In October, the coalition released a "White Paper" highlighting predatory water profiteering actions taken by Nestle’ Water Bottling Company in various cities, counties, states and countries. Most of those great “deals” yielded mega profits for Nestle’ at the expense of citizens and taxpayers. Additionally, the environmental impact on many of those areas yielded disastrous results.

Coalition spokesperson Andy Conn said, "This corporate welfare giveaway is an outrage and warrants a major investigation. For more than five months we have requested data on Nestlé water use. City Hall has not complied with our request, or given any indication that it will. Sacramentans deserve to know how their money is being spent and what they’re getting for it. In this case, they’re getting ripped off.”

For more information about the crunchnestle alliance, contact Andy Conn (530) 906-8077 camphgr55 (at) gmail.com or Bob Saunders (916) 370-8251

MORE

Demeter

(85,373 posts)When you slip into the restroom for a little tinkle, you probably don't realize that you are participating in massive environmental genocide -- but you are. Millions of gallons of water swoosh down the tubes every day, even as water becomes an ever-more precious and limited resource, and the specter of global drought and conflict looms (the U.S. has declared water a "national security issue"

To make matters worse, the Sanitary Industrial Complex is succeeding brilliantly in its marketing of "flushable" wet wipes for adults, which are gumming the gears of plumbing networks around the nation. According to yesterday's New York Times, the city has spent more than $18 million in the past five years on wet wipe-related equipment problems (www.nytimes.com/2015/03/15/nyregion/the-wet-wipes-box-says-flush-but-the-new-york-city-sewer-system-says-dont.html.)

My solution mitigates my impact on this forest and water misuse by close to 80 percent... For the past several years, I have defied our wasteful "toilet protocol," reducing my use of water and toilet paper drastically. First, I bought a package of inexpensive washcloths, in a color that complements my bathroom, and cut them into neat five-by-five inch squares. I use these dampened, nicely textured cloths to cleanse myself after I urinate. Then, I wash the cloth with soap and water while I am washing my hands (even so, I get out a new towelette every couple of days, and I put them all in the washer with my sheets for a clorox and detergent laundering). I hang the moist, cucumber-scented "wipe" neatly over my toilet-paper holder for my next event. This saves money, it saves trees, and it provides a far superior cleansing to the genitourinary area than paper does, which is why commercial wet wipes have become so popular. With a dampened washcloth, you are really washing yourself, not merely wiping or blotting. You'll have that "fresh feeling" all the time, with none of the lint residue that is so notorious with toilet paper.

We pee like mad all day, as our hydration levels have improved with our ubiquitous water bottles, Big Gulps, sodas and coffee.The EPA estimates that each of us flushes the toilet 10 to 15 times in a 24-hour period. I chug endlessly, and I pee frequently, but no longer am I slaughtering trees in the process. Naturally, you need to use toilet paper when you have a bowel movement, but for most people, that's just once or twice a day. Keep a spray bottle filled with water, perhaps adding a few drops of aromatic oil (I like bergamot or lemon) or shampoo/shower gel, next to your toilet paper, to moisten it and give your bum a superior cleansing.

ACTUALLY, NOT EVEN THEN...WASHCLOTHS CAN BE PROPERLY LAUNDERED AFTER WIPING BOTTOMS, JUST LIKE MOMMIES DO EVERY DAY

Demeter

(85,373 posts)antigop

(12,778 posts)The Harper’s article is subtitled “The catastrophic incompetence of Citigroup,” obviously a tongue-in-cheek assessment since Cockburn meticulously documents the serial charges of crimes at Citigroup as a business model.

Cockburn traces the history of how Sandy Weill parlayed Commercial Credit through a series of mergers that, thanks to the repeal of the Glass-Steagall Act by President Clinton, culminated in the too-big-to-fail Citigroup. The banking behemoth replicated the exact model that brought on the 1929 crash and Great Depression by holding savings deposits while being allowed to gamble with the deposits in wild speculations on Wall Street.

The Glass-Steagall Act, which had successfully protected bank savings deposits from 1933 until its repeal by Clinton in 1999, had prevented FDIC insured institutions from merging with investment banks on Wall Street. Despite the ravaging effects of the 2008 crash, the Glass-Steagall Act has not been restored, although two bills were introduced in Congress to do just that: the Return to Prudent Banking Act of 2015 and the Elizabeth Warren inspired 21st Century Glass-Steagall Act.

kickysnana

(3,908 posts)Three teenage cousins live there. Truth is, it would not be safer for them here.