Democrats seek to cut U.S. budget deficits in half: Yarmuth

Source: Reuters

POLITICS JANUARY 29, 2019 / 12:26 PM / UPDATED 14 MINUTES AGO

WASHINGTON (Reuters) - The chairman of the U.S. House of Representatives Budget Committee on Tuesday said he and other senior Democrats aim to write a fiscal blueprint this year that would cut annual budget deficits by 50 percent in the next 10 years, possibly including tax hikes on corporations and the wealthy.

Representative John Yarmuth, in an interview with Reuters, said part of the effort could focus on raising the U.S. corporate tax rate to 26 percent or 27 percent, up from the 21 percent enacted through a broad Republican tax cut law in 2017.

Even with added tax revenues, Yarmuth conceded the difficult path toward deficit-reduction.

Annual federal budget deficits are hurtling toward $1 trillion and Yarmuth said it is “not going to be easy to cut them by half a trillion dollars” by around 2029, especially given looming economic cross-currents.

Read more: https://www.reuters.com/article/us-usa-congress-yarmuth/democrats-seek-to-cut-u-s-budget-deficits-in-half-yarmuth-idUSKCN1PN2BE?il=0

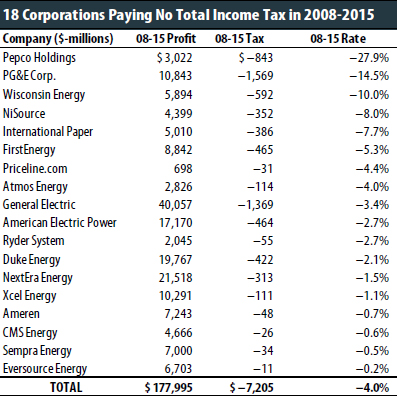

Some companies don't pay any taxes...........................

Autumn

(45,064 posts)The first mention of any "entitlement reform" they can count me out.

turbinetree

(24,695 posts)you can damn near see where this ship is sailing right now, the democrats are going to try and get it upright from the 40 year plus fiasco with the trickle down BS, and then we had in 2000 when we had balance budget, to help off set for future generations and to prevent this current fiasco, but nope, the libertarians and the ayn rand freaks, went into war and spent close to three trillion just on that boon doogle, just so some "guy' could run around on the flight deck of some carrier .......................absolutely amazing....................and then to top it all off "Eddy Munster" living off the tax payers dime now really screwed the public at larger ..........................

Autumn

(45,064 posts)SCantiGOP

(13,869 posts)UpInArms

(51,282 posts)

Bradical79

(4,490 posts)That we seem to be esentially paying them tax? I think I found Trump's bridge money...

Some was because of adjustments on what was paid in previous years and refunded. Notice the dates--2008, when the crash happened. Often it's because of losses, capital or operating, that offset profit. (How the chart defines "profit" might be an issue. But if you lose $500 million one year you get to take that as deductions spread out over several years. With TARP, the government did the opposite--it expensed many billions of dollars in 2009 and then counted repayment as income or revenue in 2010, 2011, 2012 ... A business would have carried the loan as an asset and that repayment wouldn't have been income--just the TARP interest would be revenue.)

A lot of it was energy efficiency or green-energy rebates. All that money spent on modernizing the grid, making energy companies more efficient, working towards solar and other renewables? That's money paid to the company by the government. This chart shows it as a negative tax.

Pepco is formerly Exelon and is a large energy company in the DC area.

UpInArms

(51,282 posts)We are subsidizing their profits

cstanleytech

(26,286 posts)and the game of moving their HQ overseas is over as any company that did that over the past 10 years to avoid such taxes would be subject to them or be barred from the US.

On the other hand I would leave ample fair methods for companies to lower their taxes such as the more workers that they employee that earn at least 500% over the poverty level the lower their taxes with companies that employee 5000 or more people inside the US and whom all earn that much qualifying for a rate as low as 35%.

Companies that bring new jobs from overseas that pay that much or create new jobs (transferring production from one state to another does NOT qualify) that pay that much without closing or firing workers inside the US to do it can then get an additional 15% to 20% off.