General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsElizabeth Warren Introduces 21st Century Glass-Steagall Act

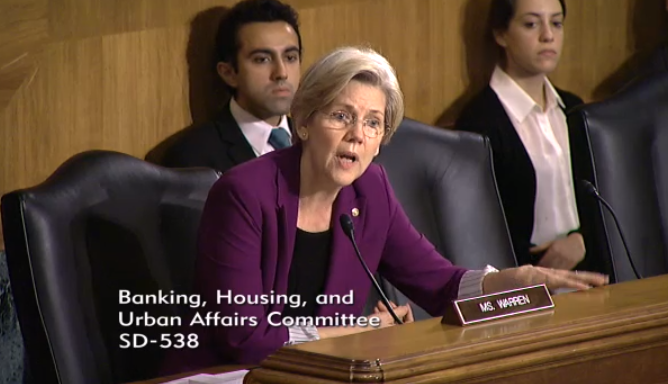

At today’s Senate Banking Committee hearing, Elizabeth Warren introduced the 21st Century Glass-Steagall Act of 2013, co-sponsored by Senators McCain, Cantwell, and King. The bill mirrors the heart of the original 1933 law, which separated traditional banking activity (like checking and lending) from the riskier activity investment banking (like derivatives).

The original law was repealed in 1999 toward the end of the Clinton administration, though the law had been eroding for years leading up to 1999. This repeal was one of several laws passed during that era which allowed the big banks to transform into megabanks, in part creating our current “too big to fail” policy.

This new bill from Senator Warren aims to play a part in reversing this trend so the banks will be smaller. After all, the three biggest banks (Chase, Bank of America, and Citi) are all bloated conglomerate banks that have enormous traditional and investment subsidiaries, so these banks wouldn’t be able to continue as they’re currently instituted. They would be broken up into much smaller firms.

What’s more, the 21st Century Glass-Steagall Act of 2013 will make it so banks cannot gamble with derivatives using depositor’s money like they do today. Currently, anyone who has money at banks like Chase, Bank of America, or Citi is implicitly using that money to help these banks make amplified bets that have the potential to cause another global meltdown. Reintroducing Glass-Steagall will make it so depositor’s money cannot be used for the derivatives market. This would be a major step toward restoring sanity to Wall Street.

Rest at Too Big Has Failed.org

NV Whino

(20,886 posts)A bright spark among the embers of a dying nation.

AikidoSoul

(2,150 posts)nobody else.

NOBODY!

Octafish

(55,745 posts)...The crooks absconded with the money and We the People bailed them out.

Then, they de-regulated the Banks.

The crooks absconded with the money and We the People bailed them out.

Sen. Warren is not with the program, which, from the POV of We the People, a good thing.

yurbud

(39,405 posts)between them and a second American Revolution.

Or rather, the owners of those in Washington don't realize it. Most pols don't seem to have an idea in their head that someone didn't pay to put there.

MsLeopard

(1,265 posts)of what the threat is, hence the massive surveillance state we have all around us, not to mention a propaganda system that might stand as the envy of every wanna-be world dominator from Attila the Hun to the Third Reich - could they see what our American capitalists have achieved. We are the most propagandized population on the planet and IMO that's why there's been no real uprising against the PTB.

But I agree that a lot of those in Washington, the employees of their owners, might be so clueless they really don't have an idea that the majority of their constituents are a thread away from revolution. ![]()

yurbud

(39,405 posts)If you had debt problems, lost your crappy job, couldn't figure out how to pay your medical bills or student loans, you would feel like an incompetent loser who can't do what everyone else does easily.

Now the slightest look or discussion online makes it clear that those are the problems of the vast majority brought on by systemic abuse by the very wealthy to benefit them by screwing us.

jmowreader

(50,528 posts)The S&L industry was a huge player in the commercial real estate market. A lot of commercial RE is only profitable if its owner can deduct something called passive loss.(There are active and passive business losses. If you have to go there every day and do work, like...oh, a chef or a backhoe driver...and you lose money, that's active loss. If your business just sits on the ground and people show up at regular intervals with money, like rental managers do, then it's passive loss. When the antichrist repealed the passive loss deduction as part of his stealth tax hike plan, all the commercial RE that was depending on that loophole went into default - taking the S&Ls along with it.

The crook that killed the S&Ls was named Ronald Reagan.

LooseWilly

(4,477 posts)So the landlords, who aren't "real estate professionals" (200 hours a year doing real estate work, or something like that) can still deduct the less profitable against the more profitable. The real problem is not being able to deduct interest and depreciation "expenses" against salary income... the end of a tax dodge.

(Though, all the passive losses can be deducted against active income in the year in which the interest in the property is disposed of... but I guess they didn't wanna work as hard as it would take to have a "cycle" of tax-haven investments for clients so they could sell one off each year, only to buy into the next... allowing them to take advantage of the smaller loophole.)

Reagan is sainted by the right wing, obviously, because of his tax system overhaul in... was it '83?

jmowreader

(50,528 posts)Reagan's "reform" killed the deduction totally. After Congress realized the extent of the destruction it caused, they erased Reagan's mistake and put in place the deduction you described.

The teabaggers revere Reagan for the Kemp-Roth Tax Cut of 1981. The fun part is, if you look at the U3 unemployment numbers from August 1981 and go about 20 months out, you will notice they took off like a rocket...18 months after Kemp-Roth they peaked at 10.8 percent, the highest in history. The Faux News people love to talk about Obama as being the worst economic president in history, but Reagan (who damn near brought on Great Depression II through his unnecessary austerity program) will never be equaled in his crappiness.

galileoreloaded

(2,571 posts)Scuba

(53,475 posts)SunSeeker

(51,508 posts)rhett o rick

(55,981 posts)JDPriestly

(57,936 posts)hopefully.

forestpath

(3,102 posts)liberal_at_heart

(12,081 posts)Now if Cantwell can just get k-12 public education funded I might consider voting for her again.

WillyT

(72,631 posts)Berlum

(7,044 posts)k and r

craigmatic

(4,510 posts)red dog 1

(27,767 posts)Triana

(22,666 posts)liberal_at_heart

(12,081 posts)Squinch

(50,911 posts)MannyGoldstein

(34,589 posts)He's still smiling today.

ProSense

(116,464 posts)Text of the Legislation

Fact Sheet

Washington, DC - Senators Elizabeth Warren (D-MA), John McCain (R-AZ), Maria Cantwell (D-WA), and Angus King (I-ME) today will introduce the 21st Century Glass-Steagall Act, a modern version of the Banking Act of 1933 (Glass-Steagall) that reduces risk for the American taxpayer in the financial system and decreases the likelihood of future financial crises.

The legislation introduced today would separate traditional banks that have savings and checking accounts and are insured by the Federal Deposit Insurance Corporation from riskier financial institutions that offer services such as investment banking, insurance, swaps dealing, and hedge fund and private equity activities. This bill would clarify regulatory interpretations of banking law provisions that undermined the protections under the original Glass-Steagall and would make "Too Big to Fail" institutions smaller and safer, minimizing the likelihood of a government bailout.

"Since core provisions of the Glass-Steagall Act were repealed in 1999, shattering the wall dividing commercial banks and investment banks, a culture of dangerous greed and excessive risk-taking has taken root in the banking world," said Senator John McCain. "Big Wall Street institutions should be free to engage in transactions with significant risk, but not with federally insured deposits. If enacted, the 21st Century Glass-Steagall Act would not end Too-Big-to-Fail. But, it would rebuild the wall between commercial and investment banking that was in place for over 60 years, restore confidence in the system, and reduce risk for the American taxpayer."

"Despite the progress we've made since 2008, the biggest banks continue to threaten the economy," said Senator Elizabeth Warren. "The four biggest banks are now 30% larger than they were just five years ago, and they have continued to engage in dangerous, high-risk practices that could once again put our economy at risk. The 21st Century Glass-Steagall Act will reestablish a wall between commercial and investment banking, make our financial system more stable and secure, and protect American families."

"Too many Main Streets across America have paid the price for risky gambling on Wall Street," Senator Maria Cantwell said. "This bill would restore clear bright lines that separate risky activities from the traditional banking system. It's time to restore faith in our financial institutions by rebuilding the firewall that protected our economy for decades in the wake of the Great Depression. Restoring Glass-Steagall would focus our financial system where it belongs: getting capital into the hands of job creators and businesses on Main Streets across America."

"As Maine families continue to feel the sting of the 2008 economic downturn, America's largest financial institutions continue to engage in risky banking and investment activities that threaten the health of our financial sector and our economy as a whole. While recent efforts at financial sector regulatory reform attempt to address the ‘too big to fail' phenomenon, Congress must take additional steps to see that American taxpayers aren't again faced with having to bail out big Wall Street institutions while Main Street suffers," Senator Angus King said. "While the 21st Century Glass-Steagall Act is not the silver bullet to end ‘too big to fail,' the legislation's re-establishment of clear separations between retail and investment banking, as well as its restrictions on banking activities, will limit government guarantees to insured depository institutions and provide strong protections against the spillover effects should a financial institution fail."

The original Glass-Steagall legislation was introduced in response to the financial crash of 1929 and separated depository banks from investment banks. The idea was to divide the risky activities of investment banks from the core depository functions that consumers rely upon every day. Starting in the 1980s, regulators at the Federal Reserve and the Office of the Comptroller of the Currency reinterpreted longstanding legal terms in ways that slowly broke down the wall between investment and depository banking and weakened Glass-Steagall. In 1999, after 12 attempts at repeal, Congress passed the Gramm-Leach-Bliley Act to repeal the core provisions of Glass-Steagall.

http://www.warren.senate.gov/?p=press_release&id=178

Fact sheet:

http://www.warren.senate.gov/files/documents/Fact%20Sheet%20-%2021st%20Century%20Glass-Steagall.pdf

I've said it before, Glass-Steagall had nothing to do with too big to fail. This bill does draw a distinct line between investment and commercial banking, and that's needed.

The Wall Street Reform law actually does more to end too big to fail.

ProSense

(116,464 posts)zipplewrath

(16,646 posts)It has ended to big to fail has it? So Warren's law won't end it, or it isn't needed? Which is it?

ReRe

(10,597 posts)And she's just getting started!

Thank you, Massachusetts, for electing Senator Elizabeth Warren!

BornLooser

(106 posts)NO Central Bank.

Say's so, right there, see? It's right there, look again.

The Honorable Sen. Warren...doing her dead level best, what a concept. That's a bygawd Democrat!

roamer65

(36,744 posts)Who will buy our Treasury paper?

BornLooser

(106 posts)Moving the 12 Fed chief votes on the Federal Open Market Committee back to the Hill, where they belong. Government should set the policy, not a private central bank. There has to be ways, in spite of the illusion of it being insurmountable. It will take heavy lifting by those who ALWAYS do said heavy lifting. The Democrats, of course. Give Sen. Warren and her allies time, 100 years of entrenchment will take time to reform...or kill.

AnotherMcIntosh

(11,064 posts)It's all the Republicans' fault?

How about some fault being placed where it belongs -- with all the Senators who received campaign contributions from banks?

moondust

(19,958 posts)felix_numinous

(5,198 posts)and she deserves massive support.

![]()

lindysalsagal

(20,581 posts)Glass-Steagall is the solution to the 20th century depression. It's the most important act in our past, after you consider the revolution itself and the constitutional amendments.

"Conservatives" should all herald it as conservative financial policy.

But, instead, they'll want to waste untold dollars on catching and punishing illegals, hunting down pot dealers, and keeping women barefoot and pregnant.

Because Democrats are tax and spend liberals.

BornLooser

(106 posts)These slimeballs are the type that give true conservatives a bad name. They are a laughingstock around the world, and a cancer on our Nation. At most...Cons. They conserve only the very worst policies of a long defeated and despised CONfederacy. They hate Us not because We're Liberals, they hate Us because We're freaking RIGHT, on every issue. Con artists conning only themselves, and the weak-minded haters.

Hydra

(14,459 posts)This is going to be a good fight- JP Morgan and the others will not take a threat like this lying down. It should be a good way to sort out who is in the pockets of the banks.

stuffmatters

(2,574 posts)Every day Warren demonstrably and knowledgeably fights for the middle class. Hilary Clinton's fingerprints are all over the State Dept's Trans Pacific Partnership ("end of democracy"![]() and corrupt Keystone XL Study("game over for climate change"

and corrupt Keystone XL Study("game over for climate change"![]() ...not to mention

...not to mention

that she & her husband presided over NAFTA and repeal of Glass Steagall.

Sure Hilary's all "pro-women" and now publicly regrets her husband's DOMA, but she's never even peeped objection to the cruel swindle of Chained CPI or Wall Street billionaire's self serving Fix the Debt propaganda machine.

Clinton's is so likeable, but yet she seem to be so hawkish militarily and "crickets" economically. I'm more interested in voting for a president who stands for solutions rather than excusing one who voted as senator for the Iraq War and the

Wall Street assault on the middle class called the bankruptcy act.

Warren just keeps hitting at the serious issues...exploitation of student loans, requests to make public the surrender to global corporatism of the secret TPP and now reinstating Glass Steagall...that's just Warren this summer (so far)!!

I'm delighted to see McCain as a cosponser here. Since he has a permanent seat on the Sunday talk shows, maybe he'll actually stop hawking so much for war and use his time to discuss the repeal of Glass Steagall.

xtraxritical

(3,576 posts)AgingAmerican

(12,958 posts)Bill Clinton was obligated to sign the bill into law because it was VETO PROOF

Sheesh

mattclearing

(10,091 posts)Can't he still veto it and make them vote again, or let it become law without his signature?

PoliticAverse

(26,366 posts)There is no requirement for him to sign it.

http://www.archives.gov/legislative/resources/education/veto/background.pdf

But he was in favor of it. Here is what Clinton said about the Gramm-Leach-Bliley Act he signed:

Beginning with the introduction of an Administration-sponsored bill in 1997, my Administration has worked vigorously to produce financial services legislation that would not only spur greater competition, but also protect the rights of consumers and guarantee that expanded financial services firms would meet the needs of America's underserved communities. Passage of this legislation by an overwhelming, bipartisan majority of the Congress suggests that we have met that goal.

The Gramm-Leach-Bliley Act makes the most important legislative changes to the structure of the U.S. financial system since the 1930s. Financial services firms will be authorized to conduct a wide range of financial activities, allowing them freedom to innovate in the new economy. The Act repeals provisions of the Glass-Steagall Act that, since the Great Depression, have restricted affiliations between banks and securities firms. It also amends the Bank Holding Company Act to remove restrictions on affiliations between banks and insurance companies. It grants banks significant new authority to conduct most newly authorized activities through financial subsidiaries.

Removal of barriers to competition will enhance the stability of our financial services system. Financial services firms will be able to diversify their product offerings and thus their sources of revenue. They will also be better equipped to compete in global financial markets.

Read the full statement at: http://www.presidency.ucsb.edu/ws/?pid=56922

mattclearing

(10,091 posts)Yay for "stimulating greater innovation and competition in the financial services industry."

![]()

lindysalsagal

(20,581 posts)steps as she left. Gee, thanks.

She, of all people, knew better. That's when Hilary lost me. Forever.

AgingAmerican

(12,958 posts)Based upon the "information" supplied by the Bush Admin. That information turned out to be FALSE.

You really need to read history.

lindysalsagal

(20,581 posts)Hilary has blood on her hands and that's the real history. She knew better.

You need to read history. I watched it happen. Hilary has blood on her hands.

AgingAmerican

(12,958 posts)Former presidents are no longer briefed on classified information.

stuffmatters

(2,574 posts)Last edited Fri Jul 12, 2013, 08:12 PM - Edit history (2)

According to Woodward's book around the Iraq Invasion, Cheney, Wolfowitz, Hadley et alios were obsessed with Sadam for years prior, even wrote Pres Clinton a letter or two demanding "action". Hilary and her husband knew damn well that Bush was exploiting 911 to justify Iraq invasion. So did most of The Villagers and press; they'd been hearing this Neo Con War Howl looking for an opportunity for years.

I remember my feeling of betrayal at the Dems in Congress that day who voted for the Iraq Resolution. Especially those Baby Boomers who had experienced the consequences upon our generation of the lies and imperialistic nonsense to justify Vietnam. Most especially those like the Clintons, who'd demonstrated against that War. They knew as much as any of us that this was a massive mistake and capitulation. I mean just think... with even Halliburton thrown in? Please, ignorance is not a defense for Hilary here.

Barbara Boxer, Barbara Mulkulski voted against the Iraq War Resolution. Eliz Warren never would have voted yes.. Hilary knew the facts yet voted yes. That will always disturb me.

lindysalsagal

(20,581 posts)lindysalsagal

(20,581 posts)Until recently it was still up on the new american century website.

Hillary was the one who knew the invasion was a sham and voted for it anyway just for political points.

No wiggling out of that: If Hilary voted for it the rest knew they had to, also.

She was a political coward at that moment.

AgingAmerican

(12,958 posts)n/t

PoliticAverse

(26,366 posts)mattclearing

(10,091 posts)The whole Internet concurs that a bill can become a law without the President's signature.

http://www.google.com/search?client=safari&rls=en&q=bill+becomes+a+law+without+the+president's+signature&ie=UTF-8&oe=UTF-8

progressoid

(49,944 posts)Clinton was never going to veto it. He supported it.

He even said so a couple years ago when he finally admitted it was a mistake to support it.

AgingAmerican

(12,958 posts)He had NO CHOICE but to sign it. Nice try sparky.

progressoid

(49,944 posts)When he signed it:

Today I am pleased to sign into law S. 900, the Gramm-Leach-Bliley Act. This historic legislation will modernize our financial services laws, stimulating greater innovation and competition in the financial services industry. America's consumers, our communities, and the economy will reap the benefits of this Act.

http://www.presidency.ucsb.edu/ws/?pid=56922

During the Banking Crisis he defended it:

MARIA BARTIROMO

Mr. President, in 1999 you signed a bill essentially rolling back Glass-Steagall and deregulating banking. In light of what has gone on, do you regret that decision?

FORMER PRESIDENT BILL CLINTON

No, because it wasn't a complete deregulation at all. We still have heavy regulations and insurance on bank deposits, requirements on banks for capital and for disclosure. I thought at the time that it might lead to more stable investments and a reduced pressure on Wall Street to produce quarterly profits that were always bigger than the previous quarter. But I have really thought about this a lot. I don't see that signing that bill had anything to do with the current crisis.

http://www.businessweek.com/stories/2008-09-23/bill-clinton-on-the-banking-crisis-mccain-and-hillary

Eventually (in 2010) he blamed his advisors:

“On derivatives, yeah I think they were wrong and I think I was wrong to take [their advice] because the argument on derivatives was that these things are expensive and sophisticated and only a handful of investors will buy them and they don’t need any extra protection, and any extra transparency. The money they’re putting up guarantees them transparency,” Clinton told me.

http://abcnews.go.com/blogs/politics/2010/04/clinton-rubin-and-summers-gave-me-wrong-advice-on-derivatives-and-i-was-wrong-to-take-it/

mattclearing

(10,091 posts)merrily

(45,251 posts)Pocket veto would not have been good either.

But the bill did not have a veto proof majority anyway. That, apparently, has become an urban legend.

merrily

(45,251 posts)Besides, even if that were not true, he still would have had a choice.

There is no guaranty that a legislator would vote exactly the same way after a Presidential veto as he woudl before.

merrily

(45,251 posts)It takes a 2/3 vote of each house of Congress to override a Presidential veto.

The vote in the Senate was 54 yea to 44 nay, or a total of 98.

2/3 of 98 would have been 66.5 Senators, but you have to round up to 67, Well short of a "veto proof" vote in the Senate, even if there were such a thing as a veto proof vote. (There isn't.)

The vote in the House was 362 yea to 57 nay nay, or a total of 419. That would have been enough to override a veto, assuming everyone would have voted the same way after the veto, which is not a safe assumption.

And, another poster noted, many Democrats supported the Bill because of Bill Clinton. Both Clinton and Greenspan pressured Congress to repeal. At first Clinton defended repeal, even after the 2008 collapse. More recently, he said he got bad advice.

The wiki even says Clinton thought Glass Steall was no longer appropriate.

https://en.wikipedia.org/wiki/Glass%E2%80%93Steagall_Act

Response to AgingAmerican (Reply #38)

avaistheone1 This message was self-deleted by its author.

cantbeserious

(13,039 posts)eom

raouldukelives

(5,178 posts)We got our work cut out for us. Every buck in Wall St is a buck against that work.

liberal_at_heart

(12,081 posts)Why would you consider her a centrist? I only ask because I'm not always up to date on some of the previous votes on some liberals, and do want to vote for the most liberal candidates as possible. I've heard some on here call Dean a liberal and then others say he's not. Apparently he is fiscally conservative, which I am not. I want someone who will spend the money necessary to get our social programs back where they need to be.

raouldukelives

(5,178 posts)I think she is wonderful but in my overall political radar I feel like she would represent centrist values.

That being said, vote for and support her! She is the best thing to hit DC in awhile.

When her views are considered middle of the road, I'll be a happy liberal. Well, happier.

xtraxritical

(3,576 posts)tclambert

(11,084 posts)We need a new simplified Sherman Act, something that the Justice Department can actually enforce without facing decades of legal maneuvering and tidal waves of documents in response to every request for information.

PoliticAverse

(26,366 posts)Reimburse any FDIC protected depositors fully, anyone else splits what remains.

DirkGently

(12,151 posts)Warren is pure gold. She embarrasses everyone else who all seem incapable of the slightest effort to do the right thing.

BillyRibs

(787 posts)Madam President!![]()

midnight

(26,624 posts)Enthusiast

(50,983 posts)How will they conspire to discredit Senator Warren?

Warren DeMontague

(80,708 posts)Jasana

(490 posts)If Senator Warren asks me to sign a petition, I jump on it.

davidpdx

(22,000 posts)repealing it was a huge mistake. I don't see it getting done though, too much money to buy the votes on both sides.

DCBob

(24,689 posts)I hope it picks up some momentum. At the moment there arent many backers.

ctsnowman

(1,903 posts)Le Taz Hot

(22,271 posts)This woman is amazing! Too bad they'll never let her be president. They need someone more pliable, hence, Hillary.

avaistheone1

(14,626 posts)Senator Elizabeth Warren rocks!

![]()

tweeternik

(255 posts)red dog 1

(27,767 posts)Whisp

(24,096 posts)I can dream!